-

. Global Polyphenylene Oxide (PPO) Market, by Application

-

Introduction

-

Automotive

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Electrical & Electronics

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Healthcare

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Building & Construction

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Air Separation Membranes

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Others

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Introduction

-

Automotive

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Electrical & Electronics

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Healthcare

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Building & Construction

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Air Separation Membranes

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

Others

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Region, 2023-2032

-

. Global Polyphenylene Oxide (PPO) Market, by Region

-

Introduction

-

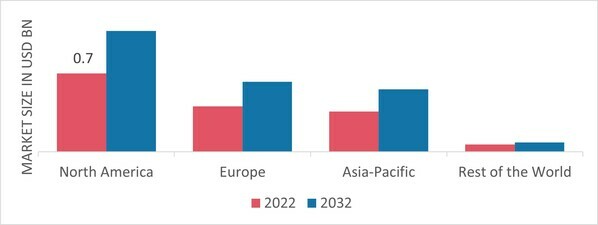

North America

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

US

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Canada

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Europe

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Germany

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

France

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Italy

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Spain

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application,2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

UK

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application,2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Russia

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application,2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Poland

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Rest of Europe

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Asia-Pacific

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

China

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

India

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Japan

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Australia & New Zealand

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Rest of Asia-Pacific

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Middle East & Africa

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

GCC

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Israel

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

North Africa

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Turkey

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Rest of Middle East & Africa

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Latin America

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Brazil

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Argentina

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Mexico

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Rest of Latin America

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Introduction

-

North America

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

US

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Canada

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Europe

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Germany

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

France

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Italy

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Spain

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application,2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

UK

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application,2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Russia

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application,2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Poland

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Rest of Europe

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Market Estimates & Forecast, by End-Use Industry, 2023-2032

-

Asia-Pacific

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

China

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

India

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Japan

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Australia & New Zealand

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Rest of Asia-Pacific

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Middle East & Africa

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

GCC

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Israel

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

North Africa

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Turkey

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Rest of Middle East & Africa

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Latin America

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Brazil

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Argentina

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Mexico

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

Rest of Latin America

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, by Application, 2023-2032

-

. Company Landscape

-

Introduction

-

Market Strategy

-

Key Development Analysis (Expansion/Merger & Acquisitions/Joint Venture/New Product Development/Agreement/Investment)

-

Introduction

-

Market Strategy

-

Key Development Analysis (Expansion/Merger & Acquisitions/Joint Venture/New Product Development/Agreement/Investment)

-

. Company Profiles

-

BASF SE

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

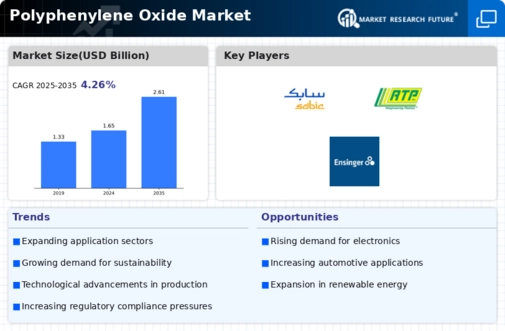

SABIC

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

RTP Company

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Celanese Corporation

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Ensinger Inc.

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Mitsubishi Electric Corporation

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

3M

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Goodfellow

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Asahi Kasei Chemicals Corp.

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Solvay SA

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Sumitomo Chemical Co., Ltd

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

LyondellBasell Industries Holdings BV

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

BASF SE

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

SABIC

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

RTP Company

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Celanese Corporation

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Ensinger Inc.

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Mitsubishi Electric Corporation

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

3M

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Goodfellow

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Asahi Kasei Chemicals Corp.

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Solvay SA

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

Sumitomo Chemical Co., Ltd

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

LyondellBasell Industries Holdings BV

-

Company Overview

-

Financial Updates

-

Product/Business Segment Overview

-

Strategy

-

Key Developments

-

SWOT Analysis

-

. Conclusion LIST OF TABLES Table 1 Global Polyphenylene Oxide (PPO) Market: by Region, 2023-2032 Table 2 North America: Polyphenylene Oxide (PPO) Market, by Country, 2023-2032 Table 3 Europe: Polyphenylene Oxide (PPO) Market, by Country, 2023-2032 Table 4 Asia-Pacific: Polyphenylene Oxide (PPO) Market. by Country, 2023-2032 Table 5 Middle East & Africa: Polyphenylene Oxide (PPO) Market, by Country, 2023-2032 Table 6 Latin America: Polyphenylene Oxide (PPO) Market, by Country, 2023-2032 Table 7 Global Polyphenylene Oxide (PPO) Application Market, by Regions, 2023-2032 Table 8 North America: Polyphenylene Oxide (PPO) Application Market, by Country, 2023-2032 Table 9 Europe: Polyphenylene Oxide (PPO) Application Market, by Country, 2023-2032 Table10 Asia-Pacific: Polyphenylene Oxide (PPO) Application Market, by Country, 2023-2032 Table11 Middle East & Africa: Polyphenylene Oxide (PPO) Application Market, by Country, 2023-2032 Table12 Latin America: Polyphenylene Oxide (PPO) Application Market, by Country, 2023-2032 Table 13 Global Polyphenylene Oxide (PPO) End-Use Industry Market, by Regions, 2023-2032 Table14 North America: Polyphenylene Oxide (PPO) End-Use Industry Market, by Country, 2023-2032 Table15 Europe: Polyphenylene Oxide (PPO) End-Use Industry Market, by Country, 2023-2032 Table16 Asia-Pacific: Polyphenylene Oxide (PPO) End-Use Industry Market, by Country, 2023-2032 Table17 Middle East & Africa: Polyphenylene Oxide (PPO) End-Use Industry Market, by Country, 2023-2032 Table18 Latin America: Polyphenylene Oxide (PPO) by End-Use Industry Market, by Country, 2023-2032 Table19 Global Application Market, by Region, 2023-2032 Table20 Global End-Use Industry Market, by Region, 2023-2032 Table21 North America: Polyphenylene Oxide (PPO) Market, by Country, 2023-2032 Table22 North America: Polyphenylene Oxide (PPO) Market, by Application, 2023-2032 Table23 North America: Polyphenylene Oxide (PPO) Market, by End-Use Industry, 2023-2032 Table24 Europe: Polyphenylene Oxide (PPO) Market, by Country, 2023-2032 Table25 Europe: Polyphenylene Oxide (PPO) Market, by Application, 2023-2032 Table26 Europe: Polyphenylene Oxide (PPO) Market, by End-Use Industry, 2023-2032 Table27 Asia-Pacific: Polyphenylene Oxide (PPO) Market, by Country, 2023-2032 Table28 Asia-Pacific: Polyphenylene Oxide (PPO) Market, by Application, 2023-2032 Table29 Asia-Pacific: Polyphenylene Oxide (PPO) Market, by End-Use Industry, 2023-2032 Table30 Middle East & Africa: Polyphenylene Oxide (PPO) Market, by Country, 2023-2032 Table31 Middle East & Africa: Polyphenylene Oxide (PPO) Market, by Application, 2023-2032 Table32 Middle East & Africa: Polyphenylene Oxide (PPO) Market, by End-Use Industry, 2023-2032 Table33 Latin America: Polyphenylene Oxide (PPO) Market, by Country, 2023-2032 Table34 Latin America: Polyphenylene Oxide (PPO) Market, by Application, 2023-2032 Table35 Latin America: Polyphenylene Oxide (PPO) Market, by End-Use Industry, 2023-2032 LIST OF FIGURES FIGURE 1 Global Polyphenylene Oxide (PPO) Market Segmentation FIGURE 2 Forecast Research Methodology FIGURE 3 Five Forces Analysis of Global Polyphenylene Oxide (PPO) Market FIGURE 4 Value Chain of Global Polyphenylene Oxide (PPO) Market FIGURE 5 Share of Global Polyphenylene Oxide (PPO) Market in 2023, by Country FIGURE 6 Global Polyphenylene Oxide (PPO) Market, 2023-2032, FIGURE 7 Global Polyphenylene Oxide (PPO) Market Size, by Application, 2023 FIGURE 8 Share of Global Polyphenylene Oxide (PPO) Market, by Application, 2023-2032 FIGURE 9 Global Polyphenylene Oxide (PPO) Market Size, by End-Use Industry, 2023 FIGURE10 Share of Global Polyphenylene Oxide (PPO) Market, by End-Use Industry, 2023-2032

-

List of Tables and Figures

-

Table FIGURE 1 Global Polyphenylene Oxide (PPO) Market Segmentation FIGURE 2 Forecast Research Methodology FIGURE 3 Five Forces Analysis of Global Polyphenylene Oxide (PPO) Market FIGURE 4 Value Chain of Global Polyphenylene Oxide (PPO) Market FIGURE 5 Share of Global Polyphenylene Oxide (PPO) Market in 2023, by Country FIGURE 6 Global Polyphenylene Oxide (PPO) Market, 2023-2032, FIGURE 7 Global Polyphenylene Oxide (PPO) Market Size, by Application, 2023 FIGURE 8 Share of Global Polyphenylene Oxide (PPO) Market, by Application, 2023-2032 FIGURE 9 Global Polyphenylene Oxide (PPO) Market Size, by End-Use Industry, 2023 FIGURE10 Share of Global Polyphenylene Oxide (PPO) Market, by End-Use Industry, 2023-2032

-

Table FIGURE 1 Global Polyphenylene Oxide (PPO) Market Segmentation FIGURE 2 Forecast Research Methodology FIGURE 3 Five Forces Analysis of Global Polyphenylene Oxide (PPO) Market FIGURE 4 Value Chain of Global Polyphenylene Oxide (PPO) Market FIGURE 5 Share of Global Polyphenylene Oxide (PPO) Market in 2023, by Country FIGURE 6 Global Polyphenylene Oxide (PPO) Market, 2023-2032, FIGURE 7 Global Polyphenylene Oxide (PPO) Market Size, by Application, 2023 FIGURE 8 Share of Global Polyphenylene Oxide (PPO) Market, by Application, 2023-2032 FIGURE 9 Global Polyphenylene Oxide (PPO) Market Size, by End-Use Industry, 2023 FIGURE10 Share of Global Polyphenylene Oxide (PPO) Market, by End-Use Industry, 2023-2032

Leave a Comment