Top Industry Leaders in the Ammonium Phosphate Market

Ammonium phosphate, a water-soluble fertilizer composed of ammonia and phosphoric acid, is a crucial agricultural input for enhancing crop yields and soil fertility. This growth is driven by factors like a burgeoning global population, rising food security concerns, and increasing adoption of intensive farming practices.

Strategies Adopted by Leading Players:

Geographic Expansion: Major players are actively expanding their production facilities and distribution networks in developing regions with high agricultural potential, particularly in Africa and South America. For example, OCP Group announced plans to invest USD 2 billion in a new fertilizer plant in Ethiopia in 2023.

Product Diversification: Companies are diversifying their product portfolios by developing specialized ammonium phosphate formulations tailored to specific crop types and soil conditions. This strategy caters to the growing demand for precision agriculture and improves brand loyalty among farmers.

Vertical Integration: Leading players are integrating upstream and downstream operations, securing access to raw materials and distribution channels. This strategy helps them control costs, improve supply chain efficiency, and gain competitive advantages.

Technological Innovation: Continuous technological advancements in fertilizer production and application are gaining traction. Companies are investing in research and development to improve the efficiency and environmental sustainability of their products. For example, Yara International is developing slow-release fertilizers that minimize nutrient loss and enhance crop uptake.

Partnerships and Collaborations: Strategic partnerships with research institutions, government agencies, and distributors are becoming increasingly common. These collaborations help companies gain access to new technologies, market knowledge, and resources, enabling them to expand their reach and influence.

Factors Influencing Market Share:

-

Production Cost and Efficiency: Companies with access to low-cost raw materials and efficient production processes have a competitive edge in terms of pricing and profitability. -

Product Quality and Innovation: Offering high-quality, specialized ammonium phosphate formulations tailored to specific regional needs and crop types can significantly boost market share. -

Brand Recognition and Reputation: Established brands with strong reputations for reliability and product quality are often preferred by farmers, influencing their purchasing decisions. -

Distribution Network and Customer Service: Extensive distribution networks and efficient customer service capabilities ensure timely product delivery and address farmer concerns, contributing to market share growth. -

Government Policies and Regulations: Government policies on fertilizer subsidies, environmental regulations, and trade restrictions can impact market dynamics and influence player strategies.

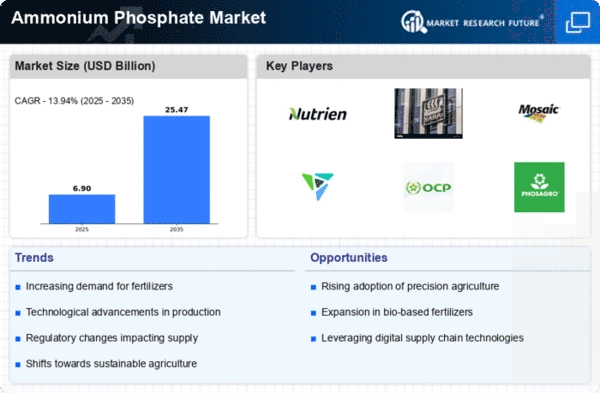

Key Players

September 2023: EuroChem completed the acquisition of K+S Aktiengesellschaft, a major European fertilizer producer, strengthening its position in the global market.

October 2023: OCP Group signed a strategic partnership with the Indian government to establish a joint venture for fertilizer production and distribution in India.

November 2023: The International Fertilizer Association (IFA) reported a global shortage of diammonium phosphate due to disruptions in the supply chain caused by the Russia-Ukraine war.

December 2023: Chinese authorities announced plans to increase domestic fertilizer production to reduce dependence on imports and stabilize domestic prices.