Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Zinc Dialkyldithiophosphates Additive Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Zinc Dialkyldithiophosphates Additive Industry must offer cost-effective items.

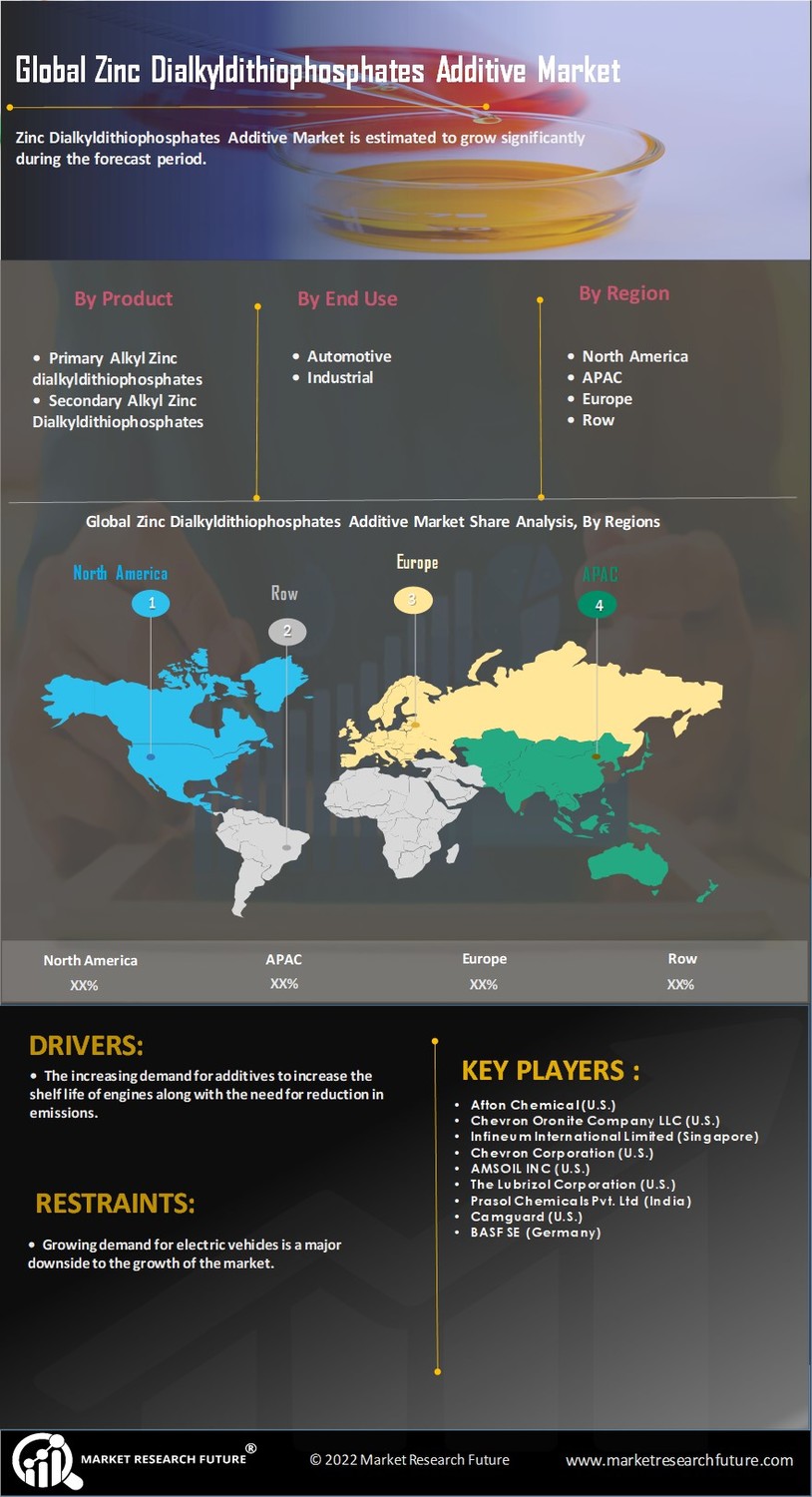

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Zinc Dialkyldithiophosphates Additive Industry to benefit clients and increase the market sector. In recent years, the Zinc Dialkyldithiophosphates Additive Industry has offered some of the most significant advantages to medicine. Major players in the Zinc Dialkyldithiophosphates Additive Market, including Afton Chemical, Chevron Oronite Company LLC, Infineum International Limited, Chevron Corporation, AMSOIL INC, The Lubrizol Corporation, Prasol Chemicals Pvt. Ltd, Camguard, and BASF SE, are attempting to increase market demand by investing in research and development operations.

The Lubrizol Corp. (Lubrizol), a division of Berkshire Hathaway Inc., is a specialty chemical company that creates and offers technologies for the consumer, industrial, and transportation sectors. Its products and services include engine additives, driveline additives, industrial specialised items, engineered polymers, coatings, and life science solutions. The company's goods are used in pipelines, compressor lubricants, specialty driveline lubricants and greases for transportation and industrial applications, fire sprinkler systems, over-the-counter medications, performance coatings, personal care items and gear oils and metalworking fluids.

It operates through a worldwide network of manufacturing plants, research facilities, sales offices, and technical offices in North America, Europe, and Asia-Pacific. The headquarters of Lubrizol are located in Wickliffe, Ohio, a city in the US. The development of a new Zinc Dialkyldithiophosphates additive for use in the automotive and industrial lubricants applications was announced by the Lubrizol Corporation in March 2022. This particular high-performance lubricant ingredient from the business is intended to offer better wear protection and oxidation stability.

Exxon Mobil Corp. (ExxonMobil), an integrated oil and gas company, finds, develops, and produces crude oil, natural gas, and natural gas liquids. It refines crude oil and makes base stocks and finished lubricants in addition to producing, moving, trading, and selling petroleum products. In addition to common petrochemicals including polyethylene and polypropylene plastics, aromatic petrochemicals, olefins, and aromatics, ExxonMobil also manufactures and distributes a wide variety of specialty items. It passes via a network of manufacturing plants, transportation hubs, and distribution centres. The corporation operates in North America, Latin America, Asia Pacific, Europe, the Middle East, and Africa.

The company's headquarters are in the American city of Irving, Texas. Infineum International Ltd., the joint venture between ExxonMobil and Shell, declared in February 2022 that it had started producing lubricant additives in China. The facility was constructed to satisfy the expanding need for lubricant additives in the area, especially Zinc Dialkyldithiophosphate additives.