轮胎胎圈钢丝市场 摘要

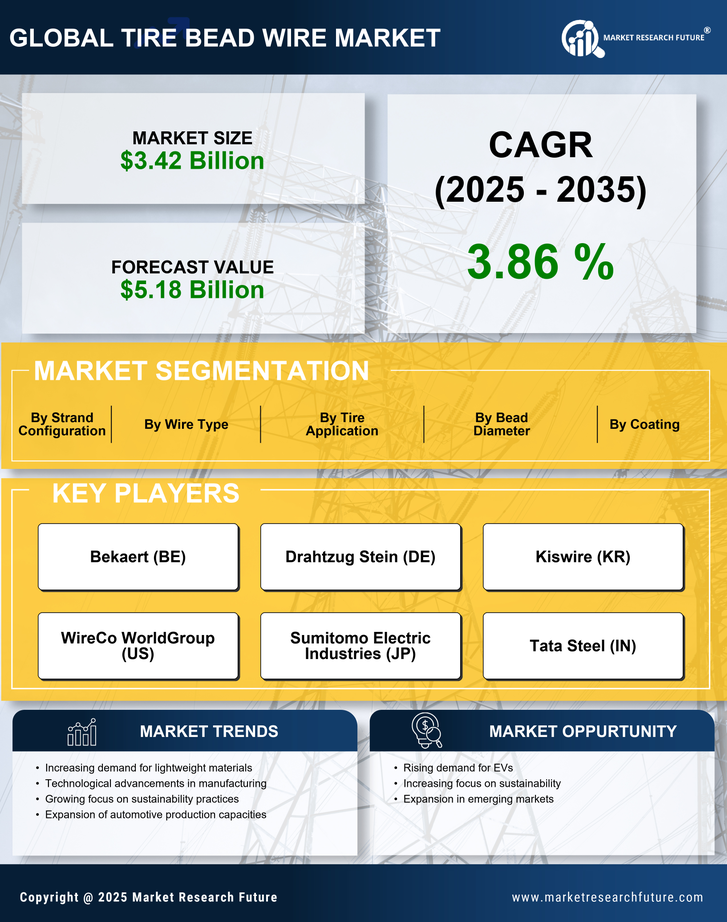

根据MRFR分析,轮胎胎圈钢丝市场规模在2024年预计为34.17亿美元。轮胎胎圈钢丝行业预计将从2025年的35.49亿美元增长到2035年的51.84亿美元,预计在2025年至2035年的预测期内,年均增长率(CAGR)为3.86。

主要市场趋势和亮点

轮胎胎圈钢丝市场目前正经历着由可持续性和技术进步驱动的动态转变。

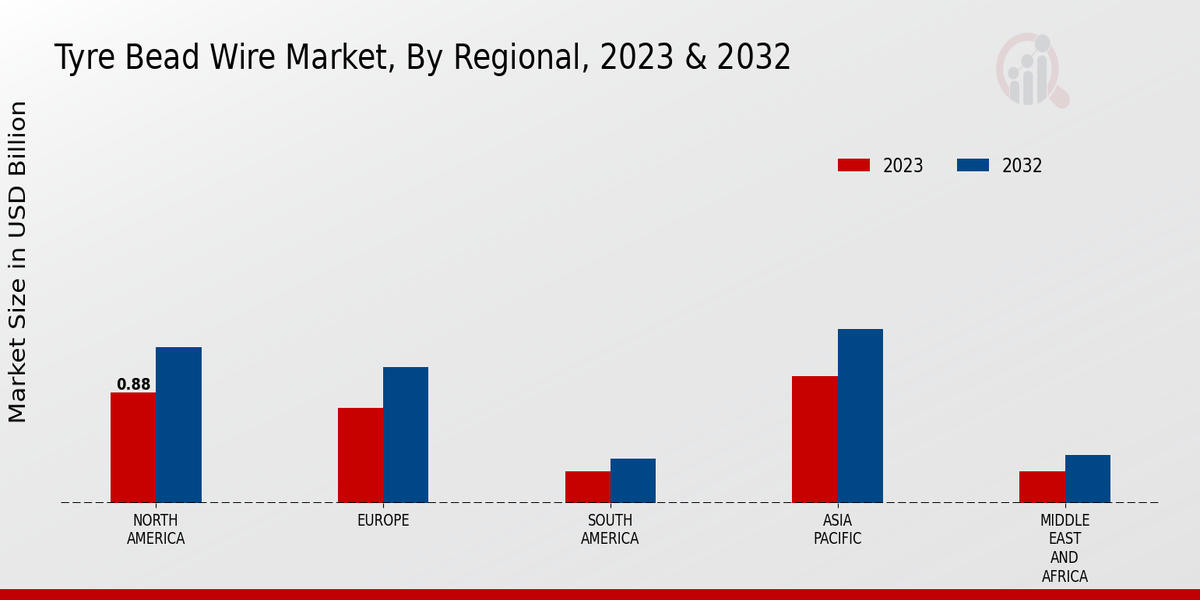

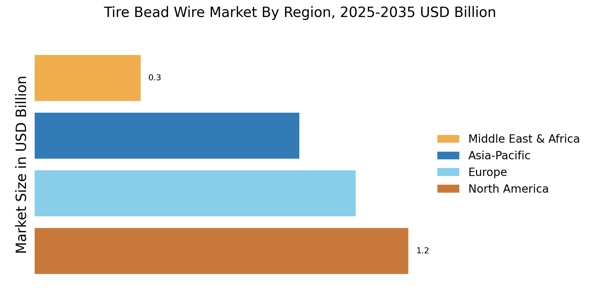

- 北美仍然是轮胎钢丝市场最大的市场,反映出强劲的汽车生产和需求。亚太地区被认为是增长最快的地区,受到汽车制造和消费者需求增加的推动。钢铁部门继续主导市场,而铝部门由于其轻量化特性正在迅速获得关注。对高性能轮胎的需求上升以及电动车市场的增长是影响市场扩张的关键驱动因素。

市场规模与预测

| 2024 Market Size | 3417亿美元 |

| 2035 Market Size | 51.84(十亿美元) |

| CAGR (2025 - 2035) | 3.86% |

主要参与者

贝卡特 (BE), 德国德拉赫兹格施泰因 (DE), 奇士维尔 (KR), WireCo 世界集团 (US), 住友电气工业 (JP), 塔塔钢铁 (IN), Kordsa 技术纺织 (TR), 康德新复合材料集团 (CN)