To gather both qualitative and quantitative information, the primary research process involved interviewing players from both the supply and demand sides. Action camera makers, sensor suppliers, and optical component OEMs' commercial directors, as well as their VPs of product development, heads of imaging engineering, and CEOs were among the supply-side sources. Athletes in adventure sports, professional cinematographers, influencers in content production, purchasing managers at consumer electronics stores, and e-commerce platform category managers made up the demand side. Data on customer acceptance rates, pricing tactics, and distribution channel dynamics were gleaned via primary research, which also verified product development roadmaps and validated market segmentation.

Primary Respondent Breakdown:

By Designation: C-level Primaries (32%), Director Level (31%), Others (37%)

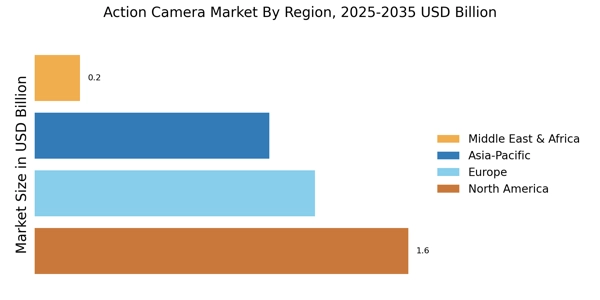

By Region: North America (32%), Europe (30%), Asia-Pacific (31%), Rest of World (7%)

Global market valuation was derived through revenue mapping and unit shipment analysis. The methodology included:

Identification of 40+ key manufacturers across North America, Europe, Asia-Pacific, and Latin America

Product mapping across box-style, cube-style, bullet-style, periscope, and 360-degree camera categories

Analysis of reported and modeled annual revenues specific to action camera product lines

Coverage of manufacturers representing 72-78% of global market share in 2024

Extrapolation using bottom-up (unit shipments × ASP by country/region) and top-down (manufacturer revenue validation) approaches to derive segment-specific valuations across resolution tiers (Ultra HD, Full HD, HD, SD)