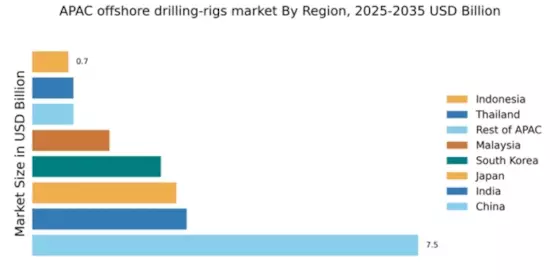

China : Strong Growth Driven by Demand

China holds a commanding 7.5% market share in the APAC offshore drilling sector, valued at approximately $3.5 billion. Key growth drivers include increasing energy demands, government support for offshore exploration, and advancements in drilling technology. The Chinese government has implemented favorable policies to boost domestic production and reduce reliance on imports, while significant investments in infrastructure are enhancing operational capabilities in the sector.

India : Growing Demand and Investments

Key markets include Mumbai and Gujarat, where major oil companies are active. The competitive landscape features players like ONGC and Reliance Industries, alongside international firms. The business environment is improving, with regulatory reforms aimed at attracting foreign investments, particularly in deep-water drilling and renewable energy sectors.

Japan : Innovation in Offshore Drilling

Key markets include Tokyo and Yokohama, where major energy companies like JOGMEC operate. The competitive landscape is characterized by a mix of domestic and international players, including Seadrill and Transocean. The business environment is stable, with a strong emphasis on safety and environmental regulations, fostering innovation in drilling technologies.

South Korea : Strategic Investments and Growth

Key markets include Busan and Ulsan, where major players like Samsung Heavy Industries and Daewoo Shipbuilding are located. The competitive landscape is robust, with both local and international firms vying for market share. The business environment is favorable, with government incentives for innovation and a focus on renewable energy applications.

Malaysia : Growing Market with Potential

Key markets include Kuala Lumpur and Sarawak, where major players like Petronas operate. The competitive landscape features both local and international firms, with a focus on collaboration and technology transfer. The business environment is evolving, with regulatory frameworks aimed at ensuring sustainable practices in offshore drilling.

Thailand : Focus on Energy Security

Key markets include Bangkok and the Gulf of Thailand, where companies like PTTEP are active. The competitive landscape is characterized by a mix of local and international players, with a focus on collaboration. The business environment is improving, with regulatory reforms aimed at enhancing operational efficiency and sustainability.

Indonesia : Potential for Growth and Investment

Key markets include Jakarta and Sumatra, where major players like Pertamina operate. The competitive landscape features both local and international firms, with a focus on technology transfer and capacity building. The business environment is evolving, with regulatory frameworks aimed at attracting foreign investments and enhancing operational efficiency.

Rest of APAC : Emerging Markets and Trends

Key markets include Vietnam and the Philippines, where local companies are beginning to explore offshore resources. The competitive landscape is diverse, with a mix of local and international players entering the market. The business environment is improving, with a focus on collaboration and technology transfer to enhance operational capabilities.