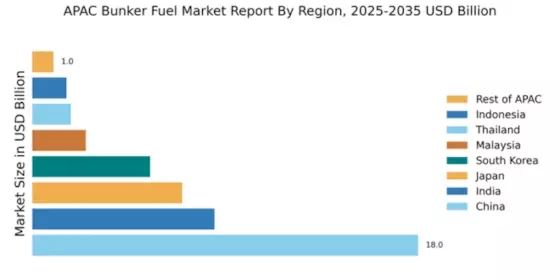

China : China's Strategic Maritime Hub

Key markets in China include major ports like Shanghai, Ningbo, and Guangzhou, which are critical for bunker fuel consumption. The competitive landscape features significant players such as Sinopec and China National Petroleum Corporation (CNPC), alongside international giants like Shell and BP. The local market is characterized by a mix of state-owned and private enterprises, fostering a dynamic business environment. The shipping industry, particularly container shipping and bulk carriers, drives demand for bunker fuel, with a growing emphasis on sustainability and compliance with international regulations.

India : India's Growing Maritime Demand

Key markets in India include Mumbai, Chennai, and Visakhapatnam, which are vital for bunker fuel consumption. The competitive landscape features major players such as Indian Oil Corporation and Bharat Petroleum, alongside international firms like ExxonMobil. The local market is characterized by a growing number of private players entering the sector, enhancing competition. The shipping industry, particularly in the oil and gas sector, is a significant consumer of bunker fuel, with increasing investments in infrastructure and technology to meet rising demand.

Japan : Japan's Advanced Shipping Sector

Key markets in Japan include Tokyo, Yokohama, and Osaka, which are essential for bunker fuel consumption. The competitive landscape features major players like Nippon Oil and JX Nippon Oil & Energy, alongside international companies such as TotalEnergies. The local market is characterized by a high level of technological advancement, with a focus on eco-friendly solutions. The shipping industry, particularly in container shipping and bulk carriers, drives demand for bunker fuel, with a growing emphasis on reducing emissions and improving efficiency.

South Korea : South Korea's Maritime Leadership

Key markets in South Korea include Busan, Incheon, and Ulsan, which are critical for bunker fuel consumption. The competitive landscape features major players like SK Energy and GS Caltex, alongside international firms such as Chevron. The local market is characterized by a focus on technological innovation and sustainability, fostering a dynamic business environment. The shipping industry, particularly in container and bulk shipping, drives demand for bunker fuel, with increasing investments in eco-friendly technologies and practices.

Malaysia : Malaysia's Strategic Maritime Position

Key markets in Malaysia include Port Klang, Penang, and Johor, which are vital for bunker fuel consumption. The competitive landscape features players like Petronas and Dialog Group, alongside international companies such as World Fuel Services. The local market is characterized by a mix of state-owned and private enterprises, fostering competition. The shipping industry, particularly in oil and gas transportation, drives demand for bunker fuel, with increasing investments in infrastructure and sustainability initiatives.

Thailand : Thailand's Expanding Maritime Sector

Key markets in Thailand include Bangkok, Laem Chabang, and Songkhla, which are essential for bunker fuel consumption. The competitive landscape features players like PTT and Bangchak Corporation, alongside international firms such as Shell. The local market is characterized by a growing number of private players entering the sector, enhancing competition. The shipping industry, particularly in tourism and trade, drives demand for bunker fuel, with increasing investments in infrastructure and technology to meet rising demand.

Indonesia : Indonesia's Growing Maritime Industry

Key markets in Indonesia include Jakarta, Surabaya, and Makassar, which are critical for bunker fuel consumption. The competitive landscape features players like Pertamina and state-owned enterprises, alongside international companies such as ExxonMobil. The local market is characterized by a mix of state-owned and private enterprises, fostering competition. The shipping industry, particularly in inter-island trade and fishing, drives demand for bunker fuel, with increasing investments in infrastructure and sustainability initiatives.

Rest of APAC : Varied Dynamics Across APAC

Key markets in the Rest of APAC include smaller nations like Vietnam, the Philippines, and Singapore, which are essential for bunker fuel consumption. The competitive landscape features a mix of local and international players, with companies like World Fuel Services and local distributors. The local market is characterized by varying levels of development and regulatory frameworks, impacting competition. The shipping industry, particularly in tourism and trade, drives demand for bunker fuel, with a focus on sustainability and compliance with international regulations.

Leave a Comment