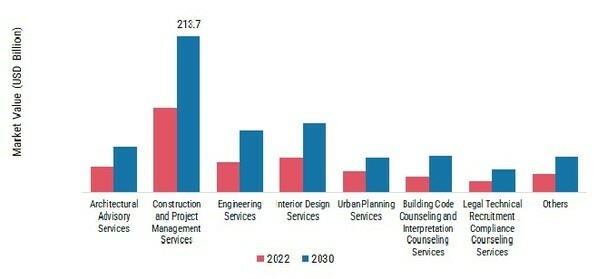

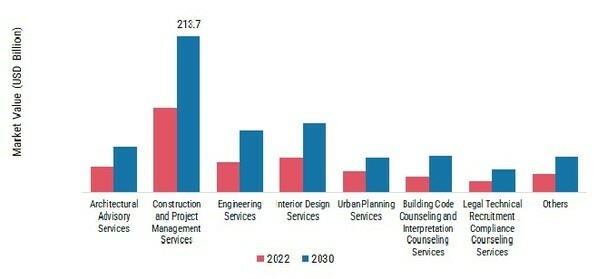

Architectural Services Market by Service Type Insights

Based on service type, the architectural services market is segmented into architectural advisory services, engineering services, urban planning services, and others. The construction and project management segment dominated the market with a share of 35.4% in 2022 and is expected to grow at a CAGR of 7.64% through the forecast period. A project's administration and construction are crucial components. Construction and project management services are more frequently needed as construction activity grows for duties like project life cycle management, cost control, scheduling, and risk management.

Due to all the mentioned factors the sales of architectural services are expected to grow significantly. The hospitality industry is also involved in using architectural services for the reorganization of their existing medical spaces to provide patients with better healthcare facilities. The seamless treatment of patients is made possible by the efficient use of the infrastructure and space accessible to a medical facility. Many companies use architectural services like interior design, space planning, and schematic design to increase consumer attraction and improve the customer experience.

Figure 2: Architectural Services Market, by Service Type, 2022 & 2030 (USD Billion) Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

The rising focus of architectural firms on designing smart structures with better space utilization is assisting the industry's growth. The demand for urban planning services is also rising due to an increasing number of smart city initiatives launched by governments around the globe, which is boosting the market growth for architectural services. Additionally, there is fierce competition among the main players in the market for architectural services. Prominent market participants are utilizing both organic and inorganic strategies to establish a strong foothold in the market.

February 2023: - Nvidia, a manufacturer of GPUs, is introducing a new service that will let users access its DGX AI supercomputer in the cloud. A new set of cloud-based tools for creating generative AI systems was also unveiled by the company. After the release of OpenAI's ChatGPT chatbot, such models have seen a surge in popularity, and Nvidia has benefited.

February 2023 - The wide release of the resource map for the Amazon Virtual Private Cloud was announced by Amazon earlier this month. Customers may access all VPC resources and connections in a visual format using the new feature's central hub, which helps them better, understand their VPC architecture.

Architectural Services Market by End-User Insights

Based on end-user, the architectural services market is segmented into education, government, healthcare, hospitality, residential, industrial, retail, and others. The industrial segment accounted for the largest share of 28.4% in 2022 and is expected to grow at a CAGR of 7.2% through the forecast period. This can be attributed to rapid industrialization, increased business company acquisitions, and new factory construction. Additionally, the demand for architectural advisory and interior design services is anticipated to increase due to rising environmental concerns and business owners' initiatives to create green buildings. This is anticipated to have a favorable effect on segment development.

Moreover, the residential category is expected to become the second-highest segment with a share of 25.1% in 2021. Furthermore, urban population growth has pressured the real estate sector to find a sustainable solution to the growing need for residential structures. The demand for residential housing has increased due to relevant macroeconomic factors like increasing employment, a low-interest rate, and an increase in disposable income, which has also increased the demand for architectural services.

Construction of homes and businesses has increased as a result of the rapid urbanization taking place in emerging nations like Brazil and India. In addition, to better manage their smart city projects, architects are predicted to require more services like urban planning and project management.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review