Research Methodology on Airborne ISR Market

Introduction

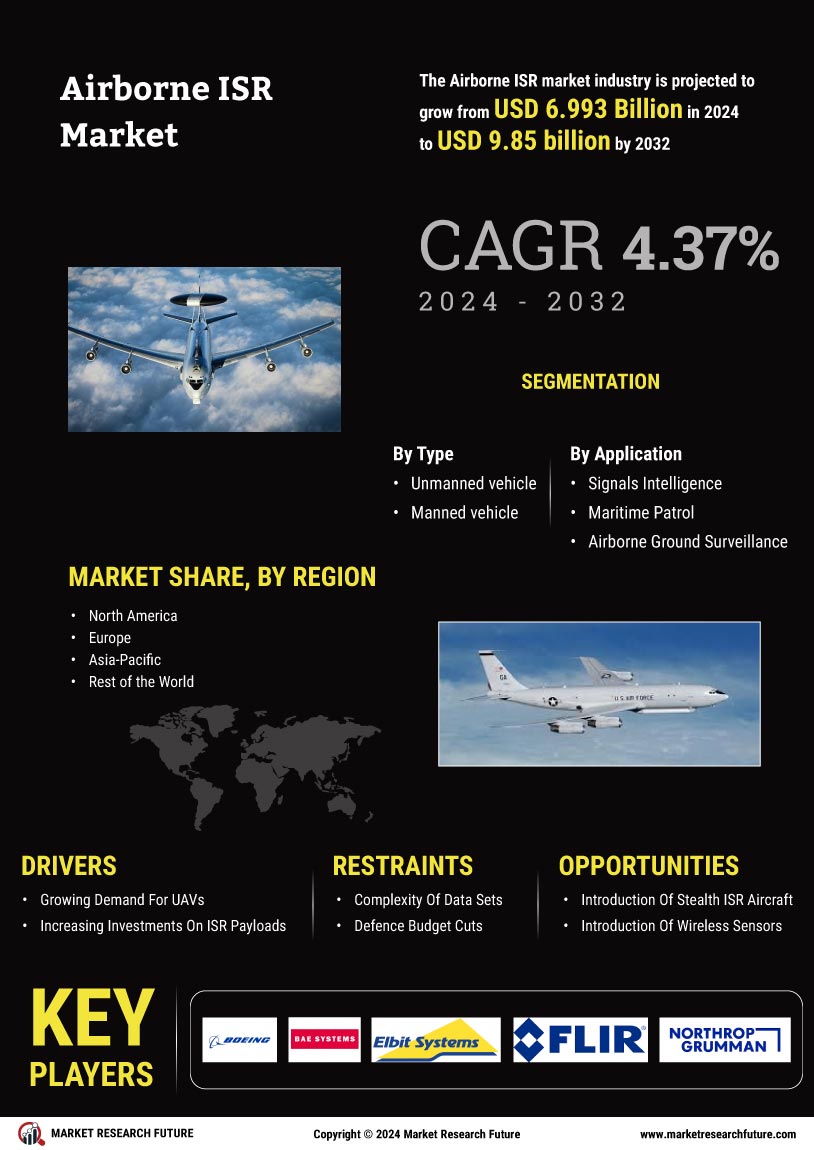

Airborne ISR (intelligence, surveillance, and reconnaissance) is a type of wireless technology that enables ISR platforms on board an aircraft to capture and monitor data in real-time. With the advent of advanced technologies such as 5G, drones, and high-speed surveillance, the airborne ISR market is estimated to grow and enable long-distance and long-term sensing and authorization. This is further projected to enable the market to witness an increase in demand for the operation of unmanned platforms for ISR purposes shortly.

The purpose of this research is to present in-depth information on the global airborne ISR market. This study will provide a comprehensive analysis to assess the current market conditions and future opportunities over the aforementioned forecast period. The global Airborne ISR Market is expected to register a steady CAGR during the forecast period of 2023 to 2030.

Research Methodology

Research Design

The current study aims to analyze the current and future prospects of the global airborne ISR market. By using a descriptive design, a comprehensive, systematic survey was conducted to analyze the existing literature and the existing market conditions. Both primary and secondary research techniques were employed in the study. The survey aims to capture the current market size, growth opportunities, and competitive landscaping.

Primary Data Sources

Primary data is obtained by direct contact with expert personnel, industry leaders, and key players in the industry. Interviews with key industry personnel and primary analysis of different parameters such as market dynamics, size, strategies, opportunities, and challenges were conducted.

Secondary Data Sources

Secondary data is compiled from market reports, industry news magazines and journals, Press releases and other industry resources, government reports, and other sources of data. Government associations, market research reports, and technical journals were also referred to for validation of the information provided.

Research Objectives

The major research objectives of this study are:

- To analyze and present an in-depth overview of the global airborne ISR market.

- To understand the market dynamics and trends of the global airborne ISR market.

- To identify the drivers and opportunities of the global airborne ISR market.

- To study the market size and segmentation of the global airborne ISR market.

- To identify and analyze the major challenges and opportunities of the global airborne ISR market.

Analysis and Evaluation

The compilation and review of primary and secondary data sources are conducted to assess the market trends, challenges, and opportunities. Multiple evaluation models such as PESTEL analysis and Porter's Five Forces analysis were employed to assess the major market players and their impact on the global airborne ISR market.

Data Analysis

The data collected through the various research methodologies were analyzed through descriptive and inferential statistical techniques. Descriptive analysis was used to understand and describe the type, category, geography, and segmentation of the airborne ISR market. Inferential statistical techniques such as Linear Regression Analysis and Multi-regression models were used to identify the impact of the market drivers and opportunities on the market.

Data Interpretation

The descriptive and inferential data analyses were used to interpret the inherent trends and opportunities for further market expansion. The statistical data were interpreted with the help of relevant graphic representations and tables. The equations used to interpret the data were verified through secondary research and industry resources.

Conclusion

With the advancement of technology, the market for Airborne ISR is projected to have tremendous growth opportunities in the forecast period 2023 to 2030. By employing a descriptive research design and an integrated methodology, the current study was conducted to assess the current and future trends of the Airborne ISR market. Furthermore, the current study offered an in-depth analysis of the industry players and their impact on the market. Primary and secondary sources of data were employed in the study, and various analysis models were used to interpret the data. Based on the analysis, it can be concluded that the market for Airborne ISR holds a significant opportunity for further market expansion over the forecast period 2023 to 2030.