Market Share

India Electric Car Market Share Analysis

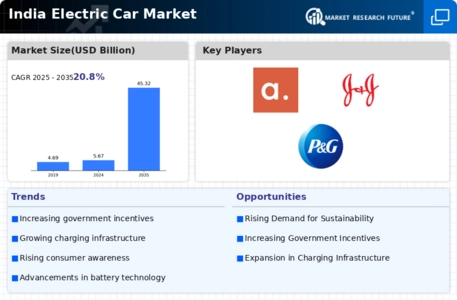

In the burgeoning landscape of India's electric car market, market share positioning strategies play a pivotal role in shaping the competitive dynamics among industry players. With a growing emphasis on sustainability and environmental consciousness, electric vehicles (EVs) have gained significant traction in recent years. One prevalent strategy involves targeting specific market segments, such as urban commuters or environmentally conscious consumers, to carve out a niche and establish a strong foothold. By understanding the unique needs and preferences of these segments, companies can tailor their offerings to effectively capture market share.

Moreover, pricing strategies are crucial in determining market positioning. In a price-sensitive market like India, offering affordable electric vehicles can be a key driver for market penetration. Companies often leverage government incentives and subsidies to lower the cost of EVs, making them more accessible to a broader consumer base. Additionally, strategic partnerships with financial institutions to offer attractive financing options can further enhance affordability and drive sales volume.

Furthermore, technological innovation plays a significant role in market share positioning. Companies that invest in research and development to improve battery efficiency, charging infrastructure, and vehicle performance can differentiate themselves in the market. By offering superior technology and features, they can attract tech-savvy consumers and gain a competitive edge over rivals.

Distribution and marketing strategies also contribute to market share positioning in the electric car market. Establishing a robust distribution network, including dealerships, service centers, and charging stations, is essential for reaching customers across different regions. Moreover, effective marketing campaigns that highlight the benefits of electric vehicles, such as lower operating costs and reduced carbon emissions, can help build brand awareness and drive consumer demand.

Additionally, collaborations with government bodies and industry stakeholders can be instrumental in shaping market share positioning strategies. Working closely with policymakers to develop supportive regulatory frameworks and infrastructure initiatives can create a conducive environment for the growth of the electric car market. Furthermore, partnerships with local manufacturers and suppliers can streamline production processes and reduce costs, enhancing competitiveness in the market.

In summary, market share positioning strategies in the India electric car market encompass a holistic approach that encompasses segmentation, pricing, technology, distribution, marketing, and collaboration. By effectively executing these strategies, companies can strengthen their market position, capitalize on growth opportunities, and contribute to the advancement of sustainable mobility in India. As the electric car market continues to evolve, agility, innovation, and strategic foresight will be key drivers of success for industry players aiming to capture a larger share of this promising market.

Leave a Comment