Increased Consumer Awareness

Consumer awareness regarding blockchain technology is on the rise in Japan, which is positively influencing the blockchain insurance market. Educational initiatives and media coverage have contributed to a better understanding of how blockchain can enhance security and efficiency in insurance transactions. Surveys indicate that over 60% of Japanese consumers are now familiar with blockchain concepts, leading to a growing interest in insurance products that leverage this technology. This heightened awareness is expected to drive demand for innovative insurance solutions, thereby fostering growth in the blockchain insurance market.

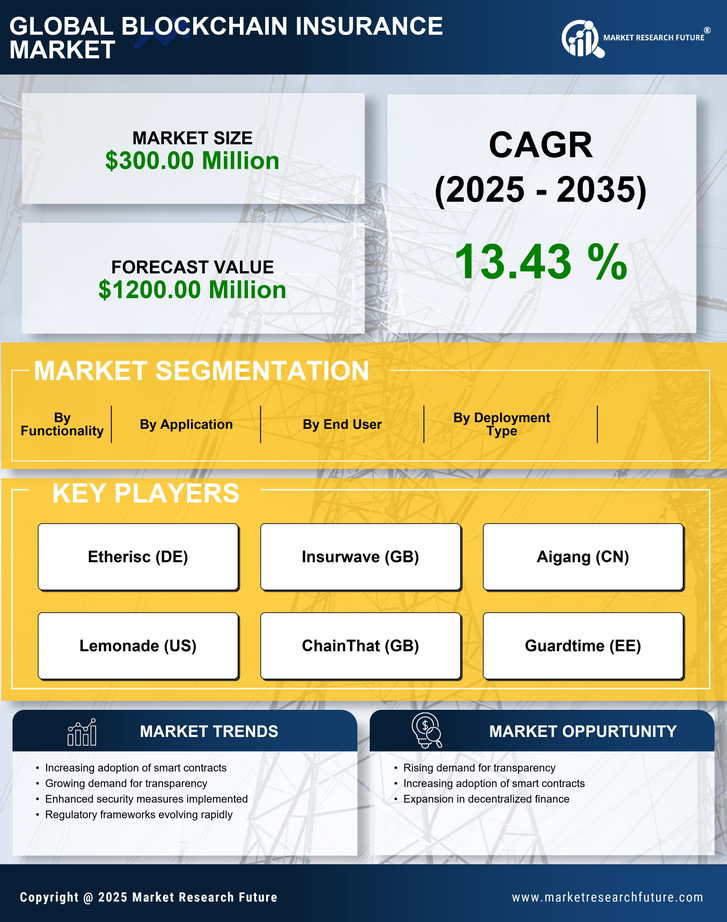

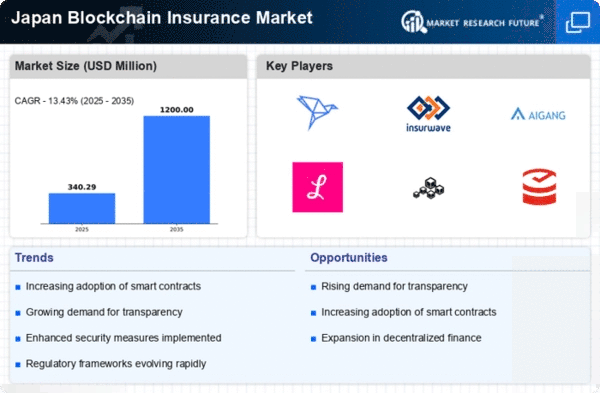

Rising Demand for Transparency

The blockchain insurance market in Japan is experiencing a notable increase in demand for transparency among consumers and businesses. This demand is driven by the inherent characteristics of blockchain technology, which offers immutable records and traceability. As consumers become more aware of their rights and the importance of transparency in transactions, insurance providers are compelled to adopt blockchain solutions. According to recent studies, approximately 70% of Japanese consumers express a preference for insurance products that utilize blockchain for enhanced transparency. This shift is likely to foster trust and confidence in the insurance sector, thereby propelling the growth of the blockchain insurance market.

Regulatory Support for Innovation

Regulatory frameworks in Japan are increasingly supportive of innovations in the blockchain insurance market. The Japanese government has recognized the potential of blockchain technology to enhance the efficiency and security of financial services, including insurance. Recent regulatory developments aim to create a conducive environment for blockchain adoption, which may include guidelines for smart contracts and data privacy. This supportive regulatory landscape is likely to encourage more insurance companies to explore blockchain solutions, thereby accelerating the growth of the blockchain insurance market.

Cost Efficiency through Automation

Cost efficiency is emerging as a critical driver in the blockchain insurance market in Japan. The automation of processes through smart contracts can significantly reduce operational costs for insurance companies. By minimizing the need for intermediaries and streamlining claims processing, blockchain technology can lead to savings that may reach up to 30% in administrative expenses. This potential for cost reduction is particularly appealing in a competitive market where profit margins are often tight. As insurers seek to enhance their operational efficiency, the adoption of blockchain solutions is likely to accelerate, further stimulating the blockchain insurance market.

Collaboration with Technology Providers

Collaboration between insurance companies and technology providers is becoming a prominent driver in the blockchain insurance market in Japan. Insurers are increasingly partnering with blockchain startups and tech firms to leverage their expertise in developing innovative solutions. These collaborations can lead to the creation of tailored insurance products that meet the specific needs of consumers. As a result, the blockchain insurance market is likely to benefit from enhanced product offerings and improved customer experiences, further driving its growth.