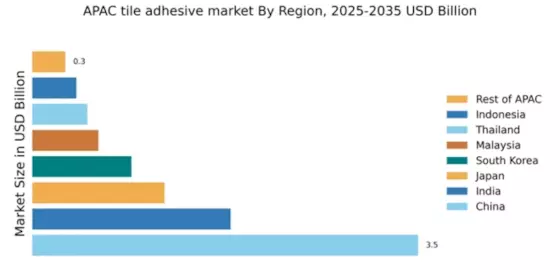

China : Unmatched Growth and Demand Trends

China holds a commanding 3.5% market share in the APAC tile adhesive sector, driven by rapid urbanization and infrastructure development. The government's focus on housing projects and commercial construction has significantly boosted demand. Regulatory policies favoring sustainable building materials further enhance market growth. The increasing trend towards high-performance adhesives reflects changing consumer preferences and technological advancements in the industry.

India : Infrastructure Boom Fuels Demand

Key markets include metropolitan areas like Mumbai, Delhi, and Bengaluru, where construction activities are booming. The competitive landscape features major players like Laticrete and Mapei, who are expanding their presence. Local dynamics favor innovative products tailored to regional needs, particularly in residential and commercial sectors.

Japan : Quality and Innovation Drive Growth

Tokyo and Osaka are pivotal markets, with a competitive landscape dominated by local players like Sika and international firms. The business environment is marked by stringent quality standards and a demand for innovative solutions. The construction sector is increasingly focusing on sustainable practices, creating opportunities for specialized adhesive products.

South Korea : Innovation and Sustainability at Forefront

Seoul and Busan are key markets, with a competitive landscape featuring major players like Henkel and Ardex. The local market is characterized by a strong focus on innovation, with companies investing in R&D to develop eco-friendly products. The business environment is favorable for new entrants, particularly those offering sustainable solutions.

Malaysia : Infrastructure Development Drives Growth

Key markets include Kuala Lumpur and Penang, where construction activities are robust. The competitive landscape features both local and international players, including Bostik and Mapei. The business environment is conducive to innovation, with a growing demand for specialized adhesives in residential and commercial applications.

Thailand : Market Resilience in Construction

Bangkok and Chiang Mai are key markets, with a competitive landscape featuring local and international players like Weber and Dunlop. The business environment is marked by challenges such as fluctuating raw material prices, but opportunities exist in the growing demand for specialized adhesive solutions in the hospitality and residential sectors.

Indonesia : Urbanization Fuels Adhesive Demand

Jakarta and Surabaya are key markets, with a competitive landscape featuring both local and international players. Major companies like Sika and Henkel are expanding their presence. The business environment is evolving, with a growing focus on sustainability and innovation in adhesive products, particularly in residential and commercial applications.

Rest of APAC : Varied Demand Across Sub-regions

Key markets include emerging economies in Southeast Asia and the Pacific Islands, where local players are gaining traction. The competitive landscape is fragmented, with opportunities for both established and new entrants. The business environment is influenced by local consumer preferences, with a growing demand for specialized adhesive solutions tailored to regional needs.