Rise of Insurtech Startups

The blockchain insurance market in Canada is witnessing a proliferation of insurtech startups. These startups leverage blockchain technology to innovate traditional insurance models. These startups are often more agile and capable of responding to market demands swiftly, offering tailored products that meet the specific needs of consumers. In 2025, it is projected that insurtech firms will capture around 25% of the overall insurance market share in Canada. This shift indicates a growing acceptance of technology-driven solutions, which could lead to increased competition and innovation within the blockchain insurance market, ultimately benefiting consumers through improved offerings.

Enhanced Customer Experience

The blockchain insurance market in Canada is poised to significantly enhance customer experience. This enhancement is achieved through the use of decentralized technology. By streamlining processes such as claims handling and policy issuance, blockchain can reduce the time taken for customers to receive payouts or access services. In 2025, it is anticipated that customer satisfaction levels in the insurance sector could improve by as much as 40% due to the efficiencies introduced by blockchain solutions. This focus on customer experience is likely to drive more insurers to adopt blockchain technology, thereby transforming the landscape of the blockchain insurance market.

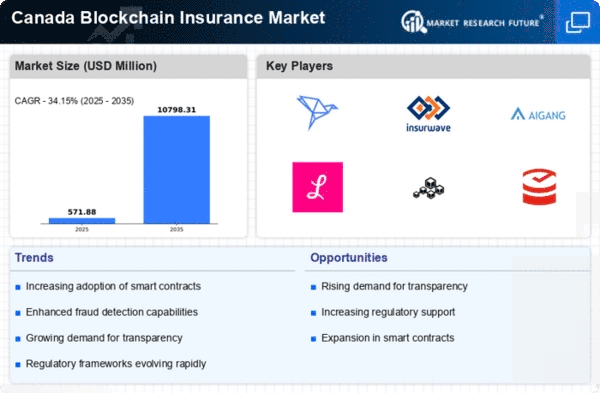

Growing Demand for Transparency

The blockchain insurance market in Canada is experiencing a notable surge in demand for transparency among consumers. This demand is driven by the inherent characteristics of blockchain technology, which offers immutable records and traceability. As consumers become more aware of their rights and the complexities of insurance products, they seek solutions that provide clear insights into policy terms and claims processes. By 2025, approximately 60% of Canadian consumers are expected to prioritize transparency when selecting insurance providers. This trend is likely to compel insurers to adopt blockchain solutions to enhance their operational transparency, thereby fostering trust and potentially increasing market share in the blockchain insurance market.

Regulatory Support for Innovation

Regulatory bodies in Canada are increasingly recognizing the potential of blockchain technology in the insurance sector. This support is crucial for the blockchain insurance market, as it encourages innovation while ensuring consumer protection. In recent years, Canadian regulators have initiated discussions on creating a framework that accommodates blockchain applications in insurance, which may include guidelines for data privacy and security. Such regulatory backing could facilitate the entry of new players into the blockchain insurance market, fostering a more dynamic and competitive environment that benefits consumers and businesses alike.

Cost Efficiency through Automation

Cost efficiency is emerging as a critical driver in the blockchain insurance market in Canada. The automation capabilities of blockchain technology can significantly reduce operational costs associated with claims processing and policy management. By utilizing smart contracts, insurers can automate various processes, minimizing the need for manual intervention and reducing the likelihood of errors. Reports indicate that companies implementing blockchain solutions may achieve cost reductions of up to 30% in administrative expenses. This potential for enhanced efficiency is likely to attract more players to the blockchain insurance market, as firms seek to optimize their operations and improve profitability.