燃料電池パワートレイン市場 概要

MRFRの分析によると、燃料電池パワートレイン市場の規模は2024年に3.4億米ドルと推定されました。燃料電池パワートレイン業界は、2025年に5.331億米ドルから2035年には47.9億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は56.8%となります。

主要な市場動向とハイライト

燃料電池パワートレイン市場は、技術の進歩と環境意識の高まりにより、 substantial growthが期待されています。

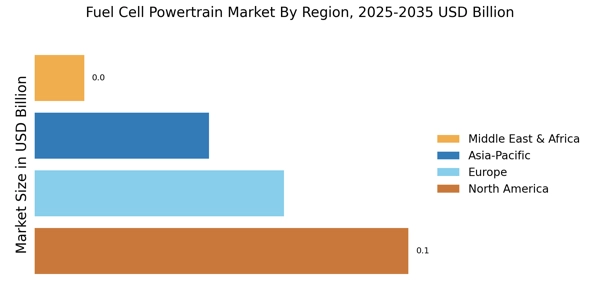

- 市場は、特に北米において輸送分野での採用が増加しているのを目の当たりにしており、北米は依然として最大の市場です。

- 技術の進歩により、燃料電池の効率が向上し、バッテリー技術に対してより競争力を持つようになっています。

- インフラへの投資は重要であり、特にアジア太平洋地域は最も成長が早い市場として認識されています。

- クリーンエネルギーソリューションの需要の高まりと環境規制の強化は、市場を前進させる主要な要因です。

市場規模と予測

| 2024 Market Size | 0.34 (米ドル十億) |

| 2035 Market Size | 47.9 (米ドル十億) |

| CAGR (2025 - 2035) | 56.8% |

主要なプレーヤー

トヨタ自動車株式会社 (JP)、ホンダ技研工業株式会社 (JP)、バラードパワーシステムズ社 (CA)、プラグパワー社 (US)、フューエルセルエナジー社 (US)、現代自動車株式会社 (KR)、ゼネラルモーターズ社 (US)、BMW AG (DE)、メルセデス・ベンツグループAG (DE)