ポリマーレジン市場 概要

MRFRの分析によると、ポリマーレジン市場の規模は2024年に163.6億米ドルと推定されています。ポリマーレジン業界は、2025年に174.92億米ドルから2035年には341.54億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は6.92を示しています。

主要な市場動向とハイライト

ポリマーレジン市場は、持続可能性と技術の進歩によって堅調な成長が期待されています。

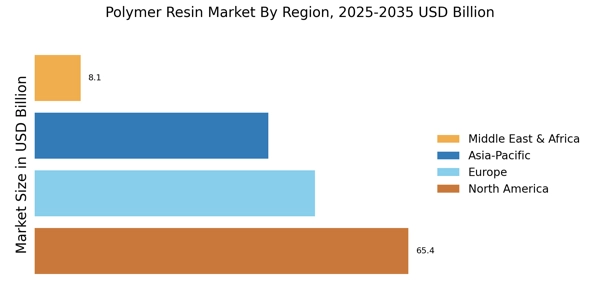

- 北米はポリマーレジンの最大市場であり、さまざまな産業にわたる強い需要を反映しています。

- アジア太平洋地域は急速な工業化と都市化により、最も成長が早い地域として浮上しています。

- ポリプロピレンは最大のセグメントとして引き続き支配的であり、ポリ塩化ビニルは急成長の可能性があると認識されています。

- 主要な市場の推進要因には、自動車部門での需要の高まりとパッケージングソリューションの革新が含まれます。

市場規模と予測

| 2024 Market Size | 163.6 (米ドル十億) |

| 2035 Market Size | 341.54 (USD十億) |

| CAGR (2025 - 2035) | 6.92% |

主要なプレーヤー

BASF(ドイツ)、ダウ(アメリカ)、SABIC(サウジアラビア)、ライオンデルバッセル(アメリカ)、デュポン(アメリカ)、三菱ケミカル(日本)、LGケム(韓国)、エボニックインダストリーズ(ドイツ)、ソルベイ(ベルギー)