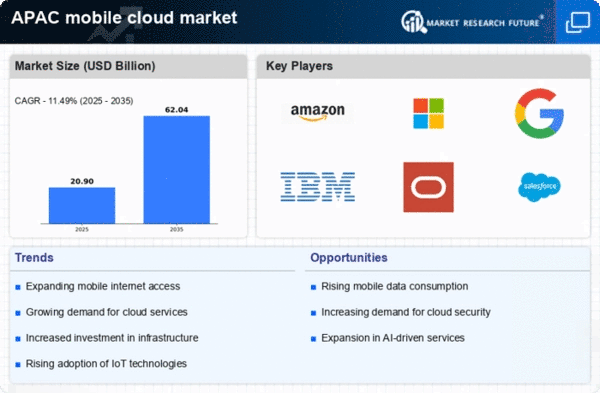

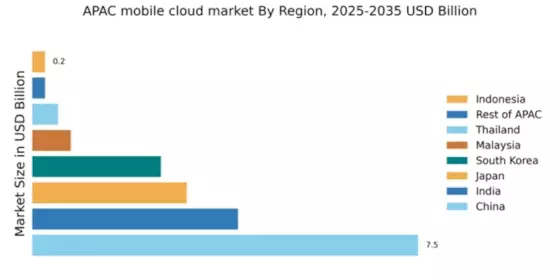

China : Unmatched Growth and Innovation

China holds a commanding 7.5% market share in the mobile cloud sector, valued at approximately $30 billion. Key growth drivers include rapid digital transformation, increased internet penetration, and government initiatives promoting cloud adoption. The demand for mobile cloud services is surging, particularly in e-commerce and fintech, supported by robust infrastructure and significant investments in technology parks and data centers.

India : Tech Adoption and Start-up Boom

India's mobile cloud market is valued at 4.0%, approximately $16 billion, driven by a burgeoning start-up ecosystem and increasing smartphone penetration. Government initiatives like Digital India are propelling cloud adoption across sectors such as healthcare and education. The demand for scalable solutions is rising, particularly in urban areas, as businesses seek to enhance operational efficiency and customer engagement.

Japan : Innovation in Cloud Solutions

Japan's mobile cloud market accounts for 3.0%, valued at around $12 billion. The growth is fueled by advancements in AI and IoT, with businesses increasingly adopting cloud solutions for data analytics and automation. Regulatory support for data privacy and security is also a significant factor. The demand for hybrid cloud solutions is particularly strong, reflecting a shift towards more flexible IT infrastructures.

South Korea : Digital Transformation in Enterprises

South Korea holds a 2.5% market share, valued at approximately $10 billion. The growth is driven by the rapid digital transformation of enterprises and government initiatives promoting smart city projects. The demand for mobile cloud services is particularly high in sectors like gaming and e-commerce. The competitive landscape features strong local players alongside global giants, fostering innovation and service diversification.

Malaysia : Government Support and Infrastructure Growth

Malaysia's mobile cloud market is valued at 0.75%, approximately $3 billion. Key growth drivers include government initiatives like the Malaysia Digital Economy Blueprint, which encourages cloud adoption across various sectors. The demand for mobile cloud services is rising, particularly in SMEs seeking cost-effective solutions. Infrastructure development, especially in urban centers like Kuala Lumpur, is enhancing service delivery and accessibility.

Thailand : Focus on Digital Economy

Thailand's mobile cloud market accounts for 0.5%, valued at around $2 billion. The growth is driven by the government's focus on the digital economy and initiatives to enhance internet connectivity. Demand for mobile cloud services is increasing in sectors like tourism and retail, as businesses seek to leverage data for better customer experiences. The competitive landscape includes both local and international players, fostering a dynamic market environment.

Indonesia : Potential for Future Growth

Indonesia's mobile cloud market is valued at 0.25%, approximately $1 billion. The growth is supported by increasing smartphone adoption and government initiatives aimed at enhancing digital infrastructure. Demand for mobile cloud services is emerging, particularly in e-commerce and logistics. The competitive landscape is evolving, with local start-ups gaining traction alongside established global players, indicating a promising future for the market.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC holds a 0.25% market share, valued at around $1 billion. Growth drivers vary significantly across countries, influenced by local regulations and market maturity. Demand for mobile cloud services is emerging in sectors like education and healthcare, with varying levels of infrastructure development. The competitive landscape features a mix of local and international players, adapting to diverse market needs.