Growing Focus on Energy Efficiency

The industrial air-compressor market in India is increasingly influenced by a growing focus on energy efficiency. As energy costs continue to rise, industries are seeking solutions that minimize energy consumption while maximizing output. The implementation of energy-efficient air-compressors can lead to savings of up to 30% in energy costs, making them an attractive option for manufacturers. Additionally, regulatory frameworks are encouraging industries to adopt sustainable practices, further driving the demand for energy-efficient solutions. This trend is likely to propel the industrial air-compressor market as companies prioritize investments in technologies that not only enhance performance but also contribute to environmental sustainability.

Expansion of the Automotive Industry

The expansion of the automotive industry in India is a crucial driver for the industrial air-compressor market. With the automotive sector projected to reach $300 billion by 2026, the demand for air-compression solutions is likely to increase significantly. Air-compressors are essential for various applications in automotive manufacturing, including painting, assembly, and testing processes. As automotive manufacturers strive for higher efficiency and quality, the need for advanced air-compression technologies becomes paramount. This growth in the automotive sector is expected to create substantial opportunities for the industrial air-compressor market, as companies seek to enhance their production capabilities and meet evolving consumer demands.

Rising Demand in Manufacturing Sector

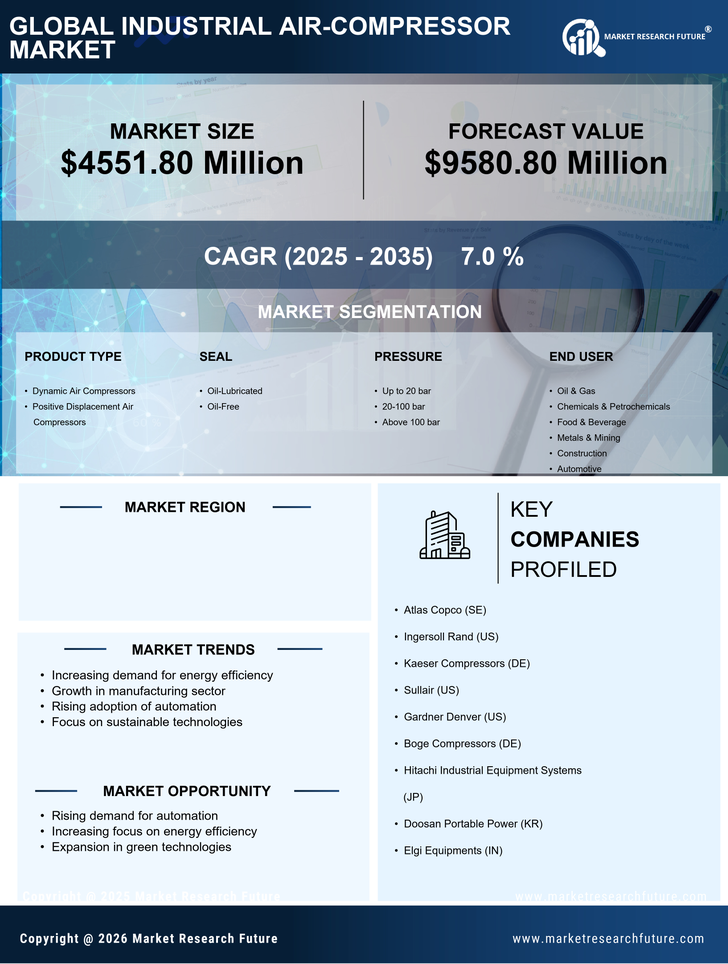

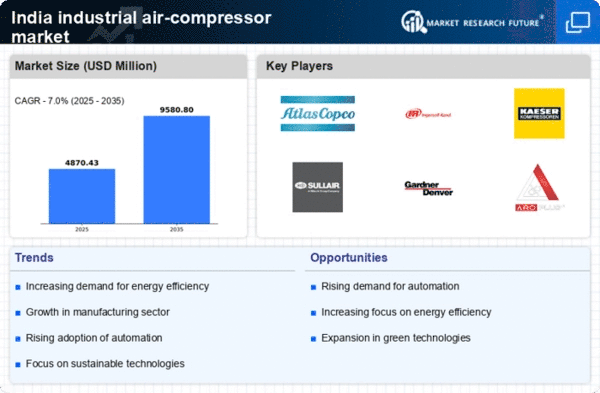

The industrial air-compressor market in India is experiencing a notable surge in demand, primarily driven by the expansion of the manufacturing sector. As the government promotes initiatives like 'Make in India', there is an increasing need for efficient and reliable air-compression solutions. The manufacturing sector's contribution to India's GDP is projected to reach 25% by 2025, which could further bolster the demand for industrial air-compressors. This growth is likely to be fueled by the need for automation and enhanced productivity, as manufacturers seek to optimize their operations. Consequently, the industrial air-compressor market is poised to benefit from this upward trend, as companies invest in advanced air-compression technologies to meet their production needs.

Infrastructure Development Initiatives

India's ongoing infrastructure development initiatives are significantly impacting the industrial air-compressor market. With substantial investments in sectors such as construction, transportation, and energy, the demand for industrial air-compressors is expected to rise. The government has allocated over $1 trillion for infrastructure projects, which includes the construction of roads, railways, and airports. These projects require reliable air-compression systems for various applications, including pneumatic tools and equipment. As infrastructure development accelerates, the industrial air-compressor market is likely to witness increased adoption of advanced technologies to support these large-scale projects, thereby enhancing operational efficiency and productivity.

Technological Innovations in Air-Compression

Technological innovations are playing a pivotal role in shaping the industrial air-compressor market in India. The introduction of smart air-compression systems equipped with IoT capabilities allows for real-time monitoring and predictive maintenance, which can significantly reduce downtime. Furthermore, advancements in compressor design, such as variable speed drives and oil-free technologies, are enhancing performance and reliability. As industries increasingly adopt automation and smart manufacturing practices, the demand for these innovative air-compression solutions is expected to rise. This trend indicates a shift towards more sophisticated and efficient air-compression systems, which could redefine operational standards in various sectors.