Expansion of Manufacturing Sector

The Industrial Air Compressor Market is poised for growth due to the expansion of the manufacturing sector. As economies recover and industrial activities ramp up, the demand for reliable and efficient air compressors increases. The manufacturing sector, which heavily relies on compressed air for various applications, is projected to witness substantial growth. For instance, the global manufacturing output is expected to rise, leading to an increased need for air compressors in production lines, assembly processes, and pneumatic tools. This expansion is further fueled by the rise of automation and Industry 4.0 initiatives, which necessitate advanced air compressor systems. Thus, the growth of the manufacturing sector serves as a significant driver for the Industrial Air Compressor Market.

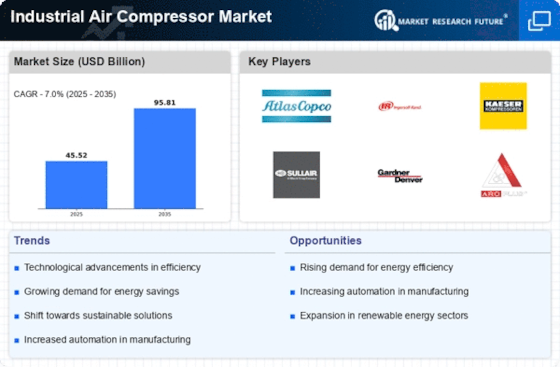

Rising Demand for Energy Efficiency

The Industrial Air Compressor Market experiences a notable surge in demand for energy-efficient solutions. As industries strive to reduce operational costs and enhance productivity, energy-efficient air compressors become increasingly vital. According to recent data, energy consumption in industrial applications accounts for a significant portion of total energy use, prompting manufacturers to innovate. The integration of advanced technologies, such as variable speed drives and smart controls, allows for optimized energy usage. This trend not only aligns with corporate sustainability goals but also meets regulatory requirements aimed at reducing carbon footprints. Consequently, the focus on energy efficiency is likely to drive growth in the Industrial Air Compressor Market, as companies seek to balance performance with environmental responsibility.

Technological Innovations in Compressor Design

Technological innovations play a crucial role in shaping the Industrial Air Compressor Market. Recent advancements in compressor design, such as the development of oil-free compressors and rotary screw compressors, enhance performance and reliability. These innovations not only improve efficiency but also reduce maintenance costs, making them attractive to end-users. Furthermore, the introduction of IoT-enabled compressors allows for real-time monitoring and predictive maintenance, which can significantly reduce downtime. As industries increasingly adopt these advanced technologies, the demand for innovative air compressor solutions is likely to rise. This trend indicates a shift towards smarter, more efficient systems within the Industrial Air Compressor Market, catering to the evolving needs of various sectors.

Increasing Adoption of Renewable Energy Sources

The Industrial Air Compressor Market is witnessing a shift due to the increasing adoption of renewable energy sources. As industries transition towards sustainable practices, the demand for air compressors that can efficiently operate in renewable energy applications rises. For instance, wind and solar energy projects require reliable compressed air systems for various operations, including maintenance and control systems. The integration of air compressors in these applications not only enhances operational efficiency but also supports the overall sustainability goals of organizations. As the global focus on renewable energy intensifies, the Industrial Air Compressor Market is likely to benefit from this trend, as companies seek to align their operations with environmentally friendly practices.

Growth in Construction and Infrastructure Development

The Industrial Air Compressor Market is significantly influenced by the growth in construction and infrastructure development. As urbanization accelerates, the demand for construction equipment and tools that utilize compressed air rises. Air compressors are essential for powering pneumatic tools, which are widely used in construction projects. Recent statistics indicate that the construction sector is expected to grow steadily, driven by government investments in infrastructure and housing. This growth creates a robust demand for industrial air compressors, as they are integral to various construction applications, including drilling, excavation, and material handling. Consequently, the expansion of the construction industry serves as a vital driver for the Industrial Air Compressor Market.