Rising Data Consumption

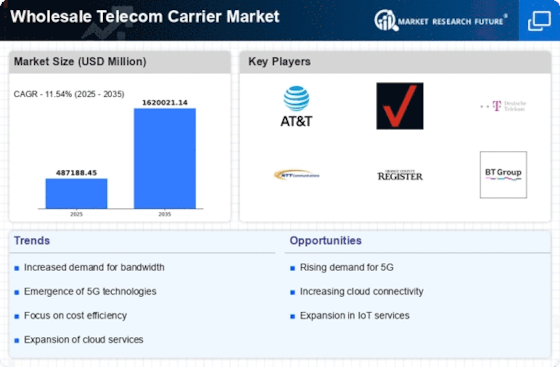

The Wholesale Telecom Carrier Market is experiencing a notable surge in data consumption, driven by the proliferation of smart devices and the increasing reliance on digital services. As consumers and businesses alike demand higher bandwidth for activities such as streaming, gaming, and cloud computing, carriers are compelled to enhance their infrastructure. Recent data indicates that global internet traffic is projected to reach 4.8 zettabytes per year by 2025, underscoring the urgency for carriers to expand their capabilities. This rising data consumption not only fuels competition among carriers but also necessitates strategic partnerships and investments in advanced technologies to meet the growing demand.

Expansion of 5G Networks

The ongoing rollout of 5G networks is a pivotal driver for the Wholesale Telecom Carrier Market. With its promise of ultra-fast speeds and low latency, 5G technology is set to revolutionize various sectors, including healthcare, transportation, and entertainment. As of October 2025, it is estimated that over 1.5 billion 5G connections will be active worldwide, creating a substantial opportunity for wholesale carriers to provide the necessary infrastructure and services. This expansion not only enhances connectivity but also encourages innovation in applications such as IoT and smart cities, further propelling the demand for wholesale telecom services.

Emergence of Cloud Services

The rise of cloud computing is reshaping the Wholesale Telecom Carrier Market, as businesses increasingly migrate their operations to cloud-based platforms. This transition necessitates robust and reliable connectivity solutions, prompting carriers to adapt their offerings. Recent statistics suggest that the cloud services market is projected to grow to 832 billion USD by 2025, highlighting the demand for telecom services that support cloud infrastructure. As carriers enhance their capabilities to provide seamless cloud connectivity, they position themselves as critical enablers of digital transformation for enterprises, thereby driving growth in the wholesale telecom market.

Regulatory Changes and Compliance

The Wholesale Telecom Carrier Market is influenced by evolving regulatory frameworks that govern telecommunications. Governments are increasingly implementing policies aimed at enhancing competition, ensuring consumer protection, and promoting fair pricing. These regulatory changes can create both challenges and opportunities for wholesale carriers. For instance, compliance with new regulations may require significant investment in infrastructure and technology. However, it also opens avenues for innovation and differentiation in service offerings. As carriers navigate this complex regulatory landscape, their ability to adapt and comply will likely determine their competitive positioning in the wholesale telecom market.

Increased Focus on Network Security

In an era where cyber threats are becoming increasingly sophisticated, the Wholesale Telecom Carrier Market is witnessing a heightened emphasis on network security. Carriers are investing significantly in advanced security measures to protect their infrastructure and customer data. According to recent reports, The Wholesale Telecom Carrier Market is expected to reach 345 billion USD by 2026, indicating a strong correlation between telecom services and security solutions. This focus on security not only enhances customer trust but also positions carriers as essential partners in safeguarding digital communications, thereby driving growth in the wholesale telecom sector.