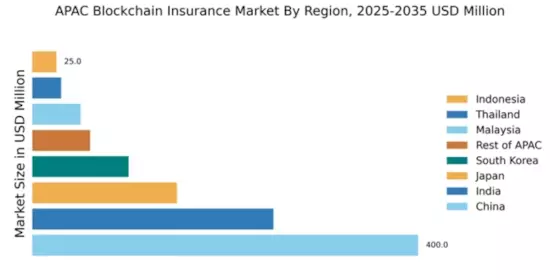

China : Rapid Growth and Innovation Hub

China holds a commanding 40% market share in the APAC blockchain insurance sector, valued at $400.0 million. Key growth drivers include a robust digital economy, increasing demand for transparency in transactions, and supportive government policies promoting blockchain technology. The Chinese government has initiated several regulations to foster innovation while ensuring consumer protection, which has led to a surge in blockchain adoption across various industries, including finance and logistics.

India : Innovative Solutions for Diverse Needs

India accounts for 25% of the APAC blockchain insurance market, valued at $250.0 million. The growth is fueled by a burgeoning startup ecosystem, increasing smartphone penetration, and a young, tech-savvy population. Government initiatives like Digital India are promoting the adoption of blockchain, enhancing operational efficiency in insurance processes. The demand for customized insurance products is rising, driven by the diverse needs of the population.

Japan : Integration of Blockchain Solutions

Japan holds a 15% market share in the APAC blockchain insurance market, valued at $150.0 million. The growth is driven by the country's advanced technological infrastructure and a strong focus on innovation. Regulatory bodies are actively exploring blockchain applications to enhance operational efficiency and customer trust. The demand for insurance products that leverage blockchain for claims processing and fraud prevention is on the rise, reflecting changing consumer expectations.

South Korea : Strong Regulatory Support and Innovation

South Korea represents 10% of the APAC blockchain insurance market, valued at $100.0 million. The growth is supported by government initiatives aimed at fostering blockchain innovation and a strong emphasis on cybersecurity. The demand for blockchain-based insurance solutions is increasing, particularly in sectors like health and property insurance. The competitive landscape features both established players and innovative startups, driving rapid advancements in the market.

Malaysia : Strategic Initiatives and Development

Malaysia captures 5% of the APAC blockchain insurance market, valued at $50.0 million. The growth is driven by government initiatives promoting digital transformation and a growing awareness of blockchain's benefits. The demand for insurance products that offer transparency and efficiency is increasing, particularly in the automotive and health sectors. The local market is characterized by a mix of traditional insurers and new entrants leveraging blockchain technology.

Thailand : Innovative Solutions for Local Needs

Thailand holds a 3% market share in the APAC blockchain insurance sector, valued at $30.0 million. The growth is driven by increasing digital literacy and government support for fintech innovations. The demand for blockchain-based insurance solutions is rising, particularly in agriculture and tourism sectors. The competitive landscape includes both local and international players, fostering a dynamic business environment that encourages innovation.

Indonesia : Potential for Rapid Growth

Indonesia accounts for 2.5% of the APAC blockchain insurance market, valued at $25.0 million. The growth is driven by a large unbanked population and increasing smartphone usage, creating opportunities for innovative insurance solutions. Government initiatives aimed at enhancing financial inclusion are also contributing to market growth. The competitive landscape is evolving, with local startups and international players entering the market to meet diverse consumer needs.

Rest of APAC : Varied Market Dynamics Across Regions

The Rest of APAC holds a 6% market share in the blockchain insurance sector, valued at $60.0 million. The growth is driven by varying levels of digital adoption and regulatory support across different countries. Demand for blockchain solutions is emerging in sectors like agriculture and logistics, reflecting local market needs. The competitive landscape features a mix of regional players and global firms, creating a dynamic environment for innovation and collaboration.