Qualitative and quantitative insights were obtained by interviewing supply-side and demand-side stakeholders during the primary research process. The supply-side sources consist of CEOs, CTOs, VPs of Product Engineering, leaders of Industrial IoT divisions, and commercial directors from predictive maintenance software vendors, condition monitoring sensor manufacturers, automation OEMs, and industrial AI/analytics providers. From the discrete manufacturing, process industries, energy & utilities, aerospace, and automotive sectors, demand-side sources included plant managers, directors of maintenance & reliability, operations technology leaders, chief engineers, and procurement heads. Market segmentation was validated, AI algorithm development timelines were confirmed, and insights regarding Industry 4.0 adoption patterns, sensor integration strategies, software-as-a-service pricing models, and cybersecurity implementation in industrial environments were gathered through primary research.

Primary Respondent Breakdown:

• By Company Tier: Tier 1 (38%), Tier 2 (35%), Tier 3 (27%)

• By Designation: C-level Primaries (32%), Director Level (33%), Others (35%)

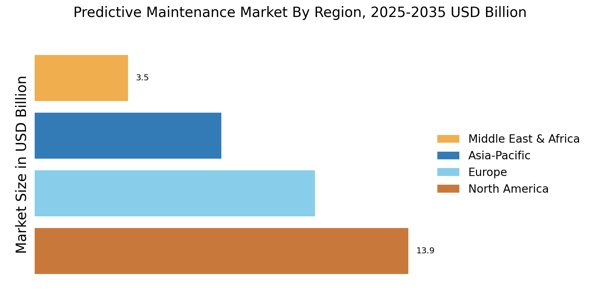

• By Region: North America (32%), Europe (30%), Asia-Pacific (28%), Rest of World (10%)

[Note: Tier 1 = >USD 10B revenue; Tier 2 = USD 1B-10B; Tier 3 =

Global market valuation was derived through revenue mapping and industrial asset installation base analysis. The methodology included:

• Identification of 55+ key solution providers, major system integrators, and condition monitoring equipment manufacturers across North America, Europe, Asia-Pacific, and Latin America

• Across vibration monitoring, oil analysis, thermography, motor current analysis, ultrasound detection, and AI-powered predictive analytics platforms, product mapping is undertaken.

• Analysis of reported and modeled annual revenues specific to predictive maintenance software licenses, sensor hardware, and professional services portfolios

• Coverage of providers representing 75-80% of global market share in 2024

• Extrapolation using bottom-up (installed base of critical industrial assets × condition monitoring adoption rate × average solution spend by vertical) and top-down (vendor revenue validation and platform deployment metrics) approaches to derive segment-specific valuations for on-premise versus cloud deployment models

Throw me a hard one. I'll dig deep

K2.5 Thinking