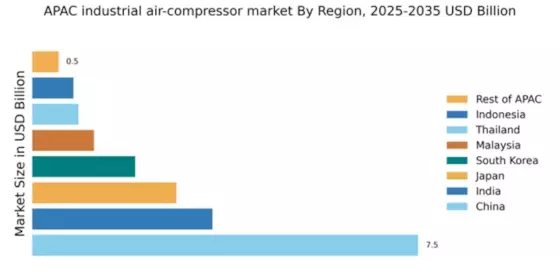

China : Unmatched Growth and Demand Trends

China holds a commanding 7.5% market share in the APAC industrial air-compressor sector, driven by rapid industrialization and urbanization. Key growth drivers include increasing demand from manufacturing, construction, and energy sectors, alongside government initiatives promoting sustainable practices. Regulatory policies favoring energy efficiency and emissions reduction are also shaping consumption patterns, while significant investments in infrastructure bolster industrial development.

India : Rapid Growth in Manufacturing Sector

India's industrial air-compressor market accounts for 3.5% of the APAC share, reflecting a burgeoning manufacturing sector. Key growth drivers include the Make in India initiative, which encourages local production and foreign investment. Demand trends show a shift towards energy-efficient compressors, driven by rising energy costs and environmental regulations. The government's focus on infrastructure development further fuels market growth.

Japan : Innovation and Quality at Forefront

Japan's market share stands at 2.8%, characterized by a strong emphasis on technology and innovation. The growth is driven by the need for high-quality, energy-efficient compressors in sectors like automotive and electronics. Regulatory policies promote advanced manufacturing techniques, while the aging infrastructure necessitates upgrades. Consumption patterns reflect a preference for premium products that offer reliability and efficiency.

South Korea : Key Player in Advanced Manufacturing

South Korea holds a 2.0% market share, supported by a robust industrial base and advanced manufacturing capabilities. Key growth drivers include the rise of smart factories and automation, which demand high-performance air-compressors. The government’s support for innovation and technology adoption enhances market dynamics. Major cities like Seoul and Busan are pivotal markets, with a competitive landscape featuring global players like Doosan Portable Power.

Malaysia : Strategic Location for Manufacturing

Malaysia's industrial air-compressor market represents 1.2% of the APAC share, driven by its strategic location and growing manufacturing sector. Key growth drivers include government initiatives to attract foreign investment and enhance local production capabilities. Demand trends indicate a rising preference for energy-efficient solutions, particularly in the electronics and automotive industries. The competitive landscape includes both local and international players.

Thailand : Investment in Infrastructure and Industry

Thailand's market share is 0.9%, with growth fueled by significant investments in infrastructure and industrial development. The government's Eastern Economic Corridor initiative aims to boost manufacturing and attract foreign investment. Demand trends show a shift towards sustainable and energy-efficient compressors, reflecting global environmental concerns. Key markets include Bangkok and Chonburi, with a competitive landscape featuring both local and international brands.

Indonesia : Rapid Industrialization and Growth

Indonesia's industrial air-compressor market accounts for 0.8% of the APAC share, driven by rapid industrialization and urban development. Key growth drivers include increasing investments in manufacturing and infrastructure projects. Demand trends indicate a rising need for reliable and efficient compressors, particularly in the mining and construction sectors. The competitive landscape is evolving, with both local and international players vying for market share.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC holds a 0.51% market share, characterized by diverse markets with unique industrial needs. Growth drivers vary by country, influenced by local regulations and economic conditions. Demand trends reflect a mix of traditional and emerging industries, with a focus on energy efficiency. The competitive landscape includes a mix of regional players and global brands, adapting to local market dynamics.