Market Growth Projections

The Global Aesthetics Market Industry is poised for substantial growth, with projections indicating a market size of 150 USD Billion in 2024 and a potential increase to 300 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 6.5% from 2025 to 2035, driven by various factors including technological advancements, rising consumer awareness, and an aging population. The market's expansion is indicative of a broader acceptance of aesthetic treatments across diverse demographics, suggesting a promising future for the industry.

Rising Demand for Non-Invasive Procedures

The Global Aesthetics Market Industry experiences a notable surge in demand for non-invasive cosmetic procedures. This trend is driven by an increasing preference for treatments that require minimal recovery time and offer immediate results. Popular procedures such as Botox and dermal fillers are gaining traction, appealing particularly to younger demographics seeking subtle enhancements. In 2024, the market is projected to reach 150 USD Billion, reflecting a growing consumer base that prioritizes aesthetic improvements without the need for surgical interventions. This shift indicates a broader acceptance of aesthetic treatments, contributing to the overall growth of the Global Aesthetics Market Industry.

Increasing Awareness of Aesthetic Treatments

There is a growing awareness of aesthetic treatments among consumers, significantly impacting the Global Aesthetics Market Industry. Educational campaigns and social media influence have played pivotal roles in demystifying aesthetic procedures, making them more accessible and acceptable. This heightened awareness is particularly evident among millennials and Generation Z, who are increasingly seeking cosmetic enhancements. As a result, the market is expected to witness a compound annual growth rate of 6.5% from 2025 to 2035. This trend suggests that as more individuals become informed about available options, the demand for aesthetic treatments will continue to rise.

Technological Advancements in Aesthetic Treatments

Technological innovations play a crucial role in shaping the Global Aesthetics Market Industry. The introduction of advanced laser technologies, radiofrequency devices, and 3D imaging systems enhances the efficacy and safety of aesthetic procedures. These advancements not only improve treatment outcomes but also expand the range of services available to consumers. For instance, the development of minimally invasive techniques allows for more precise and effective treatments, attracting a wider audience. As the industry evolves, it is anticipated that these technological strides will contribute to the market's growth, potentially reaching 300 USD Billion by 2035.

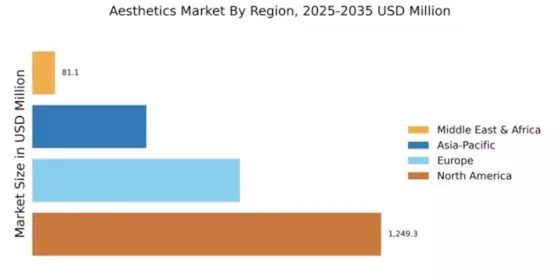

Expansion of Aesthetic Services in Emerging Markets

Emerging markets are witnessing a rapid expansion of aesthetic services, significantly influencing the Global Aesthetics Market Industry. Countries in Asia-Pacific and Latin America are experiencing increased investments in aesthetic clinics and training programs, making treatments more accessible to a broader population. This expansion is driven by rising disposable incomes and changing beauty standards, which encourage individuals to pursue aesthetic enhancements. As these markets develop, they are expected to contribute substantially to the overall growth of the industry, with projections indicating a compound annual growth rate of 6.5% from 2025 to 2035.

Aging Population and Demand for Anti-Aging Solutions

The aging population is a significant driver of the Global Aesthetics Market Industry, as older adults increasingly seek anti-aging solutions to maintain their youthful appearance. With advancements in aesthetic treatments, individuals over 50 are more inclined to invest in procedures that enhance their skin's elasticity and overall appearance. This demographic shift is expected to propel the market forward, as the number of individuals seeking aesthetic interventions rises. The market's growth trajectory indicates that by 2035, it could reach 300 USD Billion, underscoring the importance of catering to this demographic in the Global Aesthetics Market Industry.