Rising Demand for Hygiene Products

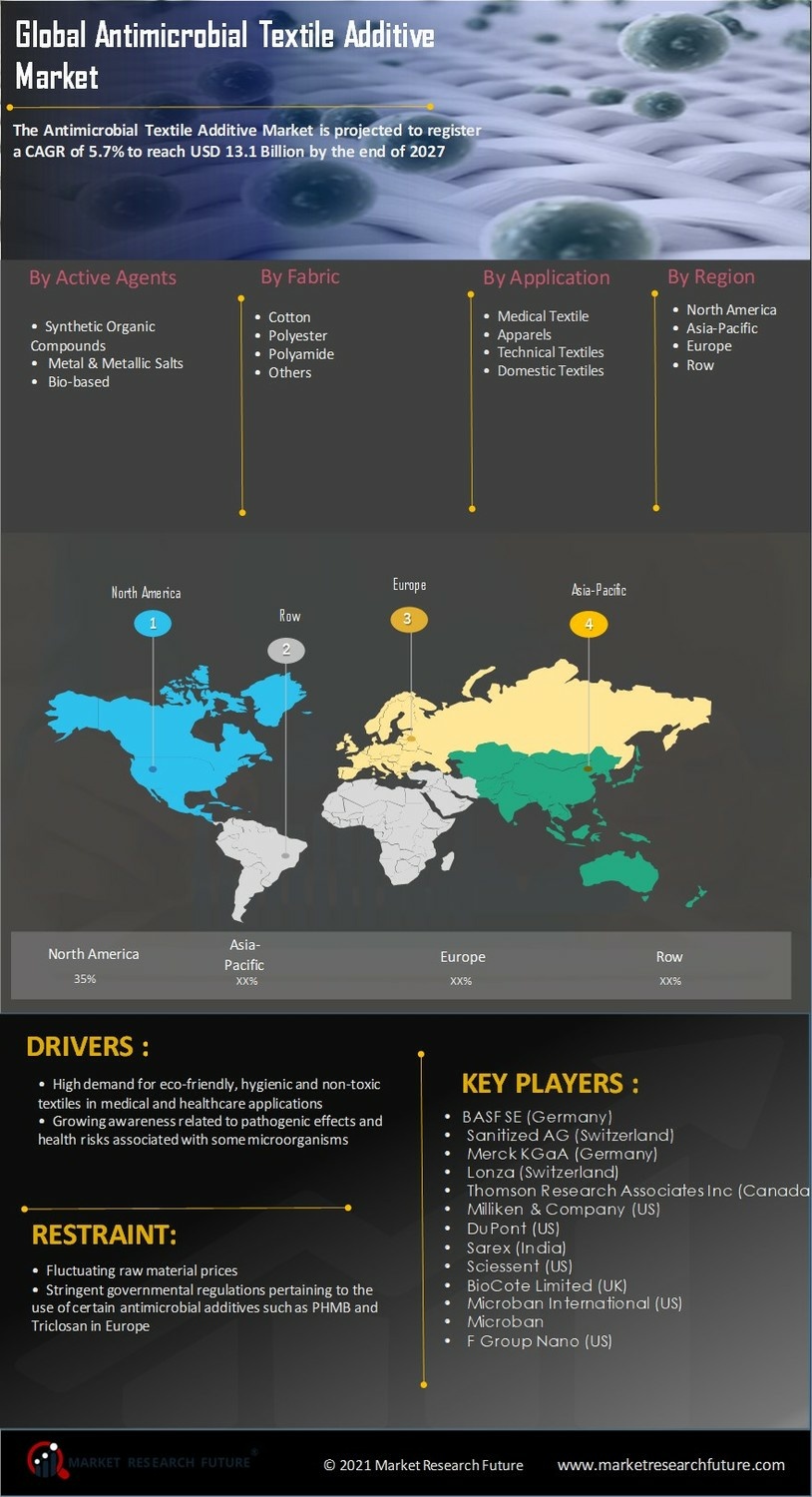

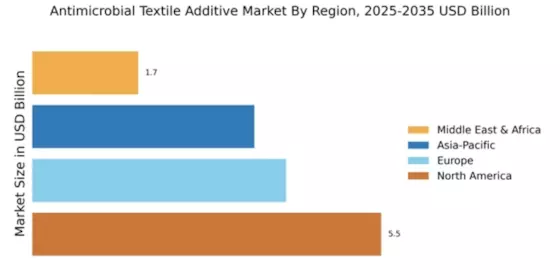

The increasing global awareness of hygiene and cleanliness drives the demand for antimicrobial textile additives. Consumers are increasingly seeking products that offer protection against bacteria and other pathogens. This trend is particularly evident in sectors such as healthcare, where antimicrobial textiles are utilized in hospital linens and uniforms. The Global Antimicrobial Textile Additive Market Industry is poised to benefit from this heightened focus on hygiene, with projections indicating a market value of 3.25 USD Billion in 2024. As the emphasis on health and sanitation continues, the demand for these additives is likely to grow, further propelling market expansion.

Growth in the Sports and Activewear Sector

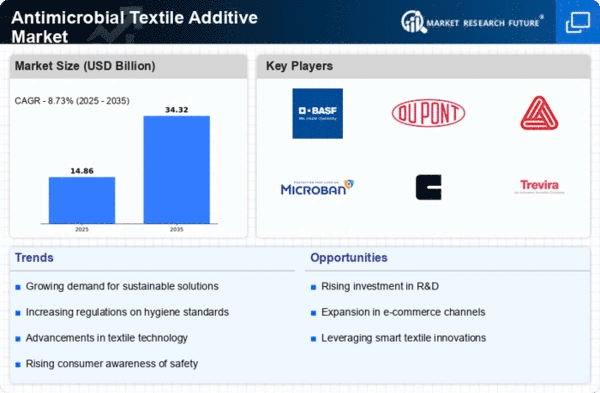

The sports and activewear sector is witnessing substantial growth, which is positively impacting the Global Antimicrobial Textile Additive Market Industry. As consumers increasingly prioritize fitness and outdoor activities, the demand for performance-oriented textiles that offer moisture management and odor control is rising. Antimicrobial additives play a crucial role in enhancing the durability and hygiene of these fabrics. This trend is expected to contribute to the market's expansion, with estimates suggesting a market size of 7.5 USD Billion by 2035. The integration of antimicrobial properties in activewear not only meets consumer expectations but also positions brands competitively in a crowded marketplace.

Consumer Preference for Sustainable Solutions

There is a growing consumer preference for sustainable and eco-friendly products, which is influencing the Global Antimicrobial Textile Additive Market Industry. As awareness of environmental issues rises, consumers are seeking textiles that not only provide antimicrobial benefits but also adhere to sustainable practices. Manufacturers are responding by developing biodegradable and non-toxic antimicrobial additives that align with these consumer values. This shift towards sustainability is expected to drive innovation and growth within the market, as companies strive to meet the evolving demands of environmentally conscious consumers.

Regulatory Support for Antimicrobial Products

Regulatory bodies are increasingly recognizing the importance of antimicrobial products in various applications, which is fostering growth in the Global Antimicrobial Textile Additive Market Industry. Governments are implementing guidelines and standards that encourage the use of antimicrobial additives in textiles, particularly in sectors such as healthcare and hospitality. This regulatory support not only enhances consumer confidence but also incentivizes manufacturers to invest in antimicrobial technologies. As a result, the market is likely to see increased adoption of these additives, contributing to a more robust industry landscape in the coming years.

Technological Advancements in Textile Manufacturing

Innovations in textile manufacturing technologies are significantly influencing the Global Antimicrobial Textile Additive Market Industry. Advanced techniques such as nanotechnology and bioengineering are enabling the development of more effective antimicrobial agents that can be integrated into textiles. These advancements not only enhance the performance of the additives but also expand their application range across various sectors, including sportswear and home textiles. As manufacturers adopt these cutting-edge technologies, the market is expected to experience robust growth, with a projected CAGR of 7.9% from 2025 to 2035, indicating a strong future for antimicrobial textiles.