Expansion of Smart City Initiatives

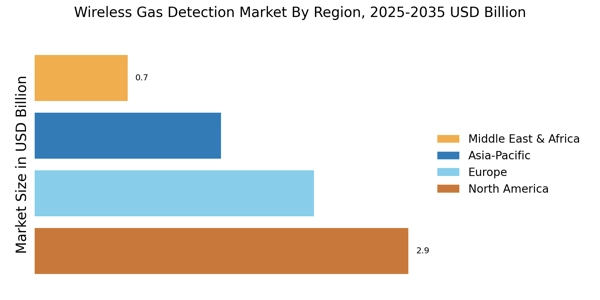

The Wireless Gas Detection Market is poised for growth due to the expansion of smart city initiatives. As urban areas increasingly adopt smart technologies to enhance public safety and improve infrastructure, the demand for advanced gas detection systems is rising. Wireless gas detection solutions are integral to smart city frameworks, providing real-time data on air quality and hazardous gas levels. This integration not only enhances the safety of urban environments but also supports the development of sustainable cities. The market is expected to see a significant uptick as municipalities invest in smart technologies, with projections indicating a potential market size increase of over 15% by 2027. This trend reflects a broader commitment to leveraging technology for improved urban living conditions.

Increasing Industrial Safety Standards

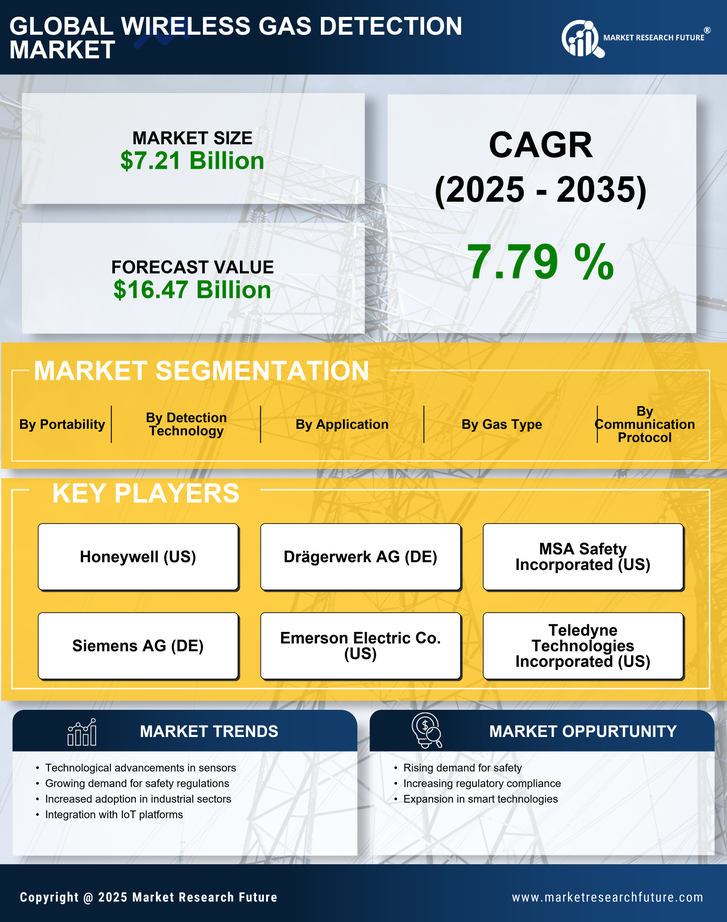

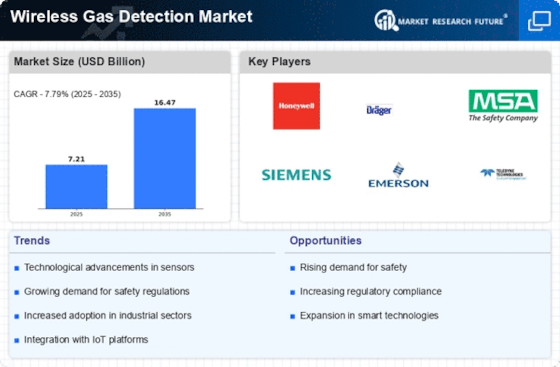

The Wireless Gas Detection Market is experiencing a surge in demand due to the increasing emphasis on industrial safety standards. Regulatory bodies are implementing stringent safety regulations to mitigate risks associated with hazardous gas emissions. This trend is particularly evident in sectors such as oil and gas, chemicals, and mining, where the potential for gas leaks poses significant safety hazards. As a result, companies are investing in advanced wireless gas detection systems to ensure compliance with safety regulations. The market is projected to grow as organizations prioritize employee safety and environmental protection, with the wireless gas detection market expected to reach a valuation of approximately USD 3 billion by 2026. This growth reflects a broader commitment to maintaining safe working environments and minimizing the risk of gas-related incidents.

Rising Demand from the Oil and Gas Sector

The Wireless Gas Detection Market is significantly influenced by the rising demand from the oil and gas sector. This industry is characterized by its inherent risks associated with gas leaks and explosions, necessitating the implementation of robust gas detection systems. Companies in this sector are increasingly adopting wireless solutions to enhance safety measures and ensure compliance with environmental regulations. The market for wireless gas detection systems in the oil and gas sector is projected to grow at a CAGR of approximately 12% through 2026, driven by the need for real-time monitoring and rapid response capabilities. This trend underscores the critical importance of advanced gas detection technologies in safeguarding personnel and assets in high-risk environments.

Growing Awareness of Environmental Concerns

The Wireless Gas Detection Market is also benefiting from the growing awareness of environmental concerns. As industries face increasing scrutiny regarding their environmental impact, there is a heightened focus on reducing emissions and preventing gas leaks. This awareness is prompting organizations to invest in wireless gas detection systems that not only enhance safety but also contribute to environmental sustainability. The market is likely to expand as companies recognize the dual benefits of compliance with environmental regulations and the protection of public health. Furthermore, the integration of wireless gas detection systems aligns with corporate social responsibility initiatives, making it a strategic investment for businesses aiming to improve their environmental footprint.

Technological Innovations in Detection Systems

Technological advancements are playing a pivotal role in shaping the Wireless Gas Detection Market. Innovations such as the development of highly sensitive sensors and real-time monitoring capabilities are enhancing the effectiveness of gas detection systems. These advancements allow for quicker response times and improved accuracy in identifying gas leaks. Moreover, the integration of Internet of Things (IoT) technology enables seamless communication between detection devices and centralized monitoring systems. This connectivity not only enhances operational efficiency but also facilitates predictive maintenance, reducing downtime. As organizations increasingly adopt these advanced technologies, the market is likely to witness substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of around 10% over the next five years.