Research Methodology on the 3D Metrology Market

Introduction

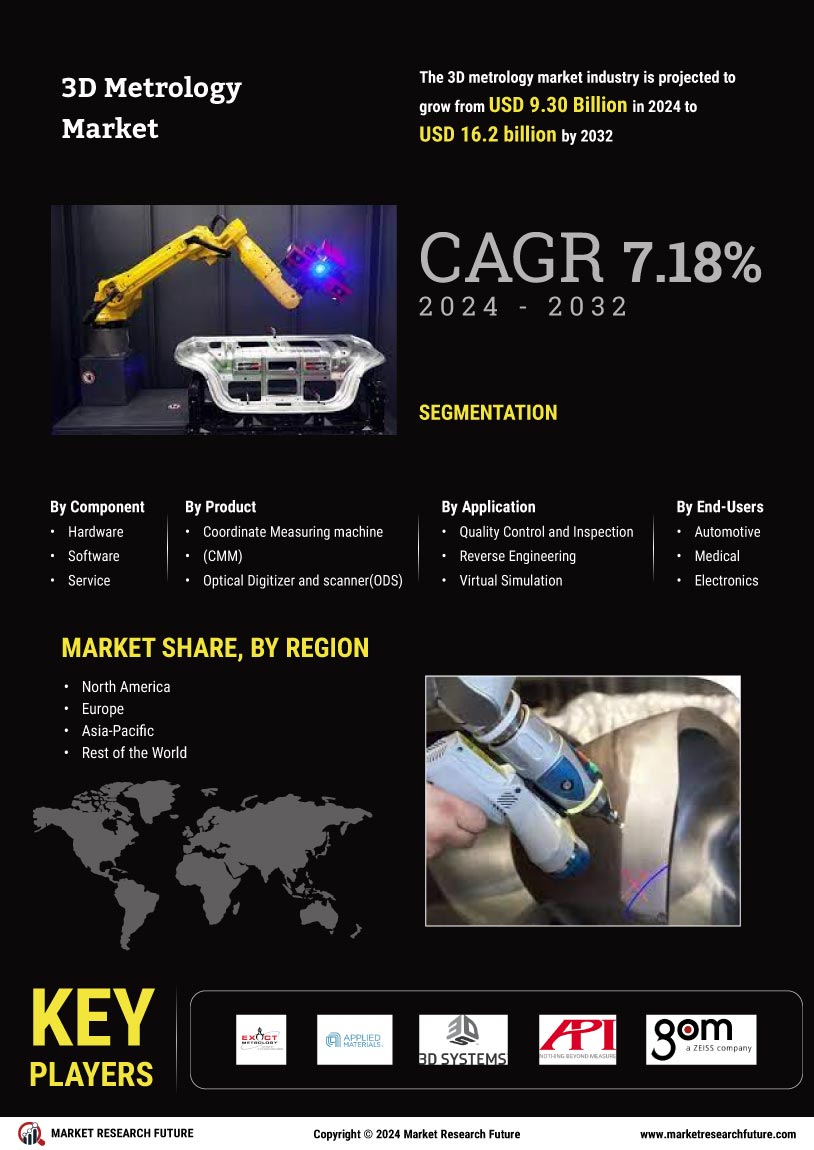

The purpose of this research report is to explore the global 3D metrology market and its associated trends. The report is primarily focused on analyzing current market trends and their impact on the performance of the 3D metrology market. In doing so, the report covers the various market dynamics such as drivers, restraints, and opportunities, as well as their respective impact on the market. Additionally, the report provides an in-depth analysis of the global 3D metrology market.

The report is based on extensive market research and secondary sources. A combination of both qualitative and quantitative research methods has been utilized in order to gain an in-depth understanding of the 3D metrology market. Furthermore, the report provides a detailed overview of the market size and growth rate in the past, with a primary focus on its current trajectory along with the forecast from 2023 to 2030.

Research Methodology

The aim of the research methodology part of the report was to uncover the current trends and various dynamics of the 3D metrology market. To this end, the research was primarily centred around the following three stages:

1. Primary Research

Primary research is conducted through a series of interviews and questionnaires aimed at gauging the opinions and views of industry experts, analysts, consultants, and stakeholders, who have extensive knowledge of the 3D metrology market. Interviews were conducted over the telephone and online. The interviewees were selected based on their positions in the 3D metrology market, their respective geographical representation, and their in-depth knowledge of the industry.

2. Secondary Research

Secondary research is conducted through a variety of sources, including industry publications, white papers, and various market databases, such as Factiva and Bloomberg. Additionally, a comprehensive review of the market was conducted through an in-depth analysis of the 3D metrology market.

3. Market Forecasting Model

Market forecasting models were used to agree upon consensus estimates for the two variables (sales and demand) of the 3D metrology market over a given period of time. This was done by analyzing historical data, as well as certain ongoing developments in the 3D metrology market. The model adopted by the research team utilizes a combination of statistical and econometric techniques to analyze both the qualitative and quantitative information gathered.

Data Triangulation

The research employed a data triangulation approach, which involves collecting data from multiple sources and triangulating it to arrive at a consensus forecast. This technique enables the research team to ensure the accuracy of the data gathered. Furthermore, the data triangulation approach also allowed the research team to identify any potential gaps in the data and account for them.