Rising Demand for Maritime Trade

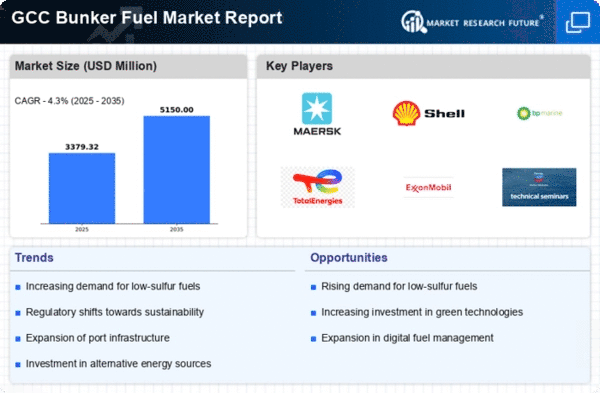

The bunker fuel market in the GCC is experiencing a notable surge in demand due to the increasing volume of maritime trade. The region's strategic location as a key shipping hub facilitates significant trade routes, particularly between Europe, Asia, and Africa. According to recent data, the volume of cargo passing through GCC ports has been on an upward trajectory, with a projected growth rate of approximately 4% annually. This growth in maritime activities directly correlates with the demand for bunker fuel, as vessels require substantial quantities to operate efficiently. Consequently, the bunker fuel market is poised to benefit from this trend, as shipping companies seek reliable fuel sources to support their operations. The interplay between trade growth and fuel demand may lead to enhanced investment in infrastructure and logistics, further solidifying the GCC's position in the global maritime landscape.

Investment in Port Infrastructure

Investment in port infrastructure is a critical driver for the bunker fuel market in the GCC. As regional economies diversify and expand, there is a concerted effort to enhance port facilities to accommodate larger vessels and increased cargo volumes. Recent reports indicate that several GCC countries are allocating substantial budgets for port development projects, with investments reaching billions of $ in the coming years. This infrastructure enhancement is expected to facilitate smoother operations for shipping companies, thereby increasing the demand for bunker fuel. Improved port facilities can lead to reduced turnaround times for vessels, making the region more attractive for shipping lines. Consequently, the bunker fuel market stands to gain from these developments, as enhanced infrastructure supports the overall growth of maritime activities in the GCC.

Shifts in Energy Policy and Diversification

Shifts in energy policy and diversification efforts within the GCC are significantly impacting the bunker fuel market. As countries in the region seek to reduce their reliance on fossil fuels, there is a growing emphasis on alternative energy sources. This transition may influence the demand for traditional bunker fuels, as shipping companies explore cleaner energy options. For instance, investments in renewable energy projects and the development of LNG as a marine fuel are gaining traction. These policy shifts could reshape the competitive landscape of the bunker fuel market, as companies adapt to changing energy dynamics. The potential for increased adoption of alternative fuels may lead to a gradual decline in conventional bunker fuel consumption, prompting stakeholders to innovate and diversify their offerings to remain relevant in a transforming market.

Technological Innovations in Fuel Supply Chain

Technological innovations are reshaping the bunker fuel market in the GCC, particularly in the supply chain management of fuel distribution. Advanced technologies such as blockchain and IoT are being integrated into operations, enhancing transparency and efficiency. These innovations facilitate real-time tracking of fuel shipments, reducing delays and improving inventory management. Moreover, the adoption of automated systems is likely to streamline the procurement process, potentially lowering operational costs. As the industry embraces these technological advancements, it may lead to a more competitive landscape, where companies that leverage technology effectively gain a significant advantage. The bunker fuel market could see a shift towards more agile and responsive supply chains, ultimately benefiting end-users through improved service delivery and reliability.

Regulatory Compliance and Environmental Standards

The bunker fuel market in the GCC is increasingly influenced by stringent regulatory compliance and environmental standards. Governments in the region are implementing regulations aimed at reducing sulfur emissions, which has led to a shift towards low-sulfur fuels. For instance, the International Maritime Organization's (IMO) 2020 regulations mandated a maximum sulfur content of 0.5% in marine fuels, compelling shipping companies to adapt. This regulatory landscape is expected to drive demand for compliant bunker fuels, potentially increasing their market share. As a result, the bunker fuel market is likely to witness a transformation, with a growing emphasis on sustainable practices and cleaner fuel options. The financial implications of these regulations could also be substantial, as companies may incur additional costs to meet compliance, thereby reshaping the competitive dynamics within the industry.

Leave a Comment