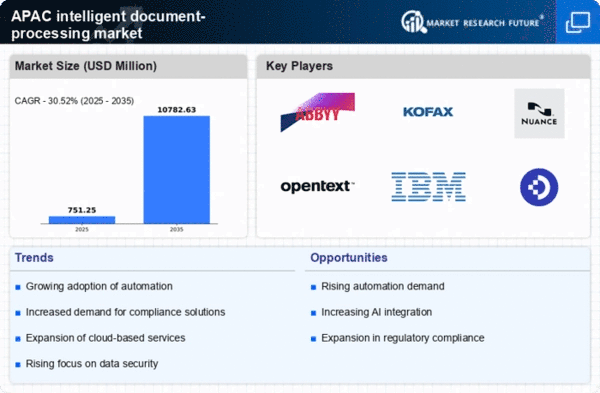

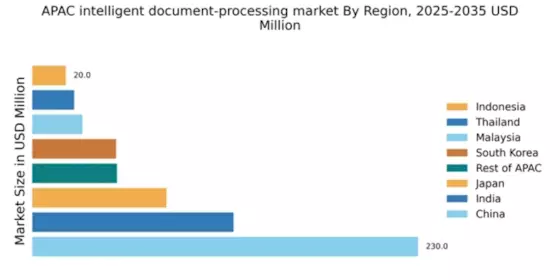

China : Unmatched Growth and Innovation

China holds a commanding market share of 230.0, representing a significant portion of the APAC intelligent document-processing market. Key growth drivers include rapid digital transformation, increasing demand for automation, and government initiatives promoting smart technologies. The regulatory environment is supportive, with policies aimed at enhancing technological infrastructure and fostering innovation in various sectors, including finance and healthcare.

India : Emerging Market with High Demand

Key markets include Bengaluru, Hyderabad, and Mumbai, where tech hubs are thriving. The competitive landscape features major players like Kofax and IBM, alongside numerous startups. The local business environment is dynamic, with a focus on sectors such as banking, insurance, and healthcare, which are increasingly leveraging document automation for operational efficiency.

Japan : Innovation-Driven Market Dynamics

Tokyo and Osaka are pivotal markets, hosting numerous tech companies and startups. The competitive landscape includes major players like Nuance and OpenText, which are well-established in the region. The local market dynamics favor sectors such as manufacturing and finance, where intelligent document processing is increasingly adopted to streamline operations and improve accuracy.

South Korea : A Hub for Technological Innovation

Seoul and Busan are key markets, with a vibrant tech ecosystem that includes major players like IBM and Kofax. The competitive landscape is characterized by a mix of established firms and innovative startups. Sectors such as finance, healthcare, and logistics are increasingly adopting intelligent document processing to enhance operational efficiency and compliance.

Malaysia : Emerging Market with Potential

Kuala Lumpur and Penang are key markets, with a growing number of tech companies and startups. The competitive landscape features players like ABBYY and local firms. The local market dynamics are influenced by sectors such as finance and manufacturing, where intelligent document processing is being increasingly integrated to streamline workflows and enhance productivity.

Thailand : Digital Transformation on the Rise

Bangkok and Chiang Mai are key markets, with a mix of established companies and startups. The competitive landscape includes players like Hyland and local firms. The local business environment is evolving, with sectors such as tourism and finance increasingly adopting intelligent document processing to enhance operational efficiency and customer service.

Indonesia : Digitalization Driving Demand

Jakarta and Surabaya are key markets, with a growing number of tech startups and established firms. The competitive landscape features players like DocuWare and local companies. The local market dynamics are influenced by sectors such as e-commerce and finance, where intelligent document processing is being increasingly integrated to streamline operations and enhance customer experiences.

Rest of APAC : Varied Growth Across Sub-Regions

Key markets include Singapore and Vietnam, where a mix of established companies and startups are present. The competitive landscape features a variety of players, including local firms and international companies. Local market dynamics vary significantly, with sectors such as finance, healthcare, and logistics increasingly adopting intelligent document processing to enhance operational efficiency.