North America : Innovation and Investment Hub

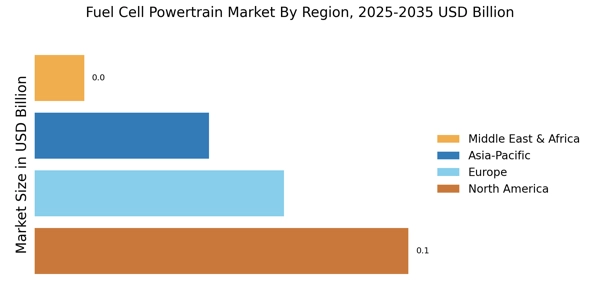

North America is the largest market for fuel cell powertrains, holding approximately 45% of the global market share. The region's growth is driven by significant investments in clean energy technologies, government incentives, and a strong push towards reducing carbon emissions. Regulatory frameworks, such as the Clean Air Act, further catalyze demand for fuel cell vehicles, making it a pivotal area for innovation and development.

The United States and Canada are the leading countries in this market, with major players like Plug Power Inc., Ballard Power Systems, and General Motors Company actively contributing to advancements in fuel cell technology. The competitive landscape is characterized by collaborations between automotive manufacturers and energy companies, aiming to enhance the efficiency and affordability of fuel cell systems. This synergy is crucial for meeting the increasing demand for sustainable transportation solutions.

Europe : Sustainable Mobility Leader

Europe is the second-largest market for fuel cell powertrains, accounting for around 30% of the global market share. The region's growth is propelled by stringent environmental regulations and ambitious targets for carbon neutrality by 2050. Initiatives like the European Green Deal and various national policies promote the adoption of hydrogen technologies, creating a favorable environment for fuel cell vehicles. Germany, France, and the Netherlands are at the forefront of this market, with key players such as BMW AG, Mercedes-Benz Group AG, and Hyundai Motor Company leading the charge.

The competitive landscape is marked by strong government support and investments in hydrogen infrastructure, which are essential for the widespread adoption of fuel cell technology. This collaborative approach among stakeholders is vital for achieving the region's sustainability goals.

Asia-Pacific : Emerging Powerhouse in Innovation

Asia-Pacific is witnessing rapid growth in the fuel cell powertrain market, holding approximately 20% of the global market share. The region's expansion is driven by increasing investments in hydrogen infrastructure, government initiatives promoting clean energy, and a growing demand for sustainable transportation solutions.

Countries like Japan and South Korea are leading the charge, with ambitious targets for hydrogen adoption and fuel cell vehicle deployment. Japan and South Korea are the primary markets in this region, with major players like Toyota Motor Corporation and Honda Motor Co., Ltd. spearheading advancements in fuel cell technology. The competitive landscape is characterized by strong government backing and partnerships between automotive manufacturers and energy providers, aimed at enhancing the efficiency and affordability of fuel cell systems. This collaborative effort is crucial for meeting the region's sustainability targets and addressing environmental concerns.

Middle East and Africa : Resource-Rich Frontier

The Middle East and Africa region is emerging as a potential market for fuel cell powertrains, currently holding about 5% of the global market share. The growth in this region is primarily driven by the increasing focus on diversifying energy sources and reducing reliance on fossil fuels. Governments are beginning to recognize the potential of hydrogen as a clean energy carrier, which could catalyze future investments in fuel cell technologies.

Countries like South Africa and the United Arab Emirates are exploring hydrogen initiatives, with key players starting to invest in research and development of fuel cell technologies. The competitive landscape is still developing, but there is a growing interest from both local and international companies to tap into this emerging market. As regulatory frameworks evolve, the region could see significant advancements in fuel cell adoption and infrastructure development.