-

EXECUTIVE SUMMARY.. 18

-

\r\n

-

MARKET ATTRACTIVENESS ANALYSIS. 20

- GLOBAL Polyacrylamide MARKET, BY product Type. 21

- GLOBAL Polyacrylamide MARKET, By application. 22

- GLOBAL Polyacrylamide MARKET, BY REGION. 23

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

MARKET INTRODUCTION.. 24

-

\r\n

-

DEFINITION. 24

-

\r\n

-

SCOPE OF THE STUDY. 24

-

\r\n

-

Research Objective. 24

-

\r\n

-

MARKET STRUCTURE. 25

-

\r\n

-

KEY BUYING CRITERIA. 25

-

\r\n

-

RESEARCH METHODOLOGY.. 26

-

\r\n

-

RESEARCH PROCESS. 26

-

\r\n

-

PRIMARY RESEARCH. 27

-

\r\n

-

SECONDARY RESEARCH. 28

-

\r\n

-

MARKET SIZE ESTIMATION. 29

-

\r\n

-

FORECAST MODEL. 30

-

\r\n

-

List of Assumptions & Limitations. 31

-

\r\n

-

MARKET DYNAMICS.. 32

-

\r\n

-

INTRODUCTION. 32

-

\r\n

-

DRIVERS. 33

- increasing awareness regarding wastewater management and growing need to reduce soil erosion. 33

- DRIVERS IMPACT ANALYSIS. 34

-

\r\n

-

\r\n

-

\r\n

-

RESTRAINT. 34

- stringent regulations for use of arcylamide monomer. 34

- RESTRAINT IMPACT ANALYSIS. 35

-

\r\n

-

\r\n

-

\r\n

-

OPPORTUNITIES. 35

- increase in the demand for enhanced oil recovery. 35

-

\r\n

-

\r\n

-

challenges. 36

- Anti-dumping duties. 36

-

\r\n

-

\r\n

-

MARKET FACTOR ANALYSIS.. 37

-

\r\n

-

Supply CHAIN ANALYSIS. 37

- raw Material Scenario. 37

- Manufacture. 38

- Distribution & sales channel. 38

- End Users. 38

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

PORTER’S FIVE FORCES MODEL. 39

- THREAT OF NEW ENTRANTS. 39

- BARGAINING POWER OF SUPPLIERS. 40

- BARGAINING POWER OF BUYERS. 40

- THREAT OF SUBSTITUTES. 40

- INTENSITY OF RIVALRY. 40

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

impact of the COVID-19 outbreak on GLOBAL polyacrylamide market. 41

- Impact of covid-19 on Supply chain of polyacrylamide market. 41

- major goverment policies to counter the pandemic. 41

- qualitative analysis on change in demand from end-users. 42

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

Pricing Overview of polyacrylamide (2019–2021) 42

-

\r\n

-

GLOBAL polyacrylamide MARKET, BY product type.. 43

-

\r\n

-

OVERVIEW.. 43

- GLOBAL POLYACRYLAMIDE MARKET ESTIMATES & FORECAST, BY product type, 2019–2030. 44

-

\r\n

-

\r\n

-

Anionic. 45

- Anionic: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030. 45

-

\r\n

-

\r\n

-

cationic. 47

- cationic: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030. 47

-

\r\n

-

\r\n

-

non-ionic. 49

- non-ionic: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030. 49

-

\r\n

-

\r\n

-

GLOBAL polyacrylamide MARKET, BY application.. 52

-

\r\n

-

OVERVIEW.. 52

- GLOBAL POLYACRYLAMIDE MARKET ESTIMATES & FORECAST, BY application, 2019–2030. 53

-

\r\n

-

\r\n

-

Water Treatment. 55

- Water Treatment: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030. 55

-

\r\n

-

\r\n

-

Pulp and Paper. 57

- Pulp and Paper: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030. 57

-

\r\n

-

\r\n

-

Mineral Processing. 59

- Mineral Processing: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030. 59

-

\r\n

-

\r\n

-

Enhanced Oil Recovery. 61

- Enhanced Oil Recovery: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030. 61

-

\r\n

-

\r\n

-

Others. 63

- Others: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030. 63

-

\r\n

-

\r\n

-

GLOBAL POLYACRYLAMIDE MARKET, BY REGION.. 66

-

\r\n

-

OVERVIEW.. 66

- global POLYACRYLAMIDE MARKET ESTIMATES & forecast, BY REGION, 2019–2030. 67

-

\r\n

-

\r\n

-

NORTH AMERICA. 70

- US. 75

- Canada. 78

-

\r\n

-

\r\n

-

\r\n

-

europe. 82

- Germany. 87

- UK. 90

- france. 93

- russia. 96

- spain. 99

- italy. 102

- Rest of Europe. 105

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

Asia-Pacific. 109

- china. 114

- Japan. 117

- India. 120

- South Korea. 123

- Australia & New Zealand. 126

- Rest of Asia-Pacific. 129

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

Latin America. 133

- Brazil. 138

- Mexico. 141

- Argentina. 144

- Rest of Latin America. 147

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

Middle East & Africa. 151

- Turkey. 156

- South Africa. 159

- GCC Countries. 162

- Rest of the Middle East & Africa. 165

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

Competitive Landscape.. 169

-

\r\n

-

Introduction. 169

-

\r\n

-

COMPETITIVE BENCHMARKING. 169

-

\r\n

-

Global MArket Strategies. 170

-

\r\n

-

KEY DEVELOPMENTS & GROWTH STRATEGIES. 170

- expansions. 170

-

\r\n

-

\r\n

-

Company Profiles.. 171

-

\r\n

-

BASF SE. 171

- COMPANY OVERVIEW.. 171

- FINANCIAL OVERVIEW.. 172

- PRODUCTS OFFERED. 172

- KEY DEVELOPMENTS. 173

- SWOT ANALYSIS. 173

- KEY STRATEGIES. 174

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

SNF GROUP. 175

- COMPANY OVERVIEW.. 175

- FINANCIAL OVERVIEW.. 175

- PRODUCTS OFFERed. 175

- KEY DEVELOPMENTS. 176

- SWOT ANALYSIS. 176

- KEY STRATEGIES. 177

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

China National Petroleum Corporation (CNPC) 178

- COMPANY OVERVIEW.. 178

- FINANCIAL OVERVIEW.. 178

- PRODUCTS OFFERed. 179

- KEY DEVELOPMENTS. 179

- SWOT ANALYSIS. 179

- KEY STRATEGIES. 180

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

The Dow Chemical Company. 181

- COMPANY OVERVIEW.. 181

- FINANCIAL OVERVIEW.. 182

- PRODUCTS OFFERed. 183

- KEY DEVELOPMENTS. 183

- SWOT ANALYSIS. 183

- Key Strategies. 184

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

PetroChina Company Limited. 185

- COMPANY OVERVIEW.. 185

- FINANCIAL OVERVIEW.. 186

- PRODUCTS OFFERed. 186

- KEY DEVELOPMENTS. 186

- SWOT ANALYSIS. 187

- Key Strategies. 187

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

Black Rose Industries Ltd. 188

- COMPANY OVERVIEW.. 188

- FINANCIAL OVERVIEW.. 188

- PRODUCTS OFFERED. 189

- KEY DEVELOPMENTS. 189

- KEY STRATEGIES. 189

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

Xitao Polymer Co., Ltd. 190

- COMPANY OVERVIEW.. 190

- FINANCIAL OVERVIEW.. 190

- PRODUCTS OFFERED. 190

- KEY DEVELOPMENTS. 190

- KEY STRATEGIES. 190

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

kemira oyj. 191

- COMPANY OVERVIEW.. 191

- FINANCIAL OVERVIEW.. 191

- PRODUCTS OFFERED. 192

- KEY DEVELOPMENTS. 192

- KEY STRATEGIES. 192

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

ZL Petrochemicals Co., Ltd. 193

- COMPANY OVERVIEW.. 193

- FINANCIAL OVERVIEW.. 193

- PRODUCTS OFFERED. 193

- KEY DEVELOPMENTS. 193

- KEY STRATEGIES. 193

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

Anhui Jucheng Fine Chemicals Co., Ltd. 194

- COMPANY OVERVIEW.. 194

- FINANCIAL OVERVIEW.. 194

- PRODUCTS OFFERED. 194

- KEY DEVELOPMENTS. 195

- KEY STRATEGIES. 195

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

References.. 196

-

\r\n

-

\r\n

-

LIST OF TABLES

-

\r\n

-

Primary Interviews 27

-

\r\n

-

List of assumptions & Limitations 31

-

\r\n

-

Pricing Overview of polyacrylamide, By region (USD/Ton) 42

-

\r\n

-

Global POLYACRYLAMIDE Market Estimates & Forecast, BY product type, 2019–2025 (USD million) 44

-

\r\n

-

Global POLYACRYLAMIDE Market Estimates & Forecast, BY product type, 2026–2030 (USD million) 44

-

\r\n

-

Global POLYACRYLAMIDE Market Estimates & Forecast, BY product type, 2019–2025 (Kilo Tons) 44

-

\r\n

-

Global POLYACRYLAMIDE Market Estimates & Forecast, BY product type, 2026–2030 (Kilo Tons) 45

-

\r\n

-

Anionic: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (USD million) 45

-

\r\n

-

Anionic: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (USD million) 46

-

\r\n

-

Anionic: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (Kilo Tons) 46

-

\r\n

-

Anionic: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (Kilo Tons) 47

-

\r\n

-

cationic: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (USD million) 47

-

\r\n

-

cationic: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (USD million) 48

-

\r\n

-

cationic: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (Kilo Tons) 48

-

\r\n

-

cationic: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (Kilo Tons) 49

-

\r\n

-

non-ionic: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (USD million) 49

-

\r\n

-

non-ionic: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (USD million) 50

-

\r\n

-

non-ionic: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (Kilo Tons) 50

-

\r\n

-

non-ionic: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (Kilo Tons) 51

-

\r\n

-

Global POLYACRYLAMIDE Market Estimates & Forecast, BY application, 2019–2025 (USD million) 53

-

\r\n

-

Global POLYACRYLAMIDE Market Estimates & Forecast, BY application, 2026–2030 (USD million) 54

-

\r\n

-

Global POLYACRYLAMIDE Market Estimates & Forecast, BY application, 2019–2025 (Kilo Tons) 54

-

\r\n

-

Global POLYACRYLAMIDE Market Estimates & Forecast, BY application, 2026–2030 (Kilo Tons) 55

-

\r\n

-

Water Treatment: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (USD million) 55

-

\r\n

-

Water Treatment: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (USD million) 56

-

\r\n

-

Water Treatment: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (Kilo Tons) 56

-

\r\n

-

Water Treatment: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (Kilo Tons) 57

-

\r\n

-

Pulp and Paper: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (USD million) 57

-

\r\n

-

Pulp and Paper: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (USD million) 58

-

\r\n

-

Pulp and Paper: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (Kilo Tons) 58

-

\r\n

-

Pulp and Paper: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (Kilo Tons) 59

-

\r\n

-

Mineral Processing: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (USD million) 59

-

\r\n

-

Mineral Processing: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (USD million) 60

-

\r\n

-

Mineral Processing: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (Kilo Tons) 60

-

\r\n

-

Mineral Processing: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (Kilo Tons) 61

-

\r\n

-

Enhanced Oil Recovery: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (USD million) 61

-

\r\n

-

Enhanced Oil Recovery: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (USD million) 62

-

\r\n

-

Enhanced Oil Recovery: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (Kilo Tons) 62

-

\r\n

-

Enhanced Oil Recovery: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (Kilo Tons) 63

-

\r\n

-

Others: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (USD million) 63

-

\r\n

-

Others: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (USD million) 64

-

\r\n

-

Others: MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (Kilo Tons) 64

-

\r\n

-

Others: MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (Kilo Tons) 65

-

\r\n

-

global POLYACRYLAMIDE MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (USD million) 67

-

\r\n

-

global POLYACRYLAMIDE MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (USD million) 68

-

\r\n

-

global POLYACRYLAMIDE MARKET ESTIMATES & forecast, BY REGION, 2019–2025 (kilo tons) 68

-

\r\n

-

global POLYACRYLAMIDE MARKET ESTIMATES & forecast, BY REGION, 2026–2030 (kilo tons) 69

-

\r\n

-

North america: Market ESTIMATES & forecast, BY country, 2019–2025 (USD million) 70

-

\r\n

-

North america: Market ESTIMATES & forecast, BY country, 2026–2030 (USD million) 71

-

\r\n

-

North america: Market ESTIMATES & forecast, BY country, 2019–2025 (kilo tons) 71

-

\r\n

-

North america: Market ESTIMATES & forecast, BY country, 2026–2030 (kilo tons) 71

-

\r\n

-

North America: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 72

-

\r\n

-

North America: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 72

-

\r\n

-

North America: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 72

-

\r\n

-

North America: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 73

-

\r\n

-

North America: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 73

-

\r\n

-

North America: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 74

-

\r\n

-

North America: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 74

-

\r\n

-

North America: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 75

-

\r\n

-

US: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 75

-

\r\n

-

US: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 76

-

\r\n

-

US: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 76

-

\r\n

-

US: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 76

-

\r\n

-

US: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 77

-

\r\n

-

US: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 77

-

\r\n

-

US: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 77

-

\r\n

-

US: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 78

-

\r\n

-

Canada: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 78

-

\r\n

-

Canada: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 79

-

\r\n

-

Canada: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 79

-

\r\n

-

Canada: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 79

-

\r\n

-

Canada: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 80

-

\r\n

-

Canada: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 80

-

\r\n

-

Canada: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 80

-

\r\n

-

Canada: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 81

-

\r\n

-

europe: Market ESTIMATES & forecast, BY country, 2019–2025 (USD million) 82

-

\r\n

-

europe: Market ESTIMATES & forecast, BY country, 2026–2030 (USD million) 83

-

\r\n

-

europe: Market ESTIMATES & forecast, BY country, 2019–2025 (kilo tons) 83

-

\r\n

-

europe: Market ESTIMATES & forecast, BY country, 2026–2030 (kilo tons) 84

-

\r\n

-

europe: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 84

-

\r\n

-

europe: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 85

-

\r\n

-

europe: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 85

-

\r\n

-

europe: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 85

-

\r\n

-

europe: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 86

-

\r\n

-

europe: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 86

-

\r\n

-

europe: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 86

-

\r\n

-

europe: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 87

-

\r\n

-

Germany: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 87

-

\r\n

-

Germany: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 88

-

\r\n

-

Germany: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 88

-

\r\n

-

Germany: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 88

-

\r\n

-

Germany: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 89

-

\r\n

-

Germany: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 89

-

\r\n

-

Germany: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 89

-

\r\n

-

Germany: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 90

-

\r\n

-

UK: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 90

-

\r\n

-

UK: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 91

-

\r\n

-

UK: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 91

-

\r\n

-

UK: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 91

-

\r\n

-

UK: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 92

-

\r\n

-

UK: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 92

-

\r\n

-

UK: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 92

-

\r\n

-

UK: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 93

-

\r\n

-

france: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 93

-

\r\n

-

france: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 94

-

\r\n

-

france: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 94

-

\r\n

-

france: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 94

-

\r\n

-

france: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 95

-

\r\n

-

france: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 95

-

\r\n

-

france: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 95

-

\r\n

-

france: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 96

-

\r\n

-

russia: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 96

-

\r\n

-

russia: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 97

-

\r\n

-

russia: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 97

-

\r\n

-

russia: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 97

-

\r\n

-

russia: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 98

-

\r\n

-

russia: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 98

-

\r\n

-

russia: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 98

-

\r\n

-

russia: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 99

-

\r\n

-

spain: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 99

-

\r\n

-

spain: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 100

-

\r\n

-

spain: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 100

-

\r\n

-

spain: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 100

-

\r\n

-

spain: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 101

-

\r\n

-

spain: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 101

-

\r\n

-

spain: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 101

-

\r\n

-

spain: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 102

-

\r\n

-

italy: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 102

-

\r\n

-

italy: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 103

-

\r\n

-

italy: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 103

-

\r\n

-

italy: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 103

-

\r\n

-

italy: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 104

-

\r\n

-

italy: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 104

-

\r\n

-

italy: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 104

-

\r\n

-

italy: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 105

-

\r\n

-

Rest of Europe: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 105

-

\r\n

-

Rest of Europe: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 106

-

\r\n

-

Rest of Europe: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 106

-

\r\n

-

Rest of Europe: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 106

-

\r\n

-

Rest of Europe: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 107

-

\r\n

-

Rest of Europe: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 107

-

\r\n

-

Rest of Europe: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 107

-

\r\n

-

Rest of Europe: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 108

-

\r\n

-

Asia-Pacific: Market ESTIMATES & forecast, BY country, 2019–2025 (USD million) 109

-

\r\n

-

Asia-Pacific: Market ESTIMATES & forecast, BY country, 2026–2030 (USD million) 110

-

\r\n

-

Asia-Pacific: Market ESTIMATES & forecast, BY country, 2019–2025 (kilo tons) 110

-

\r\n

-

Asia-Pacific: Market ESTIMATES & forecast, BY country, 2026–2030 (kilo tons) 111

-

\r\n

-

Asia-Pacific: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 111

-

\r\n

-

Asia-Pacific: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 112

-

\r\n

-

Asia-Pacific: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 112

-

\r\n

-

Asia-Pacific: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 112

-

\r\n

-

Asia-Pacific: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 113

-

\r\n

-

Asia-Pacific: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 113

-

\r\n

-

Asia-Pacific: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 113

-

\r\n

-

Asia-Pacific: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 114

-

\r\n

-

china: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 114

-

\r\n

-

china: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 115

-

\r\n

-

china: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 115

-

\r\n

-

china: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 115

-

\r\n

-

china: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 116

-

\r\n

-

china: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 116

-

\r\n

-

china: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 116

-

\r\n

-

china: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 117

-

\r\n

-

Japan: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 117

-

\r\n

-

Japan: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 118

-

\r\n

-

Japan: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 118

-

\r\n

-

Japan: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 118

-

\r\n

-

Japan: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 119

-

\r\n

-

Japan: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 119

-

\r\n

-

Japan: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 119

-

\r\n

-

Japan: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 120

-

\r\n

-

India: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 120

-

\r\n

-

India: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 121

-

\r\n

-

India: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 121

-

\r\n

-

India: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 121

-

\r\n

-

India: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 122

-

\r\n

-

India: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 122

-

\r\n

-

India: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 122

-

\r\n

-

India: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 123

-

\r\n

-

South Korea: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 123

-

\r\n

-

South Korea: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 124

-

\r\n

-

South Korea: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 124

-

\r\n

-

South Korea: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 124

-

\r\n

-

South Korea: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 125

-

\r\n

-

South Korea: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 125

-

\r\n

-

South Korea: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 125

-

\r\n

-

South Korea: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 126

-

\r\n

-

Australia & New Zealand: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 126

-

\r\n

-

Australia & New Zealand: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 127

-

\r\n

-

Australia & New Zealand: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 127

-

\r\n

-

Australia & New Zealand: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 127

-

\r\n

-

Australia & New Zealand: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 128

-

\r\n

-

Australia & New Zealand: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 128

-

\r\n

-

Australia & New Zealand: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 128

-

\r\n

-

Australia & New Zealand: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 129

-

\r\n

-

Rest of Asia-Pacific: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 129

-

\r\n

-

Rest of Asia-Pacific: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 130

-

\r\n

-

Rest of Asia-Pacific: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 130

-

\r\n

-

Rest of Asia-Pacific: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 130

-

\r\n

-

Rest of Asia-Pacific: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 131

-

\r\n

-

Rest of Asia-Pacific: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 131

-

\r\n

-

Rest of Asia-Pacific: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 131

-

\r\n

-

Rest of Asia-Pacific: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 132

-

\r\n

-

Latin America: Market ESTIMATES & forecast, BY country, 2019–2025 (USD million) 133

-

\r\n

-

Latin America: Market ESTIMATES & forecast, BY country, 2026–2030 (USD million) 134

-

\r\n

-

Latin America: Market ESTIMATES & forecast, BY country, 2019–2025 (kilo tons) 134

-

\r\n

-

Latin America: Market ESTIMATES & forecast, BY country, 2026–2030 (kilo tons) 135

-

\r\n

-

Latin America: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 135

-

\r\n

-

Latin America: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 135

-

\r\n

-

Latin America: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 136

-

\r\n

-

Latin America: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 136

-

\r\n

-

Latin America: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 136

-

\r\n

-

Latin America: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 137

-

\r\n

-

Latin America: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 137

-

\r\n

-

Latin America: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 138

-

\r\n

-

Brazil: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 138

-

\r\n

-

Brazil: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 139

-

\r\n

-

Brazil: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 139

-

\r\n

-

Brazil: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 139

-

\r\n

-

Brazil: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 140

-

\r\n

-

Brazil: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 140

-

\r\n

-

Brazil: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 140

-

\r\n

-

Brazil: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 141

-

\r\n

-

Mexico: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 141

-

\r\n

-

Mexico: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 142

-

\r\n

-

Mexico: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 142

-

\r\n

-

Mexico: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 142

-

\r\n

-

Mexico: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 143

-

\r\n

-

Mexico: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 143

-

\r\n

-

Mexico: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 143

-

\r\n

-

Mexico: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 144

-

\r\n

-

Argentina: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 144

-

\r\n

-

Argentina: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 145

-

\r\n

-

Argentina: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 145

-

\r\n

-

Argentina: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 145

-

\r\n

-

Argentina: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 146

-

\r\n

-

Argentina: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 146

-

\r\n

-

Argentina: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 146

-

\r\n

-

Argentina: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 147

-

\r\n

-

Rest of Latin America: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 147

-

\r\n

-

Rest of Latin America: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 148

-

\r\n

-

Rest of Latin America: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 148

-

\r\n

-

Rest of Latin America: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 148

-

\r\n

-

Rest of Latin America: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 149

-

\r\n

-

Rest of Latin America: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 149

-

\r\n

-

Rest of Latin America: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 149

-

\r\n

-

Rest of Latin America: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 150

-

\r\n

-

Middle East & Africa: Market ESTIMATES & forecast, BY country, 2019–2025 (USD million) 151

-

\r\n

-

Middle East & Africa: Market ESTIMATES & forecast, BY country, 2026–2030 (USD million) 152

-

\r\n

-

Middle East & Africa: Market ESTIMATES & forecast, BY country, 2019–2025 (kilo tons) 152

-

\r\n

-

Middle East & Africa: Market ESTIMATES & forecast, BY country, 2026–2030 (kilo tons) 153

-

\r\n

-

Middle East & Africa: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 153

-

\r\n

-

Middle East & Africa: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 153

-

\r\n

-

Middle East & Africa: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 154

-

\r\n

-

Middle East & Africa: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 154

-

\r\n

-

Middle East & Africa: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 154

-

\r\n

-

Middle East & Africa: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 155

-

\r\n

-

Middle East & Africa: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 155

-

\r\n

-

Middle East & Africa: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 156

-

\r\n

-

Turkey: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 156

-

\r\n

-

Turkey: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 157

-

\r\n

-

Turkey: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 157

-

\r\n

-

Turkey: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 157

-

\r\n

-

Turkey: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 158

-

\r\n

-

Turkey: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 158

-

\r\n

-

Turkey: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 158

-

\r\n

-

Turkey: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 159

-

\r\n

-

South Africa: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 159

-

\r\n

-

South Africa: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 160

-

\r\n

-

South Africa: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 160

-

\r\n

-

South Africa: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 160

-

\r\n

-

South Africa: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 161

-

\r\n

-

South Africa: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 161

-

\r\n

-

South Africa: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 161

-

\r\n

-

South Africa: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 162

-

\r\n

-

GCC Countries: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 162

-

\r\n

-

GCC Countries: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 163

-

\r\n

-

GCC Countries: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 163

-

\r\n

-

GCC Countries: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 163

-

\r\n

-

GCC Countries: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 164

-

\r\n

-

GCC Countries: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 164

-

\r\n

-

GCC Countries: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 164

-

\r\n

-

GCC Countries: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 165

-

\r\n

-

Rest of the Middle East & Africa: POLYACRYLAMIDE Market, BY product type, 2019–2025 (USD million) 165

-

\r\n

-

Rest of the Middle East & Africa: POLYACRYLAMIDE Market, BY product type, 2026–2030 (USD million) 166

-

\r\n

-

Rest of the Middle East & Africa: POLYACRYLAMIDE Market, BY product type, 2019–2025 (kilo tons) 166

-

\r\n

-

Rest of the Middle East & Africa: POLYACRYLAMIDE Market, BY product type, 2026–2030 (kilo tons) 166

-

\r\n

-

Rest of the Middle East & Africa: POLYACRYLAMIDE Market, BY application, 2019–2025 (USD million) 167

-

\r\n

-

Rest of the Middle East & Africa: POLYACRYLAMIDE Market, BY application, 2026–2030 (USD million) 167

-

\r\n

-

Rest of the Middle East & Africa: POLYACRYLAMIDE Market, BY application, 2019–2025 (kilo tons) 168

-

\r\n

-

Rest of the Middle East & Africa: POLYACRYLAMIDE Market, BY application, 2026–2030 (kilo tons) 168

-

\r\n

-

expansions 170

-

\r\n

-

BASF SE: Products offered 172

-

\r\n

-

BASF SE: Key Developments 173

-

\r\n

-

SNF Group: Products Offered 175

-

\r\n

-

SNF GROUP: Key DEVELOPMENTS 176

-

\r\n

-

China National Petroleum Corporation (CNPC): Products Offered 179

-

\r\n

-

THE DOW CHEMICAL COMPANY: PRODUCTS Offered 183

-

\r\n

-

PetroChina Company Limited: PRODUCTS Offered 186

-

\r\n

-

BLACK ROSE INDUSTRIES LTD.: Products offered 189

-

\r\n

-

XITAO POLYMER CO., LTD.: Products offered 190

-

\r\n

-

KEMIRA OYJ: Products offered 192

-

\r\n

-

KEMIRA OYJ: Key DEVELOPMENTS 192

-

\r\n

-

ZL Petrochemicals Co., Ltd: Products offered 193

-

\r\n

-

ANHUI JUCHENG FINE CHEMICALS CO., LTD: Products offered 194

-

\r\n

-

LIST OF FIGURES

-

\r\n

-

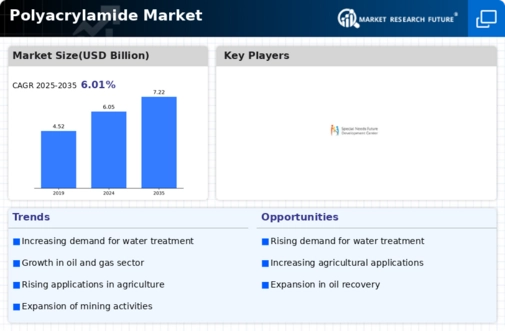

Market synopsis 19

-

\r\n

-

Market Attractiveness Analysis: Global Polyacrylamide Market, 2021 20

-

\r\n

-

Global Polyacrylamide Market analysis, by product Type, 2021 21

-

\r\n

-

Global Polyacrylamide Market analysis, by application, 2021 22

-

\r\n

-

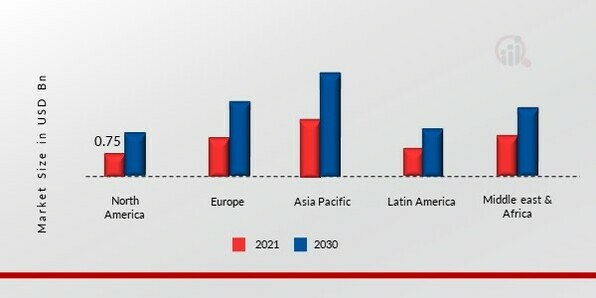

Global Polyacrylamide Market analysis, by region, 2021 23

-

\r\n

-

Global Polyacrylamide market: Structure 25

-

\r\n

-

Key Buying Criteria for Polyacrylamide 25

-

\r\n

-

Research Process 26

-

\r\n

-

TOP-DOWN & BOTTOM-UP APPROACHES 29

-

\r\n

-

MARKET dynamics overview 32

-

\r\n

-

Drivers Impact Analysis: GLOBAL polyacrylamide market 34

-

\r\n

-

Restraint Impact Analysis: GLOBAL polyacrylamide market 35

-

\r\n

-

GLOBAL polyacrylamide market: SUPPLY CHAIN analysis 37

-

\r\n

-

global polyacrylamide Market, BY product type, 2021 (% Share) 43

-

\r\n

-

global polyacrylamide Market, BY product type, 2019–2030 (USD million) 43

-

\r\n

-

global polyacrylamide Market, BY application, 2021 (% Share) 52

-

\r\n

-

global polyacrylamide Market, BY application, 2019–2030 (USD million) 53

-

\r\n

-

global POLYACRYLAMIDE MARKET, BY region, 2019–2030 (USD Million) 66

-

\r\n

-

global POLYACRYLAMIDE MARKET, BY region, 2021 (% Share) 67

-

\r\n

-

North America: POLYACRYLAMIDE MARKET share, BY country, 2021 (% share) 70

-

\r\n

-

europe: POLYACRYLAMIDE MARKET share, BY country, 2021 (% share) 82

-

\r\n

-

Asia-Pacific: POLYACRYLAMIDE MARKET share, BY country, 2021 (% share) 109

-

\r\n

-

Latin America: POLYACRYLAMIDE MARKET share, BY country, 2021 (% share) 133

-

\r\n

-

Middle East & Africa: POLYACRYLAMIDE MARKET share, BY country, 2021 (% share) 151

-

\r\n

-

BASF SE: Financial Overview snapshot 172

-

\r\n

-

BASF SE: SWOT Analysis 173

-

\r\n

-

SNF GROUP: SWOT Analysis 176

-

\r\n

-

China National Petroleum Corporation (CNPC): Financial Overview snapshot 178

-

\r\n

-

China National Petroleum Corporation (CNPC): SWOT Analysis 179

-

\r\n

-

THE DOW CHEMICAL COMPANY: Financial Overview snapshot 182

-

\r\n

-

THE DOW CHEMICAL COMPANY: SWOT Analysis 183

-

\r\n

-

PetroChina Company Limited: Financial Overview snapshot 186

-

\r\n

-

PetroChina Company LIMITED: SWOT Analysis 187

-

\r\n

-

Black Rose Industries Ltd.: Financial Overview snapshot 188

-

\r\n

-

KEMIRA OYJ: Financial Overview snapshot 191

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment