Soil Health Awareness

There is a growing awareness regarding soil health among farmers and agricultural stakeholders, which is positively influencing the ammonium phosphate market. The recognition that soil fertility is essential for sustainable agriculture has led to increased usage of nutrient-rich fertilizers like ammonium phosphate. Reports indicate that approximately 60% of US farmers are now prioritizing soil health in their farming practices. This shift is likely to drive demand for ammonium phosphate, as it plays a crucial role in replenishing essential nutrients in the soil. The ammonium phosphate market is thus expected to see a rise in consumption as more farmers seek to enhance soil quality and crop resilience.

Rising Export Opportunities

The ammonium phosphate market is poised to benefit from increasing export opportunities as global demand for fertilizers rises. The US is strategically positioned to export ammonium phosphate to various countries, particularly in regions where agricultural productivity is a priority. Recent data indicates that US fertilizer exports have grown by 15% over the past year, with ammonium phosphate being a key contributor. This trend suggests that the ammonium phosphate market may experience enhanced growth as international markets seek reliable sources of high-quality fertilizers. As global agricultural demands evolve, the US could become a leading supplier of ammonium phosphate.

Increasing Fertilizer Demand

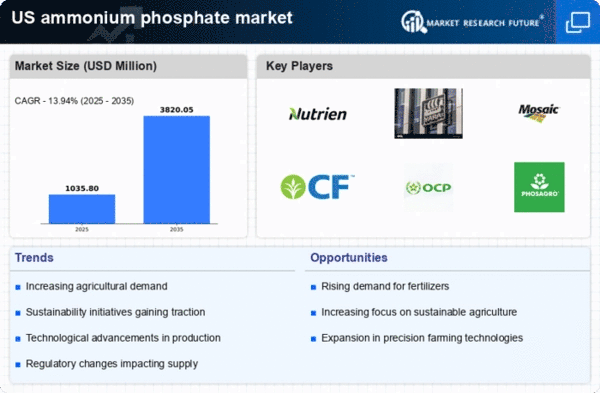

The ammonium phosphate market is experiencing a surge in demand driven by the agricultural sector's need for effective fertilizers. As crop yields become increasingly critical to meet food security goals, farmers are turning to ammonium phosphate for its high nutrient content. In the US, the fertilizer consumption has been projected to grow at a rate of approximately 2.5% annually, with ammonium phosphate accounting for a significant share. This growth is further supported by government initiatives aimed at enhancing agricultural productivity. The ammonium phosphate market is thus positioned to benefit from this upward trend, as more farmers adopt advanced fertilization techniques to optimize their crop outputs.

Government Subsidies and Support

Government policies and subsidies aimed at promoting agricultural productivity are significantly impacting the ammonium phosphate market. Various federal and state programs provide financial assistance to farmers for purchasing fertilizers, including ammonium phosphate. In recent years, the US government has allocated over $1 billion annually to support agricultural initiatives, which includes funding for fertilizer purchases. This financial backing encourages farmers to invest in high-quality fertilizers, thereby boosting the ammonium phosphate market. As these subsidies continue, the market is likely to experience sustained growth, as more farmers are incentivized to utilize ammonium phosphate for improved crop yields.

Technological Innovations in Agriculture

Technological advancements in agricultural practices are reshaping the ammonium phosphate market. Precision agriculture, which utilizes data analytics and technology to optimize farming practices, is becoming increasingly prevalent. This approach allows farmers to apply fertilizers like ammonium phosphate more efficiently, reducing waste and enhancing crop productivity. The adoption of such technologies is expected to increase the overall fertilizer market in the US by approximately 3% annually. Consequently, the ammonium phosphate market stands to gain from these innovations, as farmers seek to maximize their returns on investment through improved fertilization strategies.