Antimicrobial Textile Additive Size

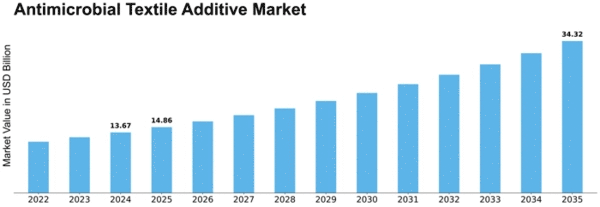

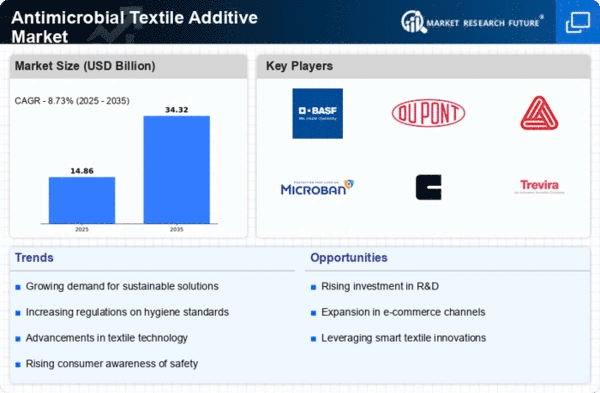

Antimicrobial Textile Additive Market Growth Projections and Opportunities

The Antimicrobial Textile Additive Market Size is affected by a range of factors which collectively define its growth dynamics. A crucial driver is the rapidly increasing awareness about hygiene and health particularly in light of global health challenges. This is because antimicrobial textile additives are utilized as materials that can stop bacteria, viruses, and fungi thereby making the environment safe from them. In healthcare sector there are rising cases of demand for antimicrobial textile additives used in beddings, uniforms and medical textiles.

Healthcare also need antibacterial textile chemicals. Hospitals need antimicrobial fabrics to prevent infections and preserve sterility. Medical scrubs, drapes, bed sheets, and other health care textiles are antimicrobial. To improve infection control and patient safety, medical textiles should include antimicrobials.

Further advancement in textile technology and development of new innovative antimicrobial formulations stimulate the market growth. For instance they invest heavily in research and development where they introduce advanced formulation having specific features within their products range through this method companies within this market segment compete effectively with each other while differentiating themselves on technology front. These changes could include more efficient anti-microbials or even ones that can withstand multiple washes without affecting other characteristics found only on certain materials. This kind of continuous innovation addresses end-users’ changing needs hence fosters wider adoption of these textiles than ever before.

Geographical factors also play a role in shaping the antimicrobial textile additive market. The demand for antimicrobial textiles for use in medical applications is significantly higher in North America and Europe given their strong health care infrastructures compared to other regions thus it has been observed that most medical facilities like using them. On the other hand Asia-Pacific is an emerging market for such textiles due to its large population base coupled with increased consciousness about cleanliness especially in this era of infectious diseases. Hence, the use of antimicrobial textiles is governed by culture and preferences resulting in different market dynamics within a given region.

Leave a Comment