China : Rapid Growth and Infrastructure Expansion

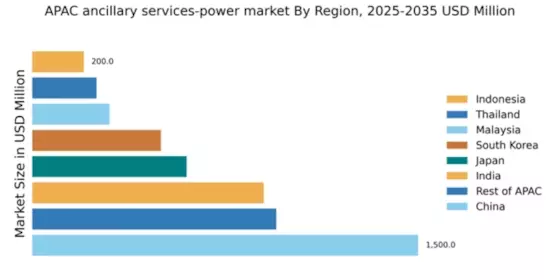

China holds a commanding market share of 38.5% in the APAC ancillary services-power market, valued at $1500.0 million. Key growth drivers include robust industrialization, increasing urbanization, and government initiatives aimed at renewable energy integration. Demand trends show a shift towards smart grid technologies and energy storage solutions, supported by regulatory policies promoting sustainability and efficiency. Infrastructure development, particularly in major cities, is pivotal for meeting rising energy demands.

India : Government Initiatives Fueling Growth

India's ancillary services-power market is valued at $900.0 million, representing 22.5% of the APAC market. The growth is driven by increasing energy consumption, urbanization, and government policies like the National Electricity Policy promoting renewable energy. Demand for ancillary services is rising, particularly in urban centers, as industries seek reliable power solutions. The government is also investing in grid modernization to enhance efficiency and reliability.

Japan : Focus on Smart Technologies

Japan's market share in the ancillary services-power sector stands at $600.0 million, accounting for 15% of the APAC total. The growth is propelled by advancements in smart grid technologies and energy efficiency initiatives. Regulatory frameworks encourage the integration of renewable energy sources, while demand for ancillary services is increasing due to the need for grid stability. The government is actively promoting energy conservation and innovation in energy management.

South Korea : Strong Focus on Renewable Integration

South Korea's ancillary services-power market is valued at $500.0 million, representing 12.5% of the APAC market. Key growth drivers include government policies supporting renewable energy and technological advancements in energy storage. Demand trends indicate a shift towards smart energy solutions, with significant investments in infrastructure. The competitive landscape features major players like Siemens and GE, focusing on innovative solutions to enhance grid reliability and efficiency.

Malaysia : Strategic Investments in Infrastructure

Malaysia's ancillary services-power market is valued at $300.0 million, accounting for 7.5% of the APAC total. The market is driven by increasing energy demand and government initiatives aimed at enhancing energy security. Regulatory policies support the integration of renewable energy sources, while infrastructure development is crucial for meeting future energy needs. Key markets include Kuala Lumpur and Penang, where industrial growth is significant.

Thailand : Government Policies Boosting Growth

Thailand's ancillary services-power market is valued at $250.0 million, representing 6.25% of the APAC market. Growth is driven by government policies promoting renewable energy and energy efficiency. Demand for ancillary services is increasing, particularly in urban areas, as industries seek reliable power solutions. The competitive landscape includes local and international players, with a focus on sustainable energy practices and infrastructure development.

Indonesia : Focus on Infrastructure Development

Indonesia's ancillary services-power market is valued at $200.0 million, accounting for 5% of the APAC total. The market is characterized by growing energy demand and government initiatives aimed at improving energy access. Regulatory frameworks are evolving to support renewable energy integration, while infrastructure development is critical for future growth. Key markets include Jakarta and Surabaya, where industrial activities are concentrated.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC ancillary services-power market is valued at $948.4 million, representing 23.6% of the total market. This diverse region includes various countries with unique regulatory environments and energy needs. Growth drivers vary, with some countries focusing on renewable energy integration while others prioritize energy security. The competitive landscape features both local and international players, adapting to local market dynamics and demands.