電動バイク市場 概要

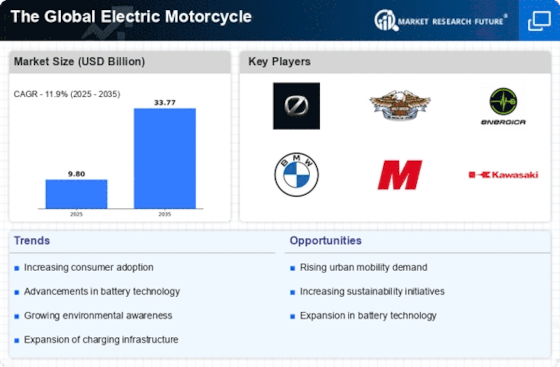

MRFRの分析によると、2024年の世界の電動バイク市場は98.04億米ドルと推定されています。電動バイク産業は、2025年に109.7億米ドルから2035年には337.7億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は11.9%となる見込みです。

主要な市場動向とハイライト

グローバル電動バイクは、持続可能性と技術の進歩によって大幅な成長が期待されています。

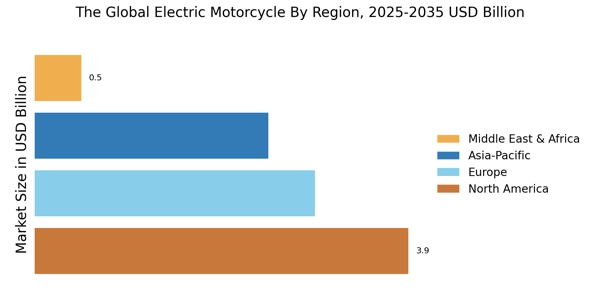

- 北米は電動バイクの最大市場であり、持続可能な交通手段への消費者の強いシフトを反映しています。

- アジア太平洋地域は、都市化の進展と環境に優しいモビリティソリューションへの需要の高まりにより、最も成長が早い市場として浮上しています。

- 75マイル未満のセグメントは市場を支配し続けており、100マイル以上のセグメントは長距離オプションを求める消費者の間で急速に支持を得ています。

- 持続可能性の取り組みと技術革新は市場を前進させる重要な要因であり、消費者はますます環境に配慮した選択を優先しています。

市場規模と予測

| 2024 Market Size | 9.804 (USD十億) |

| 2035 Market Size | 33.77 (USD十億) |

| CAGR (2025 - 2035) | 11.9% |

主要なプレーヤー

ゼロモーターサイクルズ(米国)、ハーレーダビッドソン(米国)、エネルジカモーターカンパニー(イタリア)、BMWモトラッド(ドイツ)、ホンダモーター(日本)、カワサキ重工業(日本)、ヤマハモーター(日本)、ゴゴロ(台湾)、スーパーモコ(中国)