Market Share

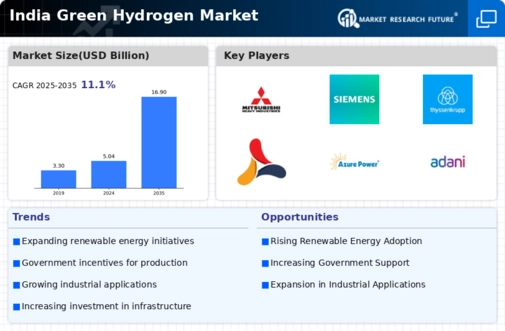

Introduction: Navigating the Competitive Landscape of India's Green Hydrogen Market

The competitive momentum in India's green hydrogen market is rapidly intensifying, driven by technological advancements, regulatory frameworks, and shifting consumer expectations for sustainable energy solutions. Key players, including OEMs, IT integrators, and infrastructure providers, are vying for market leadership by leveraging innovative technologies such as AI-based analytics, IoT integration, and green infrastructure development. OEMs are focusing on enhancing production efficiency and reducing costs, while IT integrators are offering robust data management solutions to optimize hydrogen supply chains. Infrastructure providers are investing in scalable refueling stations and distribution networks to meet the growing demand. As the market evolves, emerging disruptors, particularly AI startups, are introducing automation and predictive analytics to streamline operations and enhance decision-making. With significant regional growth opportunities on the horizon, strategic deployment trends for 2024–2025 will likely center around collaborative partnerships and investment in sustainable technologies, positioning stakeholders to capitalize on the burgeoning green hydrogen ecosystem.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions encompassing production, storage, and distribution of green hydrogen.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Cummins India | Strong legacy in energy solutions | Hydrogen production and fuel cells | India |

| Siemens | Advanced digitalization capabilities | Electrolyzers and energy management | Global with focus on India |

| ThyssenKrupp | Expertise in large-scale electrolyzer technology | Hydrogen production systems | India and Europe |

| MHI | Diverse industrial applications | Hydrogen production and storage | Asia-Pacific |

Specialized Technology Vendors

These companies focus on innovative technologies and solutions specifically for hydrogen production and utilization.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Hydrogen Pro AS | Innovative electrolyzer technology | Green hydrogen production | Global with interest in India |

| Stiesdal A/S | Focus on sustainable energy solutions | Hydrogen production technology | Europe and India |

| Air Products | Global leader in hydrogen supply | Hydrogen production and distribution | Global with operations in India |

Infrastructure & Equipment Providers

These vendors supply essential infrastructure and equipment necessary for hydrogen production and distribution.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Acme Group | Strong focus on renewable energy | Hydrogen production facilities | India |

| Azure Power | Expertise in solar energy integration | Renewable hydrogen production | India |

| Adani Group | Extensive infrastructure network | Hydrogen production and logistics | India |

| Reliance Industries Ltd. | Diverse energy portfolio | Hydrogen production and refining | India |

| NTPC Limited | Leading power generation company | Hydrogen production from renewable sources | India |

| GAIL Limited | Integrated gas company | Hydrogen production and distribution | India |

| L&T | Strong engineering capabilities | Hydrogen infrastructure development | India |

| Bharat Petroleum Corporation Limited (BPCL) | Established oil and gas player | Hydrogen production and supply | India |

| JSW Energy Neo Ltd. | Focus on sustainable energy solutions | Hydrogen production initiatives | India |

Emerging Players & Regional Champions

- ReNew Power (India): Focuses on renewable energy solutions including green hydrogen production, recently announced a partnership with a major industrial player to develop hydrogen fuel for transportation, complementing established vendors by leveraging its extensive renewable energy infrastructure.

- Tata Power (India): Engaged in green hydrogen production and storage solutions, recently signed an agreement with a state government to set up a hydrogen production facility, challenging established players by integrating hydrogen solutions into its existing energy portfolio.

- Hindustan Aeronautics Limited (HAL) (India): Developing hydrogen fuel cell technology for aerospace applications, recently collaborated with a global aerospace firm for R&D, complementing established vendors by targeting niche markets in aviation.

- Adani Group (India): Investing heavily in green hydrogen production and infrastructure, recently announced plans for a large-scale hydrogen plant in Gujarat, challenging established players by leveraging its vast resources and market reach.

- Greenko Energy Holdings (India): Focused on renewable energy storage and green hydrogen production, recently secured funding for a hydrogen project in Andhra Pradesh, complementing established vendors by providing integrated energy solutions.

Regional Trends: The India Green Hydrogen Market is witnessing a surge in regional adoption driven by government initiatives and policies promoting renewable energy. There is a growing emphasis on technology specialization, particularly in hydrogen production methods such as electrolysis and biomass gasification. Additionally, collaborations between traditional energy companies and new entrants are fostering innovation and accelerating the deployment of green hydrogen solutions across various sectors, including transportation, industrial applications, and power generation.

Collaborations & M&A Movements

- Adani Green Energy and TotalEnergies entered into a partnership to develop a green hydrogen production facility in Gujarat, aiming to leverage each other's strengths in renewable energy and technology, which is expected to enhance their competitive positioning in the rapidly growing green hydrogen sector.

- NTPC Limited acquired a 51% stake in Greenko Energy Holdings to expand its portfolio in the green hydrogen space, signaling a strategic move to diversify its energy sources and strengthen its market share amidst increasing regulatory support for clean energy initiatives in India.

- Indian Oil Corporation and Linde signed a collaboration agreement to develop hydrogen production technologies, focusing on scaling up green hydrogen production to meet the rising demand for clean fuels, thereby positioning themselves as leaders in the emerging hydrogen economy.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Electrolyzer Technology | Linde, Tata Power | Linde has advanced PEM electrolyzer technology that enhances efficiency and scalability, demonstrated in their recent project in Tamil Nadu. Tata Power is focusing on alkaline electrolyzers, leveraging local manufacturing to reduce costs and improve adoption rates. |

| Renewable Energy Integration | Adani Green Energy, ReNew Power | Adani Green Energy is integrating solar and wind power with hydrogen production, showcasing a successful pilot project in Gujarat. ReNew Power is also investing heavily in hybrid renewable systems to optimize hydrogen production. |

| Storage Solutions | Hindustan Aeronautics Limited (HAL), Indian Oil Corporation | HAL is developing advanced storage solutions for hydrogen, focusing on safety and efficiency, with a recent collaboration on hydrogen storage technology. Indian Oil is exploring liquid hydrogen storage, aiming to enhance distribution capabilities. |

| Infrastructure Development | GAIL India, NTPC Limited | GAIL India is investing in pipeline infrastructure for hydrogen transport, with ongoing projects to connect production sites to consumption areas. NTPC Limited is developing hydrogen refueling stations to support the growing demand in transportation. |

| Policy and Regulatory Support | Government of India, NITI Aayog | The Government of India is implementing favorable policies for green hydrogen, including production-linked incentives. NITI Aayog is actively promoting hydrogen as a key component of India's energy transition strategy. |

Conclusion: Navigating India's Green Hydrogen Landscape

The India Green Hydrogen Market is characterized by intense competitive dynamics and significant fragmentation, with both legacy players and emerging startups vying for market share. Regional trends indicate a growing emphasis on sustainability and local production capabilities, prompting vendors to adapt their strategies accordingly. Legacy companies are leveraging their established infrastructure and expertise, while emerging players are focusing on innovative technologies and agile operations. The ability to harness capabilities such as AI for predictive analytics, automation for efficiency, and flexibility in operations will be crucial for leadership in this evolving market. As decision-makers navigate this landscape, understanding these strategic implications will be essential for positioning their organizations for success.

Leave a Comment