Wireless Power Receiver Size

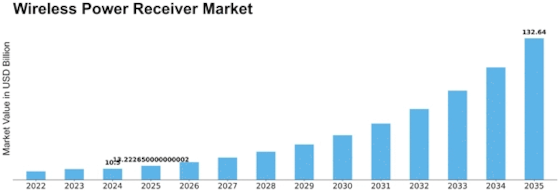

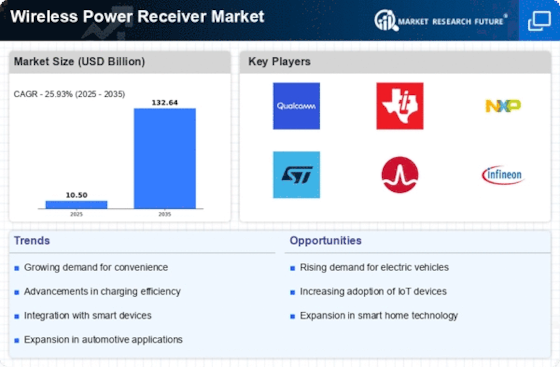

Wireless Power Receiver Market Growth Projections and Opportunities

The dynamics and growth trajectory of the Wireless Power Receiver Market are significantly influenced by factors that shape it. One such crucial determinant is an increase in demand for convenient and efficient charging solutions across a range of electronic devices. The need for hassle-free charging options becomes increasingly important as consumers depend more on smartphones, smartwatches, and other portable gadgets. Moreover, the technology development rate significantly affects the wireless power receiver market. The new wireless charging standards like Qi and Powermat are driving its growth. The regulatory landscape also affects the wireless power receiver market apart from technological advances. The introduction and adoption of technologies for wireless charging are affected by government policies as well as regulations on safety standards plus energy efficiency. To ensure their products are reliable and safe, manufacturers must follow those instructions. Furthermore, the competitive environment and market trends play a significant role in shaping the wireless power receiver market. Innovation is driven by the presence of key players as well as competition between them, which also impacts pricing strategies. In addition to this, trends such as the integration of wireless charging in public places or the automotive sector contribute towards overall growth and sustainability in the market. Thus, aligning their strategies with these trends allows firms to be ahead of others within this dynamic environment. Consumer behavior, together with preferences, also affects the wireless power receiver market. As more people become aware of wireless charging solutions available today, they tend to buy products that fit these features. Consumer taste shift prompts manufacturers to add Wi-Fi capabilities into their product lines so that they can meet their targeted markets' demands. In order to get a significant share of this market, companies must know what consumers want from them. Additionally, economic factors, such as the health of various regions or countries, determine how markets perform. Worldwide patterns of consumption depend upon levels of economic stability accompanied by individual incomes, which influence buying decisions regarding Wi-Fi-enabled chargers. Market players have to check economic conditions since they should create suitable marketing strategies as well as prices that resonate with consumers on different economic backdrops.

Leave a Comment