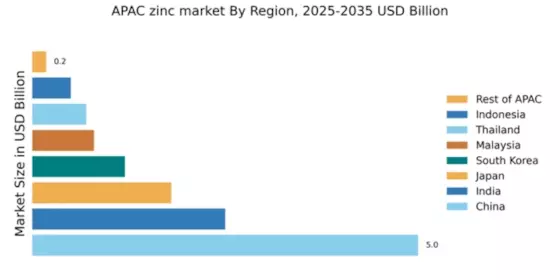

China : Unmatched Growth and Demand Trends

China holds a commanding 5.0% market share in the APAC zinc market, driven by robust industrial growth and increasing demand for galvanized steel. Key growth drivers include government initiatives promoting infrastructure development and urbanization, alongside rising consumption in automotive and construction sectors. Regulatory policies favoring sustainable mining practices further enhance market dynamics, while significant investments in infrastructure bolster production capabilities.

India : Strong Demand from Infrastructure Projects

India accounts for 2.5% of the APAC zinc market, with a growing demand fueled by extensive infrastructure projects and urban development. The government's push for 'Make in India' initiatives has spurred consumption in construction and automotive sectors. Regulatory frameworks are increasingly supportive of mining operations, while local production capabilities are being enhanced through foreign investments and technology transfers.

Japan : Innovation Drives Zinc Applications

Japan's zinc market holds a 1.8% share in APAC, characterized by advanced technology and high-quality production standards. The demand is primarily driven by the automotive and electronics industries, where zinc is used for corrosion resistance. Government policies promoting sustainable practices and recycling initiatives are shaping consumption patterns, while infrastructure investments continue to support market stability.

South Korea : Strong Industrial Demand and Innovation

South Korea represents 1.2% of the APAC zinc market, with significant demand stemming from its robust manufacturing sector. The automotive and shipbuilding industries are key consumers, driving growth through innovative applications of zinc. Regulatory support for green technologies and sustainable mining practices enhances the market environment, while local players are investing in advanced production techniques to meet rising demand.

Malaysia : Focus on Sustainable Mining Practices

Malaysia's zinc market, with a 0.8% share in APAC, is witnessing growth driven by government initiatives aimed at sustainable mining and industrial development. The demand is primarily from the construction and automotive sectors, supported by infrastructure projects. Regulatory frameworks are evolving to promote responsible mining practices, while local companies are enhancing production capabilities to meet domestic and export needs.

Thailand : Infrastructure Growth Fuels Demand

Thailand holds a 0.7% share in the APAC zinc market, with demand driven by infrastructure development and construction activities. The government's focus on enhancing transportation and urban infrastructure is a key growth driver. Regulatory policies are becoming more supportive of mining operations, while local players are expanding their production capacities to cater to both domestic and regional markets.

Indonesia : Investment in Mining Infrastructure

Indonesia's zinc market accounts for 0.5% of the APAC total, with growth potential driven by investments in mining infrastructure and regulatory reforms. The demand is primarily from the construction and manufacturing sectors, supported by government initiatives to boost local production. The competitive landscape is evolving, with both local and international players seeking to capitalize on emerging opportunities in the market.

Rest of APAC : Varied Demand Across Sub-regions

The Rest of APAC holds a modest 0.18% share in the zinc market, characterized by diverse demand patterns across different countries. Regulatory environments vary significantly, impacting market dynamics and growth potential. Local consumption is influenced by sector-specific applications, including construction and automotive industries, while infrastructure development remains a key focus for many governments in the region.