Market Analysis

India Green Hydrogen Market (Global, 2023)

Introduction

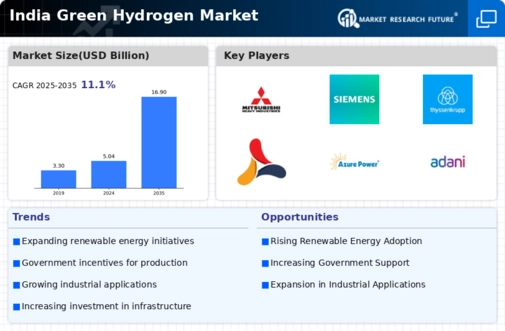

The India Green Hydrogen Market is poised to play a pivotal role in the country's transition towards a sustainable energy future, driven by a combination of government initiatives, technological advancements, and increasing environmental awareness. As India seeks to reduce its carbon footprint and enhance energy security, green hydrogen emerges as a viable alternative to fossil fuels, offering a clean and renewable energy source that can be utilized across various sectors, including transportation, industry, and power generation. The market is characterized by a growing interest from both public and private sectors, with investments in research and development, infrastructure, and production technologies gaining momentum. Furthermore, the alignment of green hydrogen production with India's abundant renewable energy resources, particularly solar and wind, positions the country as a potential leader in the global green hydrogen landscape. This report delves into the current state of the India Green Hydrogen Market, exploring key drivers, challenges, and opportunities that will shape its evolution in the coming years.

PESTLE Analysis

- Political

- The Indian government has set an ambitious target to produce 5 million tonnes of green hydrogen annually by 2030, as part of its National Hydrogen Mission. This initiative is supported by a budget allocation of ₹19,744 crore (approximately $2.4 billion) aimed at promoting research, development, and deployment of hydrogen technologies. Additionally, the government is actively engaging with various stakeholders, including state governments and private sector players, to create a conducive policy environment for green hydrogen production and utilization.

- Economic

- India's green hydrogen market is expected to attract investments of around ₹8 trillion (approximately $100 billion) by 2030, driven by both domestic and international players. The country aims to reduce its reliance on fossil fuels and enhance energy security, which is projected to create approximately 1 million jobs in the renewable energy sector by 2025. This economic shift is further supported by the rising cost of renewable energy, which has decreased by 89% since 2010, making green hydrogen a more viable option for energy production.

- Social

- Public awareness and acceptance of green hydrogen as a clean energy source are growing in India, with surveys indicating that over 70% of the population supports the transition to renewable energy sources. Educational institutions are increasingly incorporating renewable energy topics into their curricula, with over 200 universities offering specialized programs in renewable energy and sustainability. This societal shift is crucial for fostering a workforce skilled in green technologies, which is essential for the growth of the green hydrogen market.

- Technological

- India is witnessing rapid advancements in hydrogen production technologies, with the cost of electrolysis technology expected to drop by 30% by 2025. The country is also investing in research and development, with the Indian Institute of Technology (IIT) receiving ₹500 crore (approximately $60 million) for projects focused on hydrogen production and storage technologies. Furthermore, collaborations with international firms are enhancing technological capabilities, enabling India to leverage cutting-edge innovations in the green hydrogen sector.

- Legal

- The regulatory framework for green hydrogen in India is evolving, with the Ministry of Power issuing guidelines for the implementation of green hydrogen projects. These guidelines include provisions for the establishment of renewable energy purchase obligations (RPOs) that mandate a minimum percentage of energy to be sourced from renewable sources, including green hydrogen. Additionally, the government is working on a comprehensive hydrogen policy that is expected to be finalized by mid-2024, which will provide clarity on incentives and compliance requirements for stakeholders.

- Environmental

- The transition to green hydrogen is expected to significantly reduce carbon emissions in India, with estimates suggesting a potential reduction of 33 million tonnes of CO2 emissions annually by 2030. This aligns with India's commitment to achieving net-zero emissions by 2070. Furthermore, the production of green hydrogen from renewable sources can help mitigate air pollution, which is a major concern in urban areas, where air quality indices often exceed safe limits by more than 50%.

Porter's Five Forces

- Threat of New Entrants

- Medium - The India Green Hydrogen Market has moderate barriers to entry due to the significant capital investment required for technology and infrastructure development. However, the increasing government support and favorable policies for renewable energy create opportunities for new players. Established companies may have advantages in terms of technology and market presence, but the growing interest in green hydrogen can attract new entrants.

- Bargaining Power of Suppliers

- Low - The bargaining power of suppliers in the green hydrogen market is relatively low. This is primarily due to the availability of multiple sources for key inputs such as renewable energy and electrolyzers. As the market expands, the number of suppliers is likely to increase, further reducing their power. Additionally, advancements in technology may lead to more cost-effective production methods, diminishing supplier influence.

- Bargaining Power of Buyers

- Medium - Buyers in the India Green Hydrogen Market possess moderate bargaining power. As the market matures, buyers are likely to have more options and alternatives, which can increase their negotiating power. However, the unique benefits of green hydrogen, such as sustainability and compliance with environmental regulations, may limit their ability to switch to other energy sources easily.

- Threat of Substitutes

- High - The threat of substitutes in the green hydrogen market is high due to the availability of alternative energy sources such as natural gas, battery storage, and other renewable energy technologies. As these alternatives continue to evolve and become more cost-competitive, they pose a significant challenge to the adoption of green hydrogen. The market must demonstrate clear advantages in terms of efficiency and environmental impact to mitigate this threat.

- Competitive Rivalry

- High - Competitive rivalry in the India Green Hydrogen Market is high, driven by the presence of numerous players, including established energy companies and new entrants. The race to innovate and capture market share is intense, with companies investing heavily in research and development. Additionally, the urgency to meet sustainability goals and government mandates further fuels competition, making it a dynamic and rapidly evolving market.

SWOT Analysis

Strengths

- Abundant renewable energy resources, particularly solar and wind, facilitating green hydrogen production.

- Government support and favorable policies aimed at promoting clean energy and reducing carbon emissions.

- Growing investments from both domestic and international players in green hydrogen technology and infrastructure.

Weaknesses

- High initial capital costs associated with green hydrogen production and infrastructure development.

- Limited awareness and understanding of green hydrogen applications among potential end-users.

- Challenges in scaling up production and distribution networks to meet future demand.

Opportunities

- Increasing global demand for clean energy solutions and hydrogen as a fuel source.

- Potential for India to become a leading exporter of green hydrogen to international markets.

- Technological advancements in electrolysis and fuel cell technologies enhancing efficiency and reducing costs.

Threats

- Intense competition from other countries investing heavily in green hydrogen technologies.

- Regulatory and policy uncertainties that could impact investment and development timelines.

- Market volatility in renewable energy prices affecting the cost competitiveness of green hydrogen.

Summary

The India Green Hydrogen Market in 2023 presents a promising landscape characterized by strong government support and abundant renewable resources, positioning the country as a potential leader in the global green hydrogen sector. However, challenges such as high initial costs and limited market awareness must be addressed to fully capitalize on emerging opportunities. The market's growth will depend on overcoming competitive pressures and ensuring regulatory stability to attract sustained investments.

Leave a Comment