Cost Efficiency through Automation

The blockchain insurance market is poised to benefit from significant cost efficiencies driven by automation. By leveraging blockchain technology, insurers can streamline various processes, such as underwriting and claims management, which traditionally involve extensive manual intervention. In France, it is estimated that the adoption of blockchain could reduce operational costs by up to 30% by 2027. This potential for cost savings is particularly appealing to insurers looking to enhance profitability in a competitive landscape. Furthermore, automation through smart contracts can expedite claims processing, leading to improved customer experiences. As insurers increasingly recognize these advantages, the blockchain insurance market is likely to witness accelerated growth, with more companies investing in automated solutions.

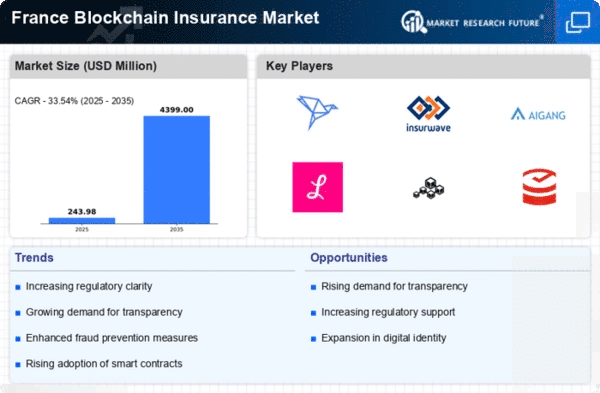

Rising Demand for Transparency and Trust

In the blockchain insurance market, there is an increasing demand for transparency and trust among consumers. As clients become more aware of the benefits of blockchain technology, they are seeking insurance products that offer greater visibility into policy terms and claims processes. This trend is particularly pronounced in France, where consumers are becoming more discerning about their insurance choices. A survey conducted in 2025 indicates that 65% of French consumers prefer insurers that utilize blockchain for its inherent transparency features. This shift in consumer preference is likely to compel insurers to adopt blockchain solutions, thereby driving growth in the market. The emphasis on transparency not only enhances customer satisfaction but also reduces the risk of fraud, further solidifying the blockchain insurance market's position in the industry.

Integration of IoT with Blockchain Solutions

The convergence of Internet of Things (IoT) technology with blockchain solutions is emerging as a key driver for the blockchain insurance market. In France, the integration of IoT devices in insurance policies allows for real-time data collection and analysis, which can enhance risk assessment and pricing accuracy. For instance, telematics in auto insurance can provide insurers with precise driving behavior data, enabling more personalized premiums. This synergy is expected to create a more dynamic insurance landscape, where policies are tailored to individual risk profiles. By 2026, the blockchain insurance market is projected to grow by 25% due to the increasing adoption of IoT-enabled blockchain solutions, as insurers seek to leverage data for better decision-making and customer engagement.

Regulatory Support for Blockchain Technology

In France, the blockchain insurance market benefits from a favorable regulatory environment that encourages innovation. The French government has shown a commitment to fostering blockchain technology through various initiatives and frameworks. This regulatory support is crucial as it provides a clear legal structure for blockchain applications in insurance, thereby enhancing trust among stakeholders. In 2025, the French insurance sector is projected to allocate approximately €200 million towards blockchain initiatives, indicating a growing recognition of its potential. This investment is likely to drive the adoption of blockchain solutions, as insurers seek to comply with regulations while improving operational efficiency. As a result, the blockchain insurance market is expected to expand, with more players entering the space to leverage these supportive policies.

Growing Interest in Decentralized Finance (DeFi)

The blockchain insurance market is witnessing a growing interest in decentralized finance (DeFi) solutions, which offer innovative alternatives to traditional insurance models. In France, the DeFi sector is rapidly evolving, with numerous startups exploring blockchain-based insurance products that eliminate intermediaries and reduce costs. This trend is indicative of a broader shift towards more accessible and efficient financial services. As of 2025, the DeFi insurance market in France is estimated to reach €150 million, reflecting a burgeoning appetite for decentralized solutions. This interest in DeFi could potentially reshape the blockchain insurance market, as consumers and businesses alike seek more flexible and transparent insurance options. The rise of DeFi may encourage traditional insurers to adapt their offerings, thereby fostering a more competitive environment.