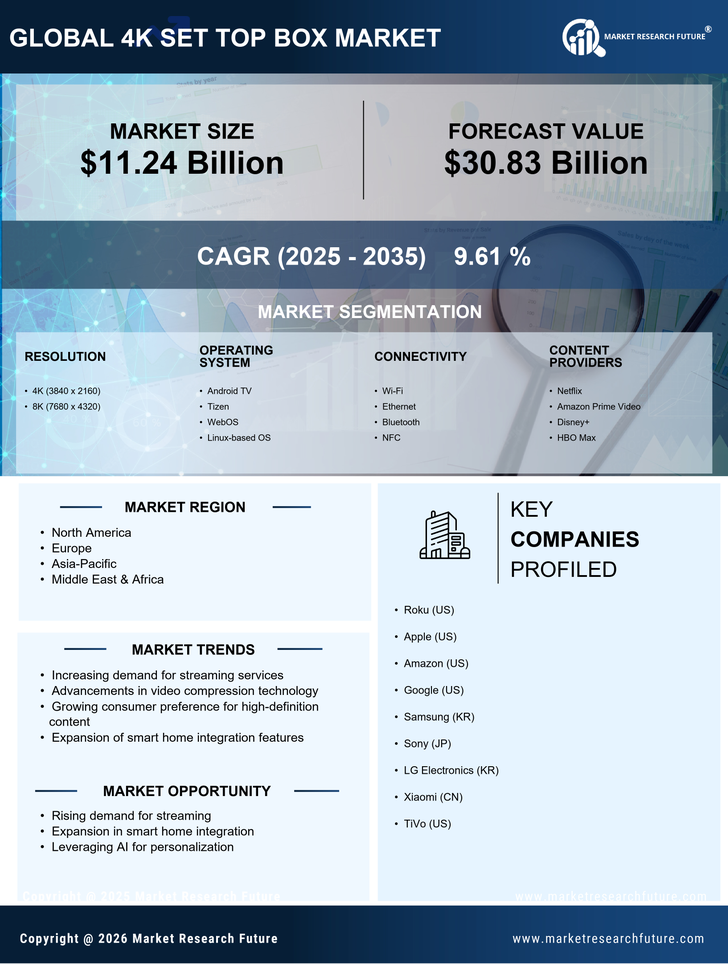

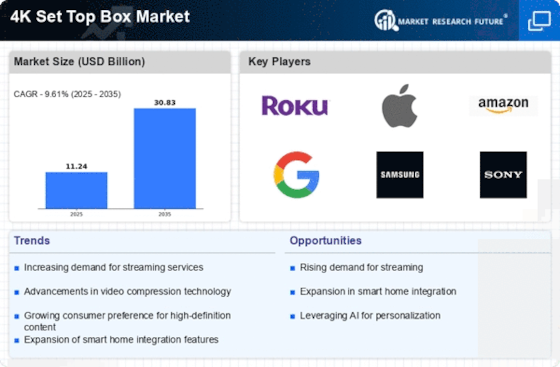

Growth of Content Providers

The 4K Set Top Box Market is significantly influenced by the growth of content providers offering 4K content. Major streaming platforms, including Netflix, Amazon Prime Video, and Disney+, have expanded their libraries to include a wide array of 4K programming. This trend is expected to continue, with a projected increase in 4K content availability by over 50% in the next few years. As consumers become more aware of the benefits of 4K content, the demand for compatible set-top boxes rises. This creates a symbiotic relationship between content providers and hardware manufacturers, as the availability of high-quality content drives sales of 4K set-top boxes. Consequently, the 4K Set Top Box Market is poised for robust growth as more consumers seek devices that can access this premium content.

Rising Consumer Expectations

In the 4K Set Top Box Market, rising consumer expectations play a pivotal role in shaping market dynamics. As consumers become more tech-savvy, they demand devices that not only deliver high-quality video but also offer seamless user experiences. Features such as voice control, personalized recommendations, and easy navigation are increasingly sought after. Market data indicates that over 70% of consumers prioritize user-friendly interfaces when selecting a set-top box. This shift in consumer behavior compels manufacturers to innovate and enhance their offerings, leading to a more competitive landscape. As a result, the 4K Set Top Box Market is likely to witness a proliferation of advanced features designed to meet these evolving expectations, ultimately driving sales and market growth.

Competitive Pricing Strategies

Competitive pricing strategies are emerging as a crucial driver in the 4K Set Top Box Market. As more manufacturers enter the market, the competition has intensified, leading to a variety of pricing options for consumers. This trend is particularly beneficial for price-sensitive consumers who may have previously hesitated to invest in 4K technology. Market analysis indicates that the average price of 4K set-top boxes has decreased by approximately 20% over the past two years, making them more accessible to a broader audience. As prices continue to become more competitive, the 4K Set Top Box Market is likely to experience increased adoption rates, as consumers are more willing to purchase devices that fit their budget while still offering advanced features.

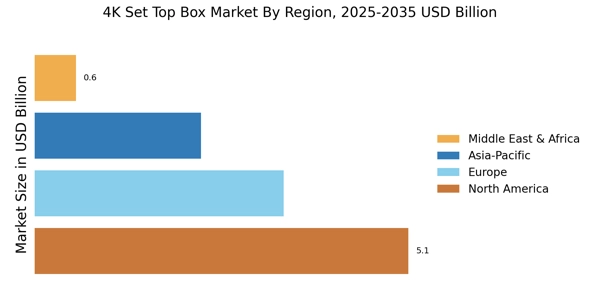

Increase in Internet Penetration

The 4K Set Top Box Market is also benefiting from the increase in internet penetration across various regions. With more households gaining access to high-speed internet, the ability to stream 4K content has become more feasible. Data suggests that internet penetration rates are expected to exceed 80% in many regions by 2025, facilitating the consumption of high-bandwidth content. This trend is particularly relevant for the 4K Set Top Box Market, as consumers require robust internet connections to fully enjoy 4K streaming services. Consequently, the expansion of internet infrastructure is likely to drive demand for 4K set-top boxes, as consumers seek devices that can deliver high-quality streaming experiences without buffering or interruptions.

Advancements in Display Technology

The 4K Set Top Box Market is experiencing a surge in demand due to advancements in display technology. As television manufacturers continue to innovate, the availability of 4K Ultra HD televisions has increased significantly. This proliferation of high-resolution displays has created a corresponding need for set-top boxes that can deliver 4K content. According to recent data, the number of households equipped with 4K TVs is projected to reach over 100 million by 2025. Consequently, consumers are seeking set-top boxes that can fully utilize the capabilities of their displays, thereby driving growth in the 4K Set Top Box Market. Furthermore, the integration of HDR (High Dynamic Range) technology in these devices enhances the viewing experience, making them more appealing to consumers.