Sustainability Initiatives

Sustainability initiatives are becoming a pivotal driver in The Global Aluminum Electrolytic Capacitors Industry. As environmental concerns gain prominence, manufacturers are focusing on producing capacitors that are more eco-friendly. This includes the development of recyclable materials and processes that minimize waste. Furthermore, regulatory frameworks are increasingly mandating the reduction of hazardous substances in electronic components, pushing companies to innovate. The market is witnessing a shift towards capacitors that not only meet performance standards but also adhere to sustainability criteria. This trend is expected to attract environmentally conscious consumers and businesses, thereby expanding market opportunities.

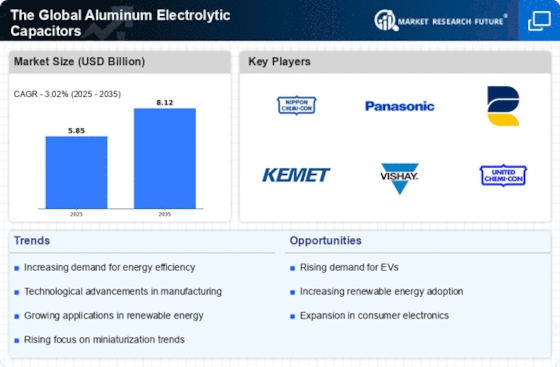

Technological Advancements

The Global Aluminum Electrolytic Capacitors Industry is experiencing a surge in technological advancements that enhance the performance and efficiency of capacitors. Innovations in materials and manufacturing processes are leading to capacitors with higher capacitance values and lower equivalent series resistance (ESR). This is particularly relevant in applications requiring high-frequency performance, such as telecommunications and consumer electronics. The introduction of new dielectric materials and improved electrolytic solutions is also contributing to the miniaturization of capacitors, allowing for more compact designs in electronic devices. As a result, manufacturers are increasingly investing in research and development to stay competitive, which is likely to drive growth in the market.

Consumer Electronics Growth

The consumer electronics sector is a major driver of The Global Aluminum Electrolytic Capacitors Industry. As technology advances, there is a growing demand for compact and efficient electronic devices, which in turn requires high-quality capacitors. Products such as smartphones, laptops, and smart home devices are increasingly incorporating advanced capacitors to enhance performance and energy efficiency. The proliferation of Internet of Things (IoT) devices is also contributing to this demand, as these devices require reliable power management solutions. Market analysts suggest that the consumer electronics segment will continue to expand, further propelling the growth of the aluminum electrolytic capacitors market.

Rising Demand in Automotive Sector

The automotive sector is a significant contributor to the growth of The Global Aluminum Electrolytic Capacitors Industry. With the increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), the demand for high-performance capacitors is on the rise. Capacitors play a crucial role in power management and energy storage in EVs, which require efficient energy conversion and storage solutions. According to industry reports, the automotive segment is projected to account for a substantial share of the market, driven by the need for reliable and durable components that can withstand harsh operating conditions. This trend is likely to continue as the automotive industry evolves.

Telecommunications Infrastructure Development

The development of telecommunications infrastructure is a critical driver for The Global Aluminum Electrolytic Capacitors Industry. As countries invest in expanding their communication networks, the demand for capacitors in telecommunications equipment is increasing. Capacitors are essential components in various devices, including base stations, routers, and switches, which require stable power supply and signal integrity. The ongoing rollout of 5G technology is particularly noteworthy, as it necessitates advanced capacitors capable of handling higher frequencies and power levels. This trend is expected to create substantial opportunities for manufacturers in the aluminum electrolytic capacitors market, as the telecommunications sector continues to evolve.