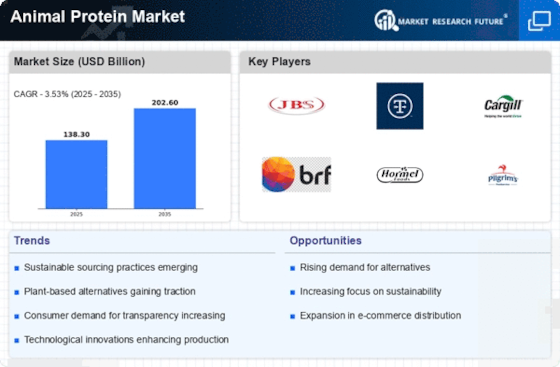

Rising Protein Demand

The increasing The animal protein Industry. As more individuals seek protein-rich diets, the demand for animal protein is projected to grow significantly. According to recent estimates, the demand for animal protein is expected to increase by approximately 20% by 2030. This trend is particularly pronounced in developing regions, where economic growth is leading to higher meat consumption. The Animal Protein Market is thus positioned to benefit from this surge in demand, as consumers increasingly prioritize protein intake in their diets. Furthermore, the shift towards more protein-rich diets is likely to influence production practices, leading to innovations in the sector.

Health and Nutrition Awareness

There is a growing awareness regarding health and nutrition among consumers, which is influencing their dietary choices. The Animal Protein Market is experiencing a shift as consumers become more informed about the nutritional benefits of animal protein, including its role in muscle development and overall health. This trend is evident in the increasing sales of high-protein products, which have seen a rise of around 15% in recent years. As health-conscious consumers seek out quality protein sources, the demand for animal protein is expected to remain robust. Additionally, the emphasis on balanced diets is likely to drive innovations in product offerings, catering to the needs of health-oriented consumers.

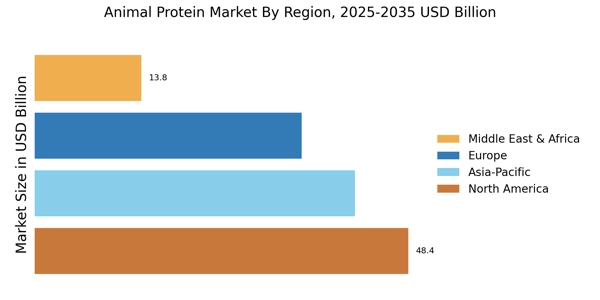

Emerging Markets and Economic Growth

Emerging markets are playing a crucial role in the expansion of the Animal Protein Market. As economies in these regions continue to grow, there is a corresponding increase in disposable income, leading to higher meat consumption. For instance, countries in Asia and Africa are witnessing a surge in demand for animal protein, with projections indicating a growth rate of over 25% in the next decade. This economic growth is fostering a shift in dietary patterns, as consumers in these regions increasingly incorporate animal protein into their diets. Consequently, the Animal Protein Market is likely to experience substantial growth opportunities as it adapts to the changing preferences of consumers in emerging markets.

Sustainability and Ethical Practices

Sustainability has become a critical focus within the Animal Protein Market, as consumers increasingly demand ethically sourced products. The push for sustainable practices is prompting producers to adopt more environmentally friendly methods, such as reducing greenhouse gas emissions and improving animal welfare standards. Reports indicate that a significant portion of consumers, approximately 60%, are willing to pay a premium for sustainably sourced animal protein. This trend is likely to drive changes in production practices, as companies strive to meet consumer expectations while maintaining profitability. The emphasis on sustainability is expected to shape the future of the Animal Protein Market, influencing both consumer choices and industry standards.

Technological Innovations in Production

Technological advancements in animal husbandry and production processes are transforming the Animal Protein Market. Innovations such as precision farming, genetic improvements, and enhanced feed efficiency are contributing to increased productivity and sustainability. For instance, the implementation of smart farming technologies has been shown to improve yield by up to 30% in certain livestock sectors. These advancements not only enhance the efficiency of production but also address consumer concerns regarding sustainability and animal welfare. As technology continues to evolve, the Animal Protein Market is likely to see further improvements in production methods, which could lead to a more sustainable and efficient supply chain.

.png)