Market Share

Application Release Automation Market Share Analysis

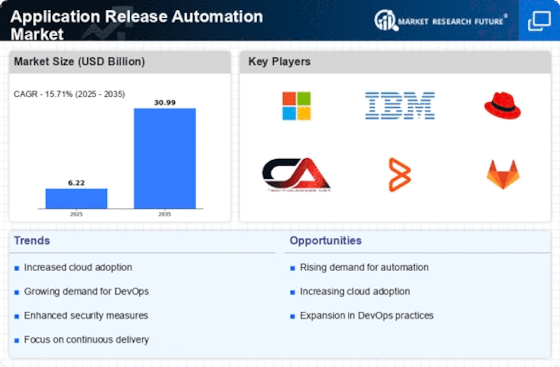

The ARA market (Application Release Automation) has underscored certain trends and advancements that underline the evolving nature of the software development and deployment environment. With the automatic release and deployment of software becoming an increasingly important process for many companies, ARA solutions have started to be regarded as fundamental tools in the streamlining of application release cycles. Among various trends of ARA market today is the growing use of cloud native and DevOps practices. Businesses are shifting gear faster and become more nimble by taking elements of DevOps to the heart. This is why the range of ARA tools that can serve these new approaches has expanded exponentially so that they now can be easily integrated into the operational systems.

Another notable feature is that the de ARA market has now moved toward comprehensive and end to end automation solutions. Organizations seeks ARA solutions to perform the entire set of activities about the application release life cycle, going from code deployment to validation and check up. In turn, it denotes a deliberate consideration for the removal of manual activities, as well as lessening of mistakes, and increased speed of the process of getting products to the market. Automation end-to-end is another motive to automate that’s based on the complexity of modern applications and their management reconciling across different environment.

Another growing tendency is the moving to the creation of systems that are intelligent and data-driven within ARA systems. The machine learning and artificial intelligence capabilities are getting more and more integrated into the ARA platforms to analyze the historical release data, look for patterns, and provide user with digestible insights. Therefore, usage of data-supported approach lets organizations to make conscious decisions, improving release process and preventing any problems during next upcoming version releases, thus increasing general efficiency and trustworthiness to applications.

Additionally, containers and microservice architectures are technologies that are gaining traction in the ARA domain. With container orchestration platforms such as Kubernetes and the usage of microservices-based application development approaches picking up pace, ARA solutions that can handle as well as deploy containerized applications have proved to be a necessity. ARA vendors are striving to extend the lifecycle of their offerings by keeping implicitly with the containers field developments in order to maintain the compatibility and the smooth integration of the modern development practices.

The market trend in ARA is characterized by the integration of software with other tools and platforms as well. Organizations of today are looking for Application Release Automation (ARA) solutions that can easily integrate to the tools they already have such as version control systems, CI tools and IT service management (ITSM). The consistency here enables an integrated and coordinated software delivery in the entire pipeline, joining all the parties in the development and release phase.

Leave a Comment