Wachsende Biokraftstoffproduktion

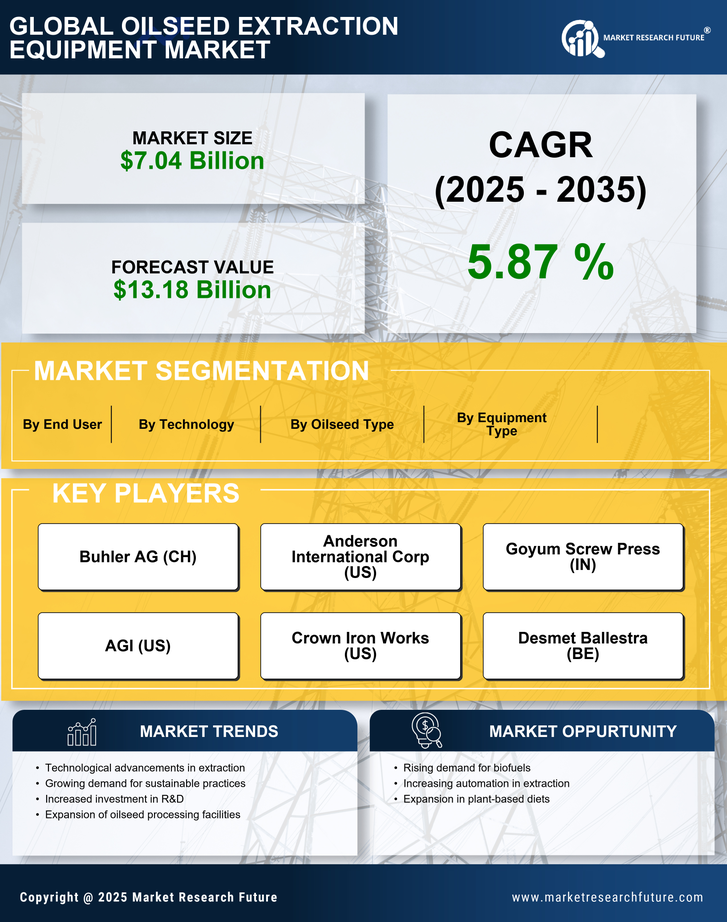

Der Übergang zu erneuerbaren Energiequellen hat erhebliche Auswirkungen auf den Markt für Ölsaaten-Extraktionsanlagen. Mit dem zunehmenden Fokus auf Nachhaltigkeit gewinnen Biokraftstoffe, die aus Ölsaaten gewonnen werden, als Alternative zu fossilen Brennstoffen an Bedeutung. Regierungen und Organisationen fördern die Nutzung von Biodiesel, der aus Ölsaaten wie Sojabohnen und Raps hergestellt wird. Dieser Trend wird voraussichtlich die Nachfrage nach Ölsaaten-Extraktionsanlagen ankurbeln, da die Produzenten effiziente und zuverlässige Maschinen benötigen, um Öl für die Biokraftstoffproduktion zu extrahieren. Jüngste Schätzungen deuten darauf hin, dass der Biodieselmarkt in den kommenden Jahren mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von über 5 % wachsen könnte. Folglich wird der Markt für Ölsaaten-Extraktionsanlagen voraussichtlich von diesem wachsenden Sektor profitieren, da die Hersteller in Anlagen investieren, die den spezifischen Anforderungen der Biokraftstoffproduktion gerecht werden.

Steigende Nachfrage nach Speiseölen

Die wachsende globale Bevölkerung und sich ändernde Ernährungsgewohnheiten treiben die Nachfrage nach Speiseölen voran, was wiederum den Markt für Ölsaaten-Extraktionsanlagen ankurbeln. Da die Verbraucher zunehmend gesundheitsbewusster werden, steigt die Präferenz für Öle, die aus Ölsaaten wie Sojabohnen, Raps und Sonnenblumen gewonnen werden. Laut aktuellen Daten wird der Verbrauch von Speiseölen voraussichtlich in den nächsten Jahren mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von etwa 4 % wachsen. Dieser Anstieg der Nachfrage erfordert die Einführung fortschrittlicher Extraktionstechnologien zur Steigerung von Ertrag und Effizienz, wodurch das Wachstum im Markt für Ölsaaten-Extraktionsanlagen angeregt wird. Hersteller werden voraussichtlich in innovative Extraktionsmethoden investieren, um dieser Nachfrage gerecht zu werden und sicherzustellen, dass sie in einem sich schnell entwickelnden Markt wettbewerbsfähig bleiben.

Erhöhte Investitionen in die Landwirtschaft

Die Investition in landwirtschaftliche Infrastruktur ist ein entscheidender Treiber für den Markt für Ölsaaten-Extraktionsgeräte. Während die Länder bestrebt sind, die Ernährungssicherheit zu verbessern und die landwirtschaftliche Produktivität zu steigern, gibt es einen bemerkenswerten Anstieg der Finanzierung für moderne Anbautechniken und -geräte. Dieser Trend ist insbesondere in Entwicklungsländern zu beobachten, wo Regierungen und private Unternehmen in den Anbau und die Verarbeitung von Ölsaaten investieren. Verbesserte landwirtschaftliche Praktiken führen zu höheren Erträgen bei Ölsaaten, was die Nachfrage nach Extraktionsgeräten erhöht. Jüngste Berichte zeigen, dass die landwirtschaftlichen Investitionen voraussichtlich um etwa 6 % jährlich wachsen werden, was dem Markt für Ölsaaten-Extraktionsgeräte zugutekommen dürfte. Infolgedessen wird erwartet, dass die Hersteller von diesem Trend profitieren, indem sie fortschrittliche Extraktionslösungen anbieten, die auf die sich entwickelnden Bedürfnisse des Agrarsektors zugeschnitten sind.

Technologische Innovationen in Extraktionsprozessen

Technologische Fortschritte spielen eine entscheidende Rolle bei der Gestaltung des Marktes für Ölsaaten-Extraktionsanlagen. Innovationen wie die Lösungsmittel-Extraktion, Kaltpressung und superkritische Fluidextraktion verbessern die Effizienz und den Ertrag der Ölextraktionsprozesse. Diese Technologien verbessern nicht nur die Qualität des extrahierten Öls, sondern reduzieren auch den Energieverbrauch und die Betriebskosten. So hat beispielsweise die Einführung automatisierter Systeme und Echtzeit-Überwachungstools die Produktionsprozesse optimiert und ermöglicht eine größere Präzision und Kontrolle. Infolgedessen nehmen Unternehmen zunehmend diese fortschrittlichen Technologien an, um ihre Abläufe zu optimieren. Der Markt für Ölsaaten-Extraktionsanlagen wird voraussichtlich einen signifikanten Anstieg erleben, da die Hersteller bestrebt sind, diese Innovationen zu nutzen, um die Produktivität zu steigern und der wachsenden Nachfrage nach hochwertigen Speiseölen gerecht zu werden.

Steigende Gesundheitsbewusstsein und Ernährungstrends

Das wachsende Bewusstsein für Gesundheit und Ernährung bei den Verbrauchern beeinflusst den Markt für Ölsaaten-Extraktionsanlagen. Da die Menschen zunehmend über die Vorteile gesunder Fette und Öle informiert sind, steigt der Verbrauch von Ölen aus Ölsaaten merklich an. Dieser Trend wird durch die zunehmende Beliebtheit pflanzenbasierter Diäten unterstützt, die die Verwendung von Ölsaaten als Quelle für essentielle Fettsäuren betonen. Marktdaten zeigen, dass die Nachfrage nach gesunden Kochölen voraussichtlich erheblich steigen wird, mit einer prognostizierten Wachstumsrate von etwa 4 % jährlich. Folglich treibt dieser Wandel in den Verbraucherpräferenzen die Hersteller dazu, in fortschrittliche Extraktionstechnologien zu investieren, die die Produktion von hochwertigen Ölen gewährleisten. Der Markt für Ölsaaten-Extraktionsanlagen ist somit bereit für Wachstum, da er sich an die sich entwickelnden Anforderungen gesundheitsbewusster Verbraucher anpasst.