Qualitative and quantitative insights were obtained by interviewing supply-side and demand-side stakeholders during the primary research process. The supply-side sources consisted of CEOs, VPs of Operations, raw material procurement leaders, and R&D directors from tungsten carbide manufacturers, powder metallurgy companies, and mining conglomerates respectively. From aerospace and defense contractors, automotive OEMs, mining companies, construction equipment manufacturers, and electronics fabrication facilities, demand-side sources included chief engineers, procurement managers, tooling specialists, and operations directors. The primary research validated market segmentation, confirmed capacity expansion timelines, and collected insights on the dynamics of supply chain resilience, pricing volatility management, and raw material sourcing strategies.

Primary Respondent Breakdown:

By Designation: C-level Primaries (32%), Director Level (31%), Others (37%)

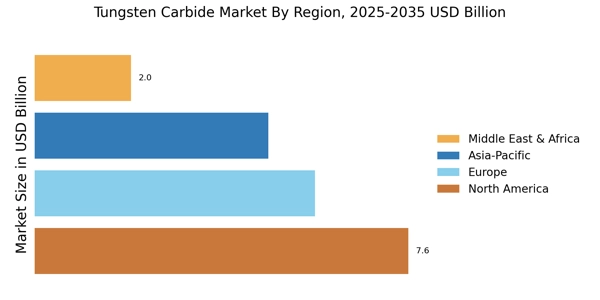

By Region: North America (32%), Europe (30%), Asia-Pacific (33%), Rest of World (5%)

Global market valuation was derived through production volume analysis and revenue mapping across the value chain. The methodology included:

The identification of over 50 key manufacturers in North America, Europe, Asia-Pacific, and Latin America

Product mapping across cemented carbide, coatings, alloys, and other tungsten carbide categories

Analysis of reported and modeled annual revenues specific to tungsten carbide portfolios

Coverage of manufacturers representing 75-80% of global market share in 2024

Extrapolation using bottom-up (industrial consumption volume × ASP by application and region) and top-down (manufacturer revenue validation) approaches to derive segment-specific valuations for aerospace & defense, automotive, mining, construction, and electronics end-use sectors