熱可塑性ポリウレタン市場 概要

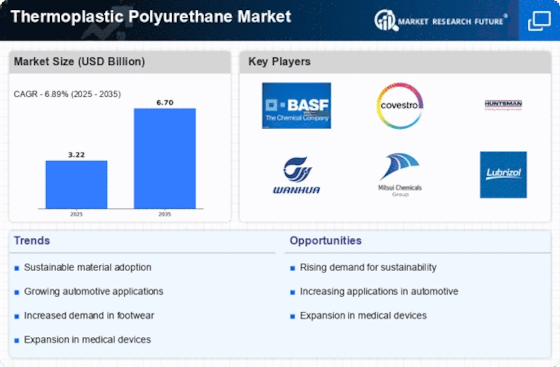

MRFRの分析によると、2024年の熱可塑性ポリウレタン市場規模は32.17億米ドルと推定されています。熱可塑性ポリウレタン産業は、2025年に34.39億米ドルから2035年には66.96億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は6.89を示します。

主要な市場動向とハイライト

熱可塑性ポリウレタン市場は、持続可能性と技術の進歩によって堅調な成長が期待されています。

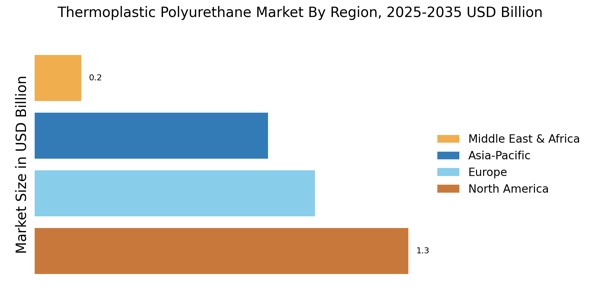

- 北米は熱可塑性ポリウレタンの最大市場であり、さまざまな産業における強い需要を反映しています。

- アジア太平洋地域は、産業の発展と消費者の需要の増加により、最も成長が早い市場として浮上しています。

- ポリエステルセグメントが市場を支配しており、ポリカプロラクトンセグメントはその独自の特性により急速に成長しています。

- 自動車部門での需要の高まりと医療用途の進展が、市場拡大を促進する主要な要因です。

市場規模と予測

| 2024 Market Size | 3.217 (米ドル十億) |

| 2035 Market Size | 6.696 (USD十億) |

| CAGR (2025 - 2035) | 6.89% |

主要なプレーヤー

BASF SE(ドイツ)、Covestro AG(ドイツ)、Huntsman Corporation(アメリカ)、Wanhua Chemical Group Co., Ltd.(中国)、Mitsui Chemicals, Inc.(日本)、Lubrizol Corporation(アメリカ)、Kraton Corporation(アメリカ)、DOW Inc.(アメリカ)、Evonik Industries AG(ドイツ)