Top Industry Leaders in the 5G Base Station Market

The Dynamic Arena: A Landscape Analysis of the 5G Base Station Market

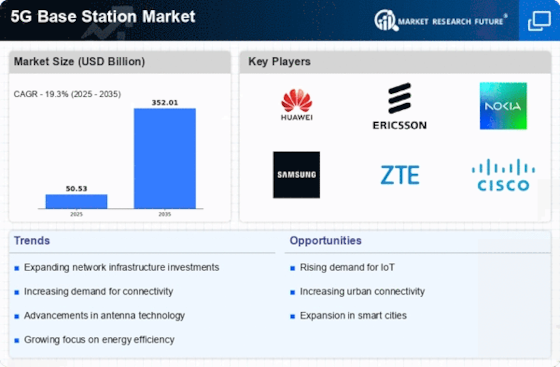

The 5G revolution is rapidly transforming the telecommunications landscape, with base stations serving as the critical backbone of this high-speed, hyper-connected future. This burgeoning market promises significant growth, attracting established giants and new contenders alike. Delving into this dynamic arena, we explore the key players, their strategies, and the factors shaping market share in the 5G base station ecosystem.

Key Players:

-

Samsung Electronics Co. Ltd (South Korea)

-

Huawei Technologies Co. Ltd (China)

-

Telefonaktiebolaget LM Ericsson (Sweden)

-

Intel Corporation (US)

-

Nokia Corporation (Finland)

-

Qualcomm Technologies Inc. (US)

-

ZTE Corporation (China)

-

NEC Corporation (Japan)

-

Ceragon Networks (US)

-

Airspan Networks (US)

-

CommScope (US)

-

Marvell Technology Group (China)

-

Qorvo Inc. (US)

-

CISCO Systems Inc (US). among others

Strategies for Success:

-

Technological Prowess: Continuously innovating in areas like Massive MIMO, millimeter wave frequencies, and network slicing provides a competitive edge.

-

Cost Optimization: Offering compelling price points without compromising quality is crucial, especially in price-sensitive markets.

-

Diversification: Addressing niche segments like private networks and rural deployments broadens the customer base and mitigates risks.

-

Ecosystem Collaboration: Partnering with network operators, chipmakers, and software vendors fosters greater market penetration and innovation.

-

Geopolitical Navigation: Adapting to evolving geopolitical landscapes and navigating regulatory hurdles are key to sustained success.

Factors Shaping Market Share:

-

Network Operator Preferences: Operator relationships, deployment plans, and technology choices significantly influence market share.

-

Government Policies: Geopolitical tensions and national security concerns can impact vendor selection and network development.

-

Technology Advancements: Rapid advancements in 5G standards and related technologies necessitate agility and adaptability.

-

Market Fragmentation: Regional variations in demand and regulatory frameworks create complex dynamics.

-

Cost and Performance Ratio: Operators seek optimal balance between affordability and network capabilities.

New and Emerging Players:

-

Airspan Networks: Offering disruptive, software-defined base stations, Airspan caters to smaller operators and rural deployments.

-

Ciena: This communications leader leverages its expertise in optical solutions to enter the 5G RAN market with open and programmable platforms.

-

Rakuten Symphony: The Japanese telco's disruptive open RAN platform attracts interest with its modularity and cost-effectiveness.

Investment Trends:

-

Focus on Open RAN: The push for open and interoperable RAN solutions creates opportunities for new entrants and disrupts traditional vendor dominance.

-

Software Defined Networks (SDN): The increasing role of software in managing and optimizing 5G networks drives investment in SDN platforms.

-

Network Automation and AI: Integrating AI and automation for network management optimizes performance and reduces costs.

-

Private Networks: Growing demand for customized and secure networks in industries like manufacturing and healthcare attracts investment.

Latest Company Updates:

- December 15, 2023: Ericsson partners with Bharti Airtel to deploy 5G in India: This deal marks a significant step in India's 5G rollout and highlights Ericsson's strong position in the Asian market.

- December 20, 2023: Nokia wins 5G contract with T-Mobile US: This deal strengthens Nokia's presence in the US market and underscores the growing demand for 5G infrastructure.

- January 2, 2024: Samsung unveils new 5G base station technology: Samsung's "Compact Macro" base station promises smaller size and lower power consumption, making it ideal for dense urban deployments.