Growth in LED Technology

The Aluminum Nitride Market is significantly influenced by the growth of LED technology. Aluminum nitride is utilized in the production of LED components due to its superior thermal management capabilities. As the demand for energy-efficient lighting solutions rises, the adoption of aluminum nitride in LED applications is expected to increase. The market for LEDs has been expanding rapidly, with projections indicating a potential market size of over 100 billion USD by 2026. This growth is likely to drive the aluminum nitride market, as manufacturers seek materials that can improve the efficiency and longevity of LED devices. The integration of aluminum nitride in LED technology not only enhances performance but also aligns with sustainability goals, further propelling its demand in the industry.

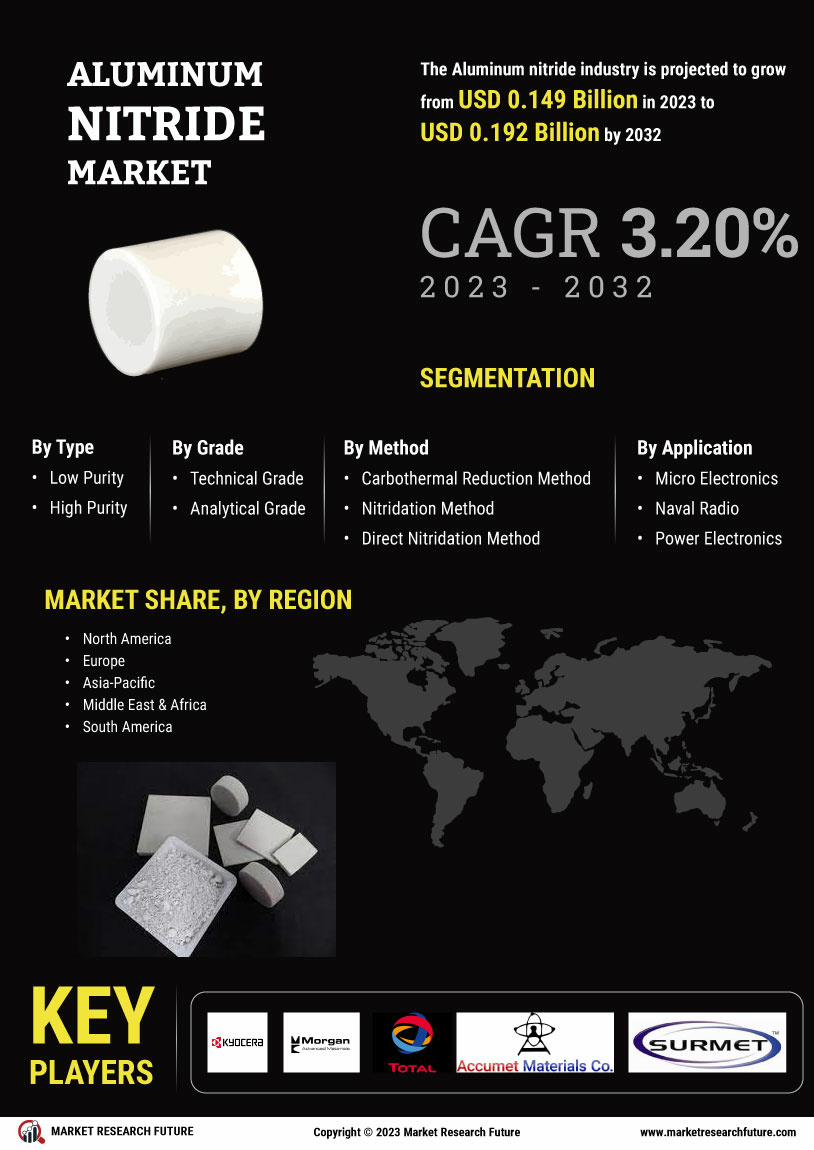

Rising Demand in Electronics

The Aluminum Nitride Market is experiencing a surge in demand driven by the increasing use of aluminum nitride in electronic applications. This material is favored for its excellent thermal conductivity and electrical insulation properties, making it ideal for high-performance electronic devices. As the electronics sector continues to expand, particularly in areas such as semiconductors and power electronics, the need for materials that can efficiently manage heat dissipation is paramount. Reports indicate that the electronics segment is projected to account for a substantial share of the aluminum nitride market, with a compound annual growth rate (CAGR) of approximately 10% over the next few years. This trend suggests that manufacturers are increasingly turning to aluminum nitride to enhance the performance and reliability of their products.

Increased Focus on Renewable Energy

The Aluminum Nitride Market is benefiting from the increased focus on renewable energy technologies. As the world shifts towards sustainable energy solutions, the demand for efficient materials in energy conversion and storage systems is rising. Aluminum nitride is being explored for its potential applications in solar cells and energy storage devices due to its excellent thermal properties. The renewable energy sector is projected to grow substantially, with investments in solar and wind energy expected to reach trillions of dollars in the next decade. This growth is likely to create new opportunities for aluminum nitride, as manufacturers seek materials that can enhance the efficiency and performance of renewable energy technologies. The integration of aluminum nitride in these applications may play a crucial role in achieving energy efficiency goals.

Advancements in Semiconductor Manufacturing

The Aluminum Nitride Market is poised for growth due to advancements in semiconductor manufacturing processes. Aluminum nitride is increasingly being recognized for its role in the fabrication of high-performance semiconductor devices. Its unique properties, such as high thermal conductivity and low dielectric constant, make it an attractive choice for various semiconductor applications. As the semiconductor industry evolves, the demand for materials that can withstand high temperatures and provide effective heat dissipation is critical. Recent data suggests that the semiconductor segment is expected to witness a CAGR of around 8% in the coming years, which could significantly impact the aluminum nitride market. This trend indicates a shift towards more efficient materials in semiconductor manufacturing, positioning aluminum nitride as a key player in the industry.

Emerging Applications in Aerospace and Defense

The Aluminum Nitride Market is witnessing emerging applications in the aerospace and defense sectors. The unique properties of aluminum nitride, such as its lightweight nature and high thermal stability, make it suitable for various aerospace applications, including thermal management systems and electronic components. As the aerospace industry continues to innovate, the demand for advanced materials that can withstand extreme conditions is increasing. The defense sector is also exploring the use of aluminum nitride in high-performance electronic systems. Market analysis indicates that the aerospace and defense segments are expected to grow at a CAGR of approximately 7% over the next few years, which could significantly influence the aluminum nitride market. This trend suggests that aluminum nitride may become a critical material in the development of next-generation aerospace and defense technologies.