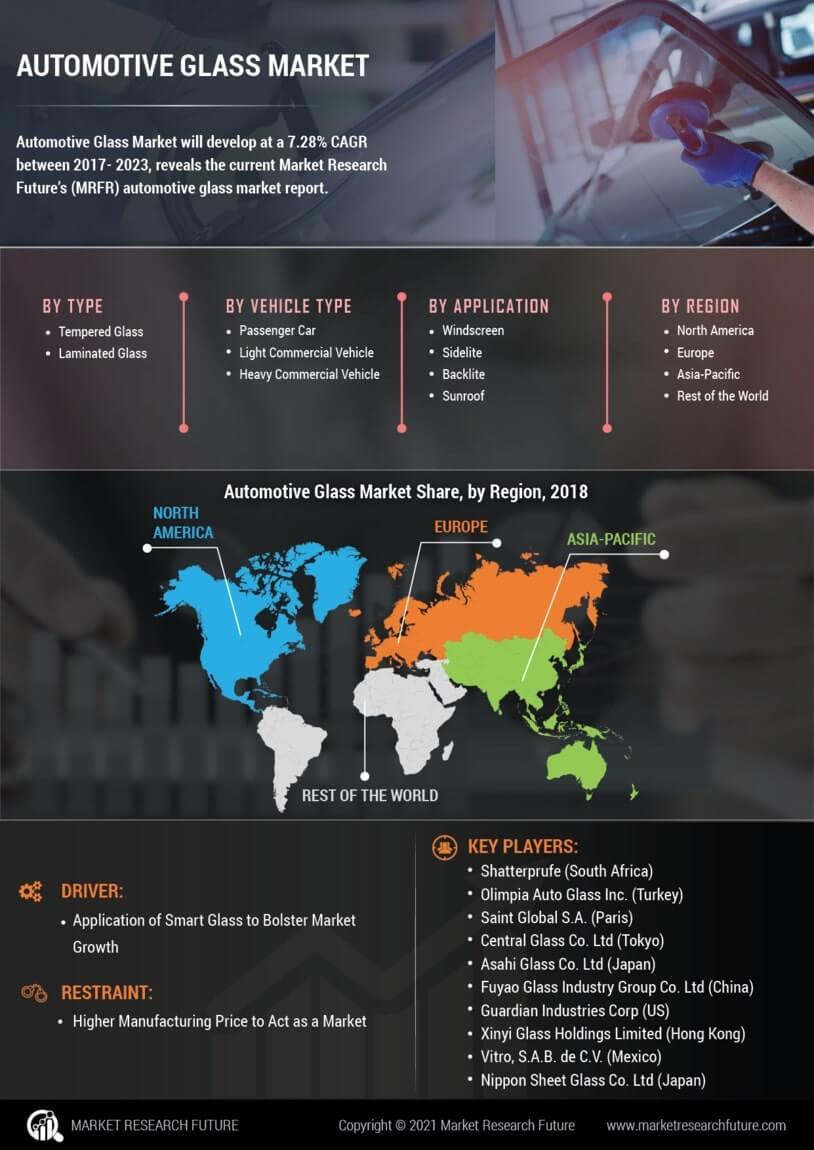

自動車ガラス市場 概要

MRFRの分析によると、自動車ガラス市場の規模は2024年に211億米ドルと推定されています。自動車ガラス業界は、2025年に231.2億米ドルから2035年には577.1億米ドルに成長する見込みで、2025年から2035年の予測期間中に年平均成長率(CAGR)は9.58を示します。

主要な市場動向とハイライト

自動車ガラス市場は、技術の進歩と消費者の意識の高まりにより成長が期待されています。

- "ガラス製造における技術革新が製品の性能と安全機能を向上させています。

- 持続可能性の取り組みが注目を集めており、消費者の好みや製造プロセスに影響を与えています。

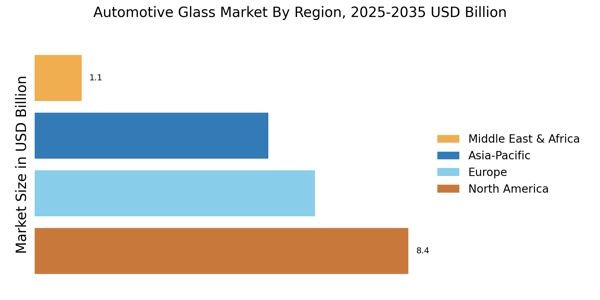

- 北米は依然として最大の市場であり、アジア太平洋地域は自動車用ガラスにおいて最も成長が早い地域として浮上しています。

- 車両生産の増加と軽量材料への需要の高まりが市場拡大を促進する主要な要因です。"

市場規模と予測

| 2024 Market Size | 21.1 (USD十億) |

| 2035 Market Size | 57.71 (USD十億) |

| CAGR (2025 - 2035) | 9.58% |

主要なプレーヤー

サンゴバン(フランス)、AGC株式会社(日本)、NSGグループ(日本)、ガーディアンガラス(アメリカ)、ピルキントン(イギリス)、信義ガラス(中国)、福耀ガラス(中国)、シカAG(スイス)