Expansion of Smart Cities

The development of smart cities is a significant catalyst for the 5G Network Equipment Market. As urban areas evolve, the integration of smart technologies necessitates a robust and efficient communication network. 5G technology facilitates the interconnectivity of various devices, enabling real-time data exchange and improved city management. For instance, smart traffic systems, energy management, and public safety applications rely heavily on 5G capabilities. The market for smart city solutions is expected to grow substantially, with investments projected to reach trillions of dollars in the coming years. This trend underscores the critical role of 5G network equipment in supporting the infrastructure required for smart city initiatives, thereby driving the market forward.

Emergence of Edge Computing

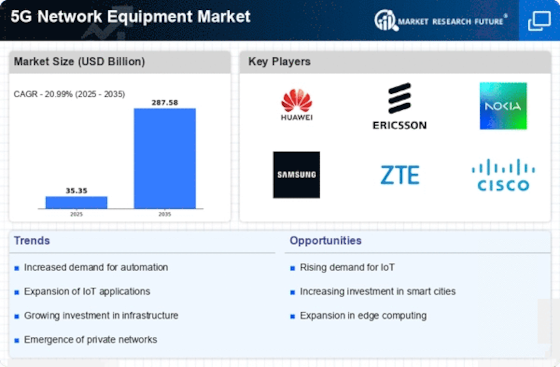

The emergence of edge computing is transforming the landscape of the 5G Network Equipment Market. By processing data closer to the source, edge computing reduces latency and enhances the performance of applications that rely on real-time data. This shift is particularly relevant for industries such as manufacturing, healthcare, and autonomous vehicles, where immediate data processing is critical. The 5G Network Equipment Market is anticipated to grow significantly, with estimates suggesting it could surpass 15 billion dollars by 2025. This growth is likely to drive demand for 5G network equipment that supports edge computing architectures, thereby fostering innovation and expansion within the market.

Government Initiatives and Policies

Government initiatives and policies aimed at promoting 5G technology are crucial drivers of the 5G Network Equipment Market. Various countries are implementing regulatory frameworks and funding programs to accelerate the deployment of 5G networks. These initiatives often include subsidies for infrastructure development and incentives for telecom operators to invest in advanced technologies. For example, several governments have set ambitious targets for nationwide 5G coverage, which necessitates substantial investment in network equipment. As these policies take shape, they are likely to create a favorable environment for the growth of the 5G Network Equipment Market, encouraging innovation and competition among equipment manufacturers.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity is a primary driver of the 5G Network Equipment Market. As consumers and businesses alike seek faster internet speeds, the need for advanced network infrastructure becomes paramount. According to recent data, the number of 5G subscriptions is projected to reach over 1.5 billion by 2025, indicating a robust growth trajectory. This surge in demand compels telecom operators to invest heavily in 5G network equipment, thereby propelling market expansion. Enhanced connectivity is not only crucial for personal use but also for industries such as healthcare, automotive, and entertainment, which rely on seamless data transmission. Consequently, the 5G Network Equipment Market is likely to witness significant advancements in technology and infrastructure to meet these escalating demands.

Increased Adoption of Augmented and Virtual Reality

The rising adoption of augmented reality (AR) and virtual reality (VR) applications is poised to significantly influence the 5G Network Equipment Market. These technologies demand high bandwidth and low latency, characteristics that are inherent to 5G networks. Industries such as gaming, education, and training are increasingly leveraging AR and VR to enhance user experiences. Market analysis suggests that the AR and VR market could reach over 200 billion dollars by 2025, creating a substantial demand for the underlying 5G infrastructure. As businesses seek to implement these immersive technologies, the need for advanced 5G network equipment becomes evident, thereby propelling market growth and innovation.